The United States Department of Energy has unveiled plans for nearly US$1 billion in funding to accelerate domestic critical minerals production, marking Washington's most aggressive push yet to reduce America's dangerous dependence on Chinese supply chains.

The funding blitz, announced under President Trump's "Unleashing American Energy" executive order, targets every stage of the critical minerals value chain from upstream mining through downstream manufacturing.

China currently controls 60-70% of global rare earth mining and a staggering 85-90% of processing capacity, creating a bottleneck that has left U.S. industry and defence contractors exposed.

The Middle Kingdom imposed export restrictions on seven rare earth elements in December last year, targeting materials vital to defence technologies where the U.S. is entirely dependent on Chinese supply.

Beijing's move came as direct retaliation for U.S. semiconductor restrictions, demonstrating how critical minerals have become weapons in the trade war.

For heavy rare earths, China processes 90% of global supply, while the U.S. has no commercial-scale separation facilities in operation.

Even when new nameplate capacity comes online, facilities will be dwarfed by Chinese production.

MP Materials expects to produce just 1,000t of neodymium-iron-boron magnets by end-2025 - less than 1% of China's 2018 output.

DoE key funding allocations:

- US$500 million for battery materials processing and recycling facilities, requiring 50% cost-sharing from recipients

- US$250 million for pilot programmes to extract critical minerals from industrial byproducts

- US$135 million for rare earth demonstration projects

- US$50 million for the Critical Minerals and Materials Accelerator to fund technology development, focusing on rare earth magnet supply chains and gallium processing for semiconductors

- US$40 million for ARPA-E's RECOVER programme to extract critical minerals from industrial wastewater

China spent three decades building its dominance through state subsidies, environmental exemptions, and vertical integration.

On top of having to catch up to China's 30-year head start, Western attempts to compete face regulatory hurdles, environmental compliance costs - and China's willingness to operate processing facilities at a loss to maintain market control.

Meanwhile, defence contractors face a tight 2027 deadline to eliminate Chinese magnets from their supply chains, adding urgency to the domestic buildout.

But even optimistic projections suggest meaningful U.S. production capacity won't emerge until the 2030s.

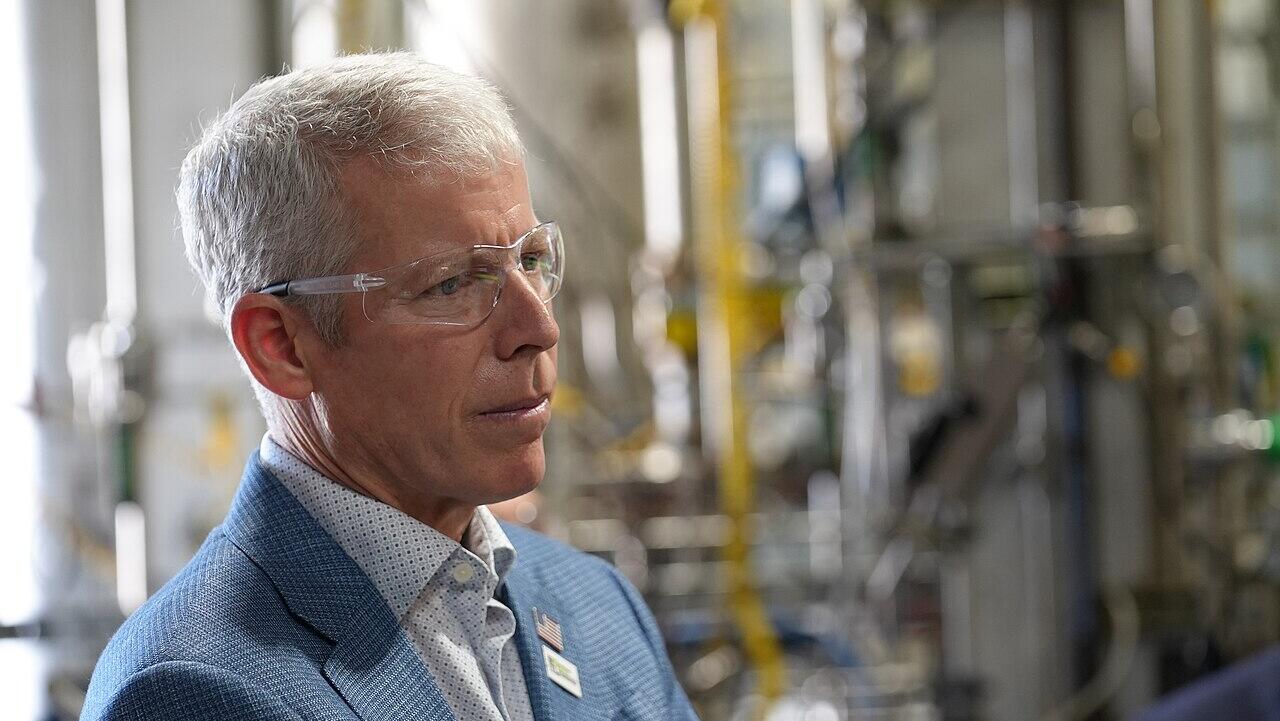

"For too long, the United States has relied on foreign actors to supply and process the critical materials that are essential to modern life and our national security," Energy Secretary Chris Wright said.

The billion-dollar commitment represents a significant escalation, but success will require sustained political will and private investment far exceeding current government allocations.