While cybersecurity firm CrowdStrike (NASDAQ : CRWD) surpassed Q1 sales and profit estimates, it foreshadowed a Q2 revenue guidance below market expectations due to expected weaker sales.

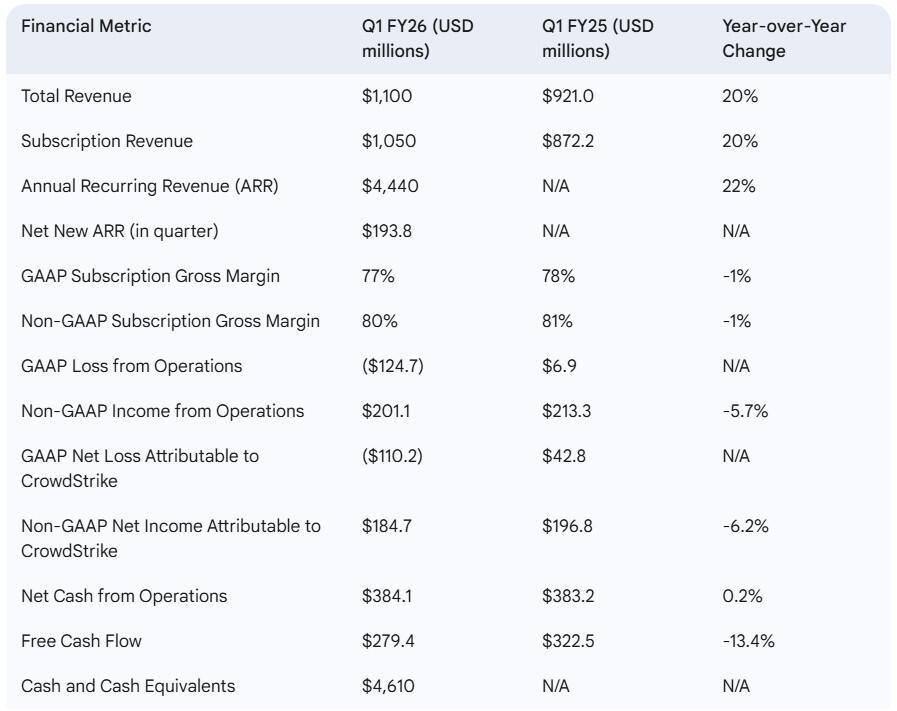

Revenue rose 20% to US$1.10 billion during the quarter, while annual recurring revenue (ARR) jumped 22% to $4.4 billion, with the addition of $194 million in net new ARR.

Earnings per share (EPS) were down from 79c in Q1 last year with an EPS of 73c.

Q1 financials:

CrowdStrike attributed the strong sales and revenue in part, to market consolidation around its products and a strategic emphasis on key large deals.

Q1 deals and advancements:

Falcon Privileged Access: A new module within Falcon Identity Protection.

Charlotte AI: Advanced SOC operations with agentic AI response and workflows.

Cloud Security: Introduced AI model scanning and Shadow AI detection for cloud risk.

Managed Threat Hunting: Falcon OverWatch now protects third-party data.

Data Protection: Enhanced data security across endpoints, cloud, and GenAI.

Exposure Management: Streamlined vulnerability management, extended AI risk prioritisation.

Microsoft Collaboration: Partnered to unify cyber threat actor identification.

Services Partner Program: Launched a program to accelerate Next-Gen SIEM adoption.

Cloud Partnership: Expanded AI security partnership with Google Cloud.

"We started the fiscal year with record Q1 large deal and MSSP momentum alongside sustained 97% gross retention and consistently strong net retention as the market consolidates on Falcon as its cybersecurity platform of choice for the agentic AI era," CrowdStrike CEO George Kurtz told the market.

Kurtz also highlighted the impact of Falcon Flex demand and ongoing innovation across various domains, including AI and identity protection.

Notably, the company's board approved a share repurchase program of up to $1 billion of common stock.

Guidance

CrowdStrike says tariffs and Department of Government Efficiency efforts could lower revenue, as the US federal, state, and local contract environment appears more challenging.

It's also competing with rival cybersecurity firms such as Palo Alto Networks and Fortinet.

The software company forecast second-quarter revenue of between $1.14-$1.15 billion, compared with estimates of $1.16 billion, while expecting a jump in EPS of 82-84c.

CrowdStrike shares have surged year-to-date over 40%, and after a dip following the announcement, shares settled up 2% in after hours trade, swapping for US$488.76.