Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Nestle and Honda's sales stifled

- Sony lifts the full-year bar after powerful video gaming performance

- Coinbase smashes expectations amid post-election crypto rally

- Motorola sales hit new record

- Nissan continues losing streak

- Hyatt, Unilever miss forecasts

- Airbnb beats estimates with strong revenue and EPS gains

_______________________________________________________________________________________

8:42 am (AEDT):

Hello everyone, Harlan Ockey here to walk you through today's earnings reports. We have quite the day today, with results coming in from the likes of Nestle, Sony, Honda, and more.

First up on the ASX, we have Cochlear (COH). The company has expressed confidence about the long term demand for its hearing products after increasing statutory net profit by 7% to A$205 million in the first half of the 2025 financial year (FY25).

Cochlear said underlying net profit increased 7% to A$206 million as sales revenue rose 5% to $1.17 billion in the six months to 31 December 2024. Directors declared an interim dividend of $2.15 per share, $1.72 franked, to be paid on 14 April to shareholders registered on 14 March, compared with $2 in the first half of FY24.

The company said it remained confident about the opportunity to grow its markets as the significant, unmet and addressable clinical need for cochlear and acoustic implants was expected to continue to underpin the long-term sustainable growth of the business.

“Our clear growth opportunity and strategy, combined with a strong balance sheet, mean we are well placed to create value for our stakeholders now, and over the long term,” Cochlear said in an ASX announcement.

The company forecast underlying net profit to be at the lower end of the A$410 million to $430 million guidance range provided in August 2024, incorporating a lower contribution from services revenue and higher cloud-related investment. Cochlear shares closed on Thursday at $304.54, down $2.15 (0.70%), capitalising the company at $19.93 billion. (Thank you to our Garry West for the write-up! Read his full story here.)

9:03 am (AEDT):

Moving to Switzerland's SIX, Nestle (NESN) reported a downturn in sales growth. The company's sales grew by just 2.2% across 2024, well below 2023's 7.2% but above analysts' projection of 2.1%.

Nestle's overall sales came in at CHF91.35 billion, 1.8% under 2023's sales. Net profit was CHF10.88 billion, 2.9% below 2023.

Basic earnings per share were CHF4.19, a decrease of 1% from the previous year.

“We have a clear roadmap to accelerate performance and transform for the future. Increasing investment to drive growth is central to our plan. This means delivering superior product taste and quality with unbeatable value, scaling our winning platforms and brands, accelerating the rollout of our innovation ‘big bets’ and addressing underperformers,” said CEO Laurent Freixe.

Nestle's share price rose by 6.2% following its results. Its 2025 guidance expects organic sales growth to improve throughout the year.

Read Chloe Jaenicke's full report here.

9:26 am (AEDT):

At the TYO, Sony (6758) has lifted its full-year forecast after beating analyst expectations on revenue. Its revenue was JP¥4.41 trillion, above LSEG analysts' projected ¥3.77 trillion, and an 18% year-over-year increase.

Sony's operating income also surpassed expectations, reaching JP¥469.3 billion. LSEG analysts expected ¥404.21 billion.

Net income was JP¥341.1 billion, a 32.1% year-over-year increase. Sony's net earnings per share were ¥56.41, rising ¥6.36 year-over-year.

Its Game and Network Services division saw a major jump in sales, increasing 237.9% year-over-year to reach JP¥1.68 trillion.

Sales of its Playstation 5 increased to 9.5 million units, up from 8.2 million year-over-year, following the release of the Playstation 5 Pro in November. Monthly active Playstation platform users increased by 5% year-over-year in December.

Sony became the largest shareholder of Kadokawa in December, acquiring a 10% stake in the manga, gaming, and anime company.

Entertainment, Technology, and Services, Sony's second-largest division, fell by 31.2% to ¥704.5 billion. Sony's Music and Pictures divisions saw 59.6% and 31.9% growth, respectively.

