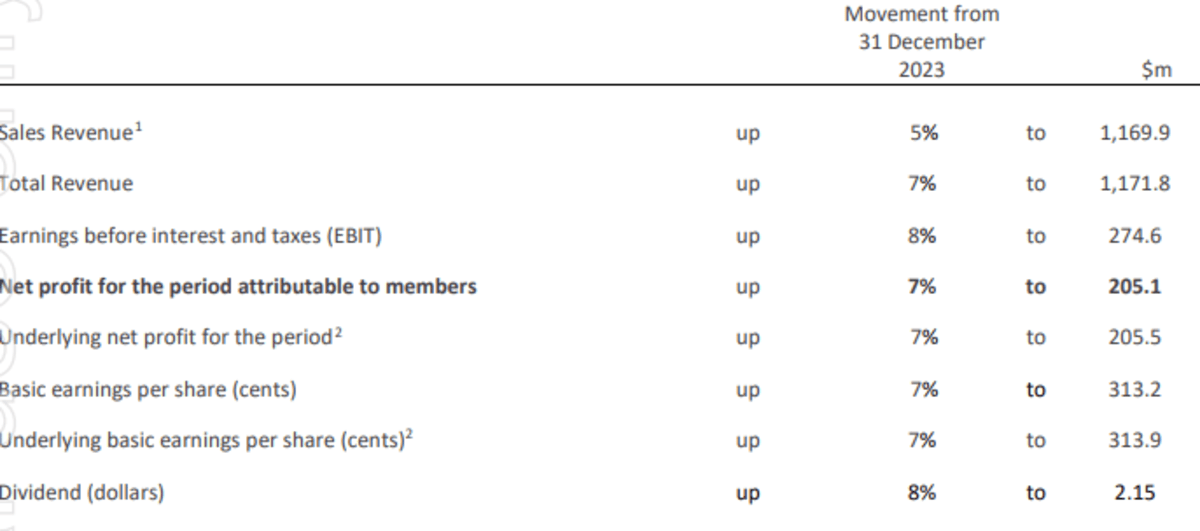

Cochlear has expressed confidence about the long term demand for its hearing products after increasing statutory net profit by 7% to $205 million in the first half of the 2025 financial year (FY25).

Cochlear said underlying net profit increased 7% to $206 million as sales revenue rose 5% to $1.17 billion in the six months to 31 December 2024.

Directors declared an interim dividend of $2.15 per share, $1.72 franked, to be paid on 14 April to shareholders registered on 14 March, compared with $2 in the first half of FY24.

Cochlear said the 5% revenue increase, or 6% in constant currency (cc) terms, built on the 20% cc growth in the first half of 2024, with strong growth in cochlear and acoustic implants revenue moderated by a decline in revenue from its services business.

Cochlear implant revenue increased 13% and acoustics revenue grew 22% but services revenue declined 12%, all in constant currency terms.

The company said it remained confident about the opportunity to grow its markets as the significant, unmet and addressable clinical need for cochlear and acoustic implants was expected to continue to underpin the long-term sustainable growth of the business.

“Our clear growth opportunity and strategy, combined with a strong balance sheet, mean we are well placed to create value for our stakeholders now, and over the long term,” Cochlear said in ASX announcement.

The company forecast FY25 underlying net profit to be at the lower end of the $410 million to $430 million guidance range provided in August 2024, incorporating a lower contribution from services revenue and higher cloud-related investment.

Founded in 1981 and listed on the Australian Securities Exchange since 1995, Cochlear is best known for the cochlear implant, which was developed in the 1970s by Australian researcher Dr Graeme Clark at the University of Melbourne.

Cochlear (ASX: COH) shares closed on Thursday at $304.54, down $2.15 (0.70%), capitalising the company at $19.93 billion.