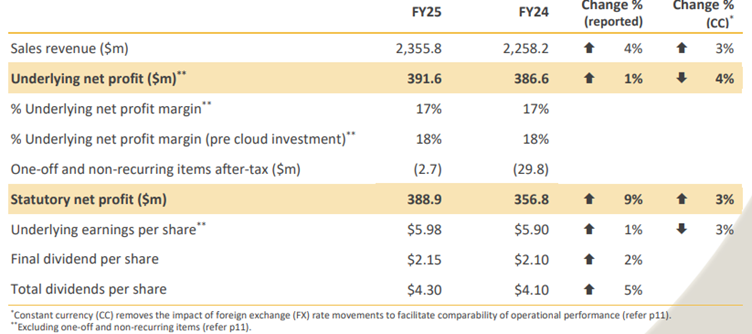

Cochlear has announced a 9% increase in statutory net profit after tax (NPAT) and a 1% increase in underlying NPAT for the 2025 financial year (FY25).

The medical device company said NPAT was $388.9 million and statutory NPAT was $391.6 million in the 12 months ended 30 June 2025.

The company, which is best known for its hearing implants, said underlying earnings per share rose 1% to $5.98 on sales revenue which grew 4% to $2.356 billion in FY25.

Directors declared an 85% franked final dividend of $2.15 per share to be paid on 13 October to shareholders registered on 19 September, compared with $2.10 a year earlier, bringing the full year payment to $4.30 versus $4.10.

The company also said it expected to deliver underlying NPAT of $435 million to $460 million in FY26, an 11-17% increase on FY25.

Sales revenue growth included strong contributions from cochlear and acoustic implants and was moderated by a decline in Services revenue.

It expected strong revenue growth in developed markets from the launch of the new Nucleus Nexa implant, moderated by lower growth in emerging markets revenue with overall revenue and earnings growth weighted to the second half.

“As we look to the future, we remain confident of the opportunity to grow our markets,” Cochlear said in an ASX announcement.

“There remains a significant, unmet and addressable clinical need for cochlear and acoustic implants that is expected to continue to underpin the long-term sustainable growth of the business.”

A clear growth opportunity was the rising awareness of the link between cognitive decline and hearing loss.

Cochlear (ASX: COH) shares closed on Thursday at $305.99, down $7.30 (2.33%), capitalising the company at $20.01 billion.

Founded in 1981 and based on research by Professor Graeme Clark at the University of Melbourne, the company operates in more than 180 countries with hundreds of thousands of implant recipients worldwide.