With momentum building throughout the second half of 2025, technology, business services, and financial services - including payments and wealth management platforms – are emerging as the most attractive sectors for private equity (PE) investment over the next year.

According to the latest outlook by Corrs Chambers Westgarth, 2026 will see PE activity continue gaining momentum, especially within technology and business services that have seen earnings multiples steadily increase over the past 12 months.

While healthcare remains a perennial area of interest, Corrs expects to see growing interest in businesses that can benefit from increased demand for onshore manufacturing, particularly in the defence sector.

While the mid market – especially transactions in the $50 - $250 million range – have shown strong resilience - Corrs has also witnessed an investment focus on platform plays with clear growth potential and operational improvement, rather than financial engineering.

"The trend toward targeted, nuanced and discreet sale processes continues, with early engagement of a select group of potential buyers proving popular," the Corrs report noted.

Settings are ripe for investment in defence

The Australian commercial law firm expect M&A activity within Australia’s defence sector - and in defence adjacent technologies - to increase in 2026, due to rising geopolitical tensions, government investment in sovereign defence capabilities and the shift in AUKUS from policy design to industrial implementation.

“Global defence contractors are increasing their presence in Australia, while local start ups and advanced manufacturers are seeking capital and partnerships to participate in allied capability development,” the report notes.

“Naturally, investments in this sector will be scrutinised more closely under the Foreign Investment Review Board's (FIRB) national security provisions and we expect that ‘Five Eyes’ and other strategically allied investors will have the edge over other jurisdictions.”

Given that the landmark bilateral framework on critical minerals between Australia and the U.S. commits at least US$1 billion from each government towards an $8.5 billion pipeline of priority critical minerals projects, Corrs also expects resources M&A to remain a dominant force in 2026.

“This policy catalyst creates a clear pathway for strategic acquisitions in lithium, rare earths and other critical minerals aligned with defence and advanced technology supply chains,” the report notes.

US-driven M&A

The Corrs report also makes the left field prediction that 2026 will see Australia surge in foreign direct investment - driven notably by U.S. interests.

Despite the 13% fall in the number of foreign bidders this year and the uncertain policy settings in the U.S., Corrs foresees a return of U.S. interest in Australian M&A transactions.

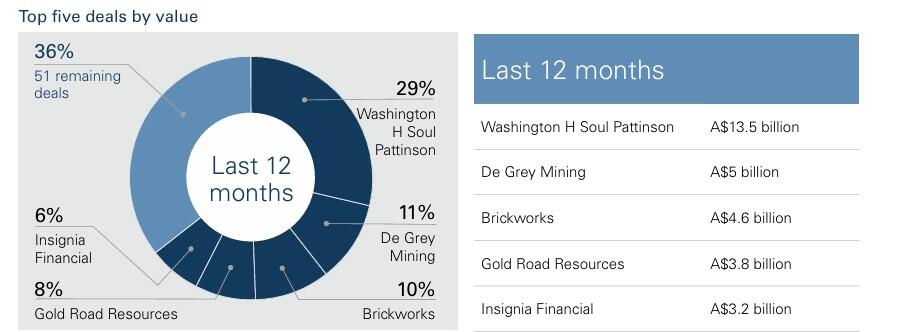

U.S. bidders contributed 16% of total deal value in 2025, with two major U.S. bidder transactions exemplifying this trend: CC Capital Partners' $3.2 billion scheme for Insignia Financial (ASX: IFL), and CoStar Group's $2.8 billion acquisition of Domain Holdings Australia.

Underpinning the predicted uptick in U.S.-driven M&A transactions locally is the likelihood of interest rate stabilisation in key economies, increasing CEO confidence, the re-entry of private equity bidders and anticipated favourable regulatory reforms in the U.S.

Local bidders return

Interestingly, after foreign bidders accounted for 54% of all participants in the previous survey period – the first time in over five years that foreign bidders outnumbered Australian participants – the Australian public M&A market has witnessed a rebalancing towards domestic-led market activity.

Based on Corrs analysis, the resurgence of Australian bidders reflects renewed domestic confidence and capital deployment across local acquirers.

In the last 12 months, Australian bidders returned to their dominant position, accounting for 59% of all bidders and eclipsing foreign bidders in line with historical patterns.

This suggests to Corrs that 2024 figures - where foreign bidders represented the majority of all bidders for the first time - reflected a temporary shift rather than a lasting trend.

Beyond Australia, Europe was the second most prominent, with bidders from the UK, Austria and bidders from the U.S. and Canada made up North America’s 12% share.

Pre-bid stakes

Given that it gives bidders pricing discovery, a clear signal to targets on shareholder appetite, a potential seat at the boardroom table and a strong defensive position, Corrs expects a pre-bid stake to be more strategically important than ever.

Stakes have played or will play a critical role in the outcome of transactions such as CoStar’s acquisition of Domain, L1 Capital’s (ASX: L1H) acquisition of Platinum Asset

Management, Genesis Capital’s bid for Pacific Smiles, Betr Entertainment’s (ASX: BTR) bid for PointsBet (ASX: PBH) and BGH’s bid for WebJet (ASX: WJL).

In those deals, the make-up of the register (for example, Nine’s 50% stake), history of competition (such as with Platinum), and need to bring the board to the table, meant the stake in each case brought with it material benefits.

“While a significant stake (i.e. 10% or more) is always preferable from a bidder’s perspective, total return swaps at below the 5% threshold can prove very useful at the outset of a stake-build for price discovery purposes and are highly recommended as a bidder strategy,” Corrs noted.

“Importantly, the decision not to acquire a pre bid stake can prove decisive if a competing bidder subsequently acquires a stake that otherwise might not have been available, which puts the initial bidder at a significant disadvantage.”