DICK’S Sporting Goods (NYSE: DKS) delivered record-breaking Q1 results, with net sales climbing 5.2% to US$3.18 billion (A$4.95 billion).

Comparable sales jumped 4.5%, marking the fifth consecutive quarter of growth above 4%. Earnings per share landed at $3.24 GAAP and $3.37 non-GAAP, slightly ahead of last year’s figures.

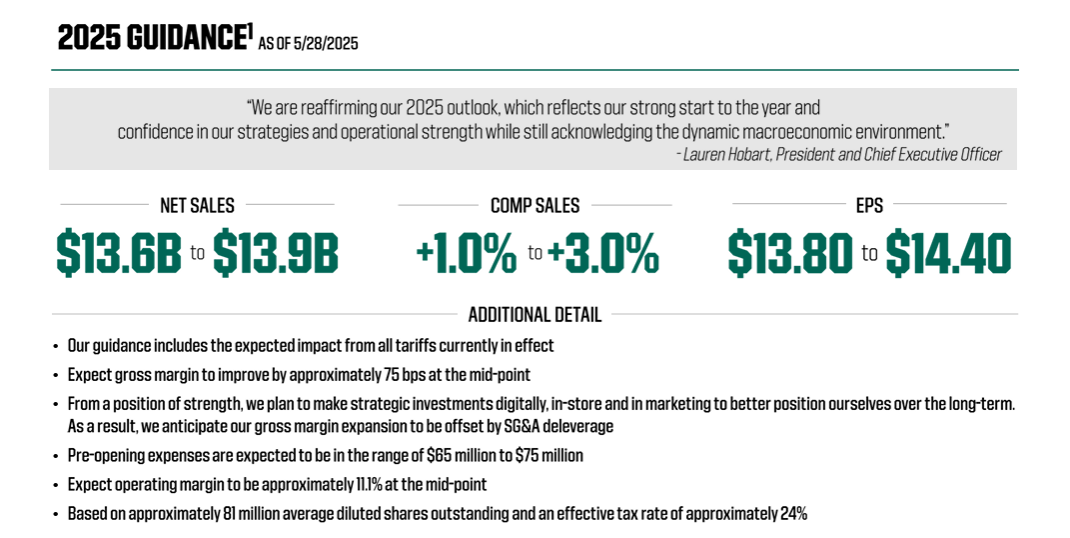

The retailer reaffirmed its 2025 outlook, projecting full-year earnings between $13.80 and $14.40 per share.

Lauren Hobart, President and Chief Executive Officer said: “We are very pleased with our first-quarter results. Our performance demonstrates the momentum and strength of our long-term strategies and the consistency of our execution. Our Q1 comps increased 4.5% driven by growth in both average ticket and in transactions and this was our fifth straight quarter with comps over 4.0%. Our first quarter gross margin expanded and we delivered non-GAAP EPS ahead of the prior year.”

Expanding Footprint and Market Presence

DICK’S continued its aggressive expansion, opening two new House of Sport locations and four new Field House stores in Q1. But the biggest move? A $2.4 billion acquisition of Foot Locker, a deal set to reshape the global sports retail landscape. The merger, expected to close in late 2025, will give DICK’S greater leverage with major brands like Nike and Adidas, while expanding its international footprint.

Shareholder Rewards and Financial Strength

The company remains committed to shareholder returns, authorising a quarterly dividend of $1.2125 per share, payable on 27 June, 2025. DICK’S plans to finance the Foot Locker acquisition through a mix of cash-on-hand, revolving borrowings, and new debt, ensuring financial flexibility. Despite macroeconomic uncertainties, the retailer’s strong execution and strategic positioning continue to drive consistent growth.

Looking Ahead: A Retail Powerhouse in the Making

Hobart emphasised the company’s momentum and resilience, noting that DICK’S is well-positioned to navigate economic shifts while capitalising on long-term strategies.

"We are reaffirming our 2025 outlook, which reflects our strong start to the year and confidence in our strategies and operational strength while still acknowledging the dynamic macro-economic environment," Hobart said.

With record sales, expanding store formats, and a transformative acquisition, DICK’S Sporting Goods is poised to become a dominant force in global sports retail. Investors will be watching closely as the company integrates Foot Locker and leverages its growing market influence.

Ed Stack, Executive Chairman said: "As you see in our first quarter results, we're proud of the strong position we're in today and incredibly excited about the future. Earlier this month, we announced our plans to acquire Foot Locker, a move that represents a truly exciting and transformational moment for DICK'S. For many years we've admired Foot Locker's brand and the powerful community they've built in sneaker culture. By bringing our two great brands together, we see the opportunity to create a global leader in the sports retail industry by serving a broader set of athletes."

At the time of writing, DICK'S Sporting Goods Inc's (NYSE: DKS) share price was US$177.12, up $2.90 (1.66%) today. After-hours trading reached $180.08, up $2.96 (1.67%). Its market cap was around $14.18 billion.

Related content