The company now projects its full-year FY2024 sales will be JP¥13.2 trillion, up 4% from its forecast in November.

Frankie Reid has the full story.

9:54 am (AEDT):

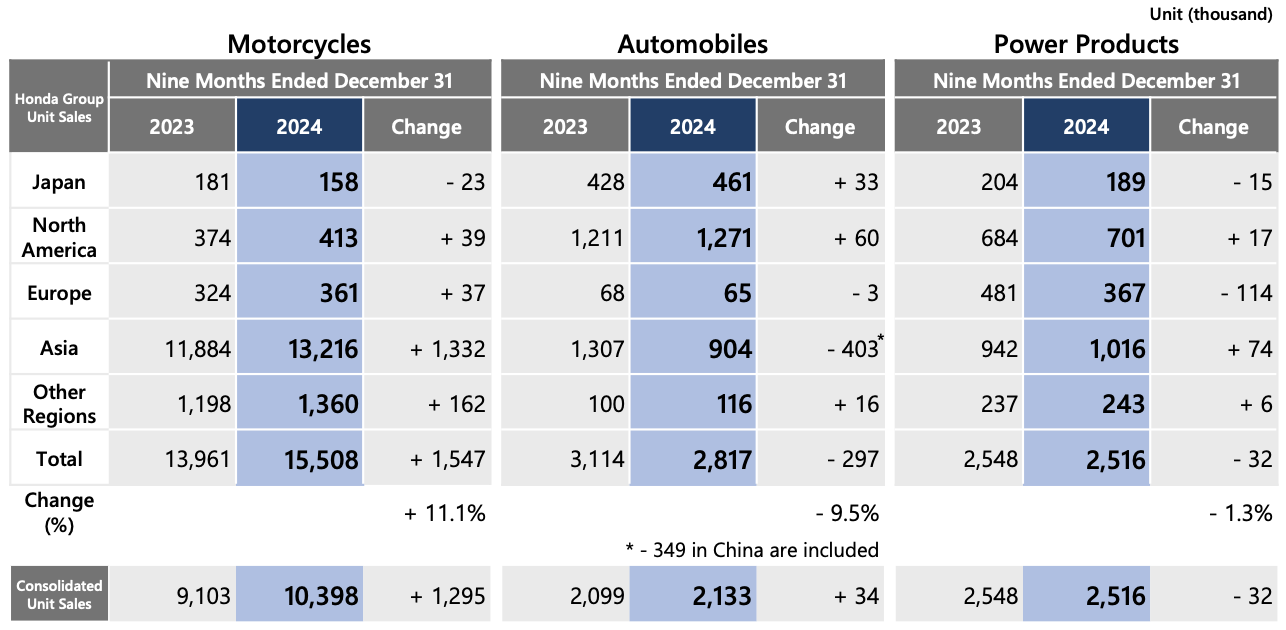

Still at the TYO, Honda (7267) saw profits fall in the first nine months of its fiscal year. Its net profit was JP¥805.2 billion, a 7.4% decline year-over-year. Sales revenue rose 8.9% to ¥16.33 trillion.

Earnings per share were JP¥169.69 in the first nine months of its fiscal year, falling 7.09% year-over-year.

Motorcycle sales rose sharply in several markets last quarter. India, its largest wholesale market, reported 1.26 million units sold, up 7.5% year-over year.

Vehicle sales slumped in Japan and China, however. In China, sales were 264,000 last quarter, just 65.5% of Chinese sales in the same quarter of FY2023. Demand remained solid in the United States, growing by 8.8% year-over-year to reach 367,000 units..

Its full-year FY2024 net profit forecast is JP¥950 billion, unchanged from its previous projections in November. Honda revised its expected full-year motorcycle sales up, while moving its expected car sales down by 50,000 units.

Honda said it had ended talks on a proposed merger with Nissan and Mitsubishi this week.

10:01 am (AEDT):

Meanwhile at the ASX, AMP (AMP) has delivered a 43% slump in statutory net profit to A$150 million for the 12 months ended 31 December 2024.

The company said this reflected business simplification spending and a loss on the sale of the Advice business to Entireti for $10.2 million in December.

AMP said underlying net profit after tax (NPAT) grew 15.1% to A$236 million on revenue which rose 5% to $2.869 billion in the 2024 financial year (FY24). Directors declared a final dividend of 1.0 cent per share, 20% franked, to be paid on 3 April to shareholders on record on 3 March, taking the full year dividend to 3 cents per share, compared with 4.5 cents in 2023.

“2024 was another year of strategic delivery for AMP as we build positive performance momentum and focus firmly on growth,” Chief Executive Alexis George said in a statement. AMP shares closed down one cent (0.57%) at A$1.75 on Thursday, capitalising the company at $4.42 billion.

A one percent jump in share prices is in prospect when the Australian Securities Exchange resumes trading on Friday following a buoyant day on Wall Street. Futures flagged a strong opening with the S&P/ASX 200 March share price index (SPI) contract trading 82 points or 0.96% higher than the previous settlement at 8,490.00 at 9.40am AEDT (10.40pm GMT). (Write-up courtesy of Garry West — read his full story on AMP here.)

10:20 am (AEDT):

Continuing with the ASX, Mirvac (MGR) saw an increase in residential sales. Its statutory profit was A$1 million, compared to a $201 million loss in the first half of FY2024.

Mirvac exchanged 947 residential lots, an increase of 51% year-over-year. Residential pre-sales increased to A$1.9 billion. Operating earnings per share were 6.0 cpss.

“We delivered a good result in the first half and remain on track to achieve guidance in FY25. We have made significant progress delivering our strategic initiatives and we are now setting the business up for a return to growth," said CEO Campbell Hanan.

“Our committed development pipeline is expected to deliver over $100 million in future net operating income and $650 million in potential development value in the coming years, while lifting our exposure to the living and industrial sectors," said Hanan.

Read Andrew Banks' full article on Mirvac here.

11:15 am (AEDT):

Over to the NASDAQ, Coinbase (COIN) surpassed expectations in revenue and earnings per share.

Revenue last quarter was US$2.27 billion, above analyst projections of $1.84 billion. Diluted earnings per share were $4.68, more than double analysts' expected $2.11 and up from $1.04 year-over-year.

Full year revenue was US$6.6 billion, while net income was $2.6 billion.

The company's Q1 2025 outlook includes US$685 million to $765 million in subscription and services revenue.

Cryptocurrencies have rallied following the U.S. presidential election in November, as President Donald Trump is an ally of the industry with his own meme coin and a major stake in crypto platform World Liberty Financial. "The Trump Administration is moving fast to fulfill its promise of making the US the crypto capital of the planet, and globally, leaders are taking notice and increasing their attention and investment into crypto," said Coinbase.

Read Oliver Gray's full article on Coinbase here.

Meanwhile, the ASX is seeing a Valentine's Day rally — read Garry West's report here. The U.S.' S&P 500 futures have remained flat. Oliver Gray has the full story here.

11:32 am (AEDT):

Sienna Martyn here, taking over this Friday.

Staying on the NASDAQ, let’s take a look at footwear company Crocs Inc (CROX) which recorded Q4 results that topped the market’s revenue expectations.

Sales were up 3.1% year on year to $989.8 million, while next quarter’s revenue guidance of $905.8 million was less impressive, coming in 2.3% below analysts’ estimates.

The company’s non-GAAP profit of $2.52 per share was 11.3% above analysts’ consensus estimates.

While adjusted EPS guidance for the upcoming financial is $12.93 at the midpoint, beating analyst estimates by 2.7%

Shares in Crocs jumped 23.9% overnight (AEDT) to US$110.05 following the company delivering solid Q4 results.

12:00 pm (AEDT):

British multinational bank Barclays PLC (LON: BARC) shares sank after 2025 guidance failed to impress, despite reporting impressive full year tax profit which rose by 24% in 2024.

Shares were down 5.2% at yesterday’s close to £292.

Net profit attributable to shareholders also went up 24% to £5.316 billion but fell short of the £5.449 billion expected by analysts.

Barclays investment and retail units logged 28% and 46% year-on-year hikes to £2.61 and £2.62 billion, respectively.

The banking group also announced it will be handing out share awards worth £500 to the vast majority of its staff following the improved financial performance.

12:17 pm (AEDT):

Cameron Drummond reports that mobile phone market behemoth and tech solutions provider Motorola (NYSE : MSI) has delivered solid fourth-quarter sales reaching US$3 billion - a 6% increase compared to the same period last year.

For the full year, sales grew by 5% driven by strong performance across both its Products and Systems Integration and Software and Services divisions.

Motorola also showed robust cashflow of US$1.1 billion during the quarter (US$2.4bn over the year - a 17% increase) which has set up the company to pay out US$164 million in dividends, whilst continuing to invest in innovation and strategic acquisitions.

Motorola CEO Greg Brown said 2024 marked another exceptional year for the company.

“Strong demand for our safety and security solutions, together with our record backlog, positions us well for another year of strong growth.”

12:30 pm (AEDT):

That's all from me for now, passing back over to Harlan to take you through the afternoon.

12:53 pm (AEDT):

Thank you, Sienna! Back to the TYO, Nissan (7201) saw profits continue to slide, and has revised its full FY2024 forecast downward.

Net income for the first nine months of its fiscal year was JP¥5.1 billion, well below the 325.4 billion in the first nine months of FY2023. Net revenue for the fiscal year to date was ¥9.14 trillion, down from FY2023's ¥9.17 trillion.

The company's full-year FY2024 outlook has been revised to JP¥12.5 trillion, compared with its previous forecast of ¥12.7 trillion.

After the collapse of merger talks between Nissan, Mitsubishi, and Honda, Nissan is reportedly seeking new partners, including Foxconn.

Nissan will also close three factories in the next two years, in a bid to stem repeated quarterly losses.

1:15 pm (AEDT):

Returning to the NASDAQ, Applied Materials (AMAT) beat analysts' projections on revenue and earnings per share.

Its revenue was US$7.17 billion, up 7% year-over-year and above Zacks estimates of $7.15 billion. Non-GAAP diluted earnings per share were $2.38, surpassing both FY2024 Q1's $2.13 and estimates of $2.28.

Net sales in its largest division, Semiconductor Systems, also surpassed estimates last quarter, reaching US$5.36 billion. This is above analysts' projected $5.31 billion, and an increase of 9.1% year-over-year.

Applied Global Services, its second-largest division, posted sales of US$1.59 billion, up 8% year-over-year. These sales were below estimates of $1.65 billion, however.

Net sales in its Corporate and Display divisions exceeded analysts' expectations, but still fell by 57.7% and 25% respectively.

Applied Materials projects its revenue this quarter will be US$7.1 billion, with non-GAAP diluted earnings per share at $2.30.

“Applied Materials is enabling the major device architecture inflections critical for energy-efficient AI and our focus on high-velocity co-innovation creates unique collaboration opportunities with our customers and partners, positioning Applied for continued growth and outperformance in the years to come," said CEO Gary Dickerson.

1:24 pm (AEDT):

In an update from the ASX, shares in GQG Partners (GQG) rose 3.3% this morning after reporting operating income surged by 50%. WAM Capital (WAM) also saw share prices increase by 1.5% following strong profit increases.

Mark Story has a full report here.

1:58 pm (AEDT):

At the NYSE, Moody's Corporation (MCO) saw strong gains in revenue. Last quarter, the company's revenue was US$1.67 billion, up 13% year-over-year and above analyst estimates of $1.59 billion.

Full-year FY2024 revenue was US$7.1 billion, a 20% year-over-year increase. Diluted earnings per share were $2.17 last quarter and $11.26 across the fiscal year, up 17% and 29% respectively.

Revenue grew across sectors last quarter, with Moody's Analytics reaching US$863 million, up 8% year-over-year. Moody's Investors Service saw $809 million last quarter, an 18% year-over-year increase.

Its FY2025 guidance includes diluted earnings per share of US$12.75 to $13.25.

“Moody’s delivered a strong finish in Q4, capping a year of incredible achievements with full year revenue growth of 20%," said CEO Rob Fauber. "The investments we’ve made in our platform, data and product innovation, paired with disciplined execution, put us in a position to capitalize on these durable demand drivers for both businesses.”

The company's share price has risen by 37.9% over the past 12 months.

2:26 pm (AEDT):

Still at the NYSE, Hyatt Hotels (H) posted earnings below analyst expectations. Its adjusted diluted earnings per share were US$0.42, compared with estimates of $0.79.

The company saw a net loss of US$56 million last quarter, with net income at $1.3 billion across 2024. Adjusted EBITDA was $255 million last quarter.

Net rooms growth was 7.8% across 2024, in line with Hyatt's forecast.

Its 2025 full-year guidance projects net income of US$190 million to $240 million, with net rooms growth at 6-7%.

The company repurchased around 8 million shares in 2024, returning US$1.25 billion to shareholders.

“The purposeful evolution of our business model and strong brand focus has accelerated our network effect benefiting each of our stakeholders. Our fourth quarter results demonstrate the strength of our commercial offerings, as evidenced by the growth of the World of Hyatt loyalty program, which reached approximately 54 million members,” said CEO Mark Hoplamazian.

Hyatt's share price fell 3.15% following the release of its quarterly results.

The company also agreed to acquire Playa Hotels & Resorts this week for US$2.6 billion, including $900 million in debt.

3:09 pm (AEDT):

Over to the NASDAQ, Airbnb (ABNB) exceeded analysts' projections with strong revenue. Revenue was US$2.48 billion, up 12% year-over-year and above LSEG estimates of $2.42 billion.

Earnings per share were US$0.73, above estimates of $0.58.

Airbnb's net income was US$461 million last quarter, compared with Q4 2023's net loss of $349 million. Full-year net income was $2.6 billion.

The company saw 111 million nights and experiences booked last quarter, up 12% year-over-year. Total nights and experiences booked across 2024 reached 491.5 million, rising 10% year-over-year.

Airbnb.org, the company's non-profit, has housed more than 19,000 Californians following January's Los Angeles wildfires. Airbnb and its founders have donated US$18 million to the wildfire relief effort, and the company raised an additional $9 million in donations.

“Airbnb is a fundamentally stronger company today than it was several years ago,” the company said in a shareholder letter. Since our 2020 IPO, our

revenue and GBV have tripled, and in 2024, we successfully outpaced the travel industry’s growth. We’re continuing to build on this momentum in 2025, executing a multi-year strategy to perfect the core service, accelerate growth in global markets, and launch and scale new offerings."

The company projects revenue of US$2.23 billion to $2.27 billion this quarter.

Airbnb's share price soared by 15% in extended trading following the results. Read Sienna Martyn's full report here.

3:41 pm (AEDT):

At the LSE, Unilever (ULVR) saw sales just below expectations. Its underlying sales growth last quarter was 4%, missing estimates of 4.1%.

The company's full-year GAAP net profit was EU€6.4 billion, falling 10.8% from 2023. GAAP diluted earnings per share in 2024 were €2.29, falling 10.6% from 2023.

Its “power brands", which include Dove and Vaseline, posted underlying sales growth of 5.3% last year. Its Beauty and Wellbeing division saw the highest underlying sales growth in 2024, up 6.5%.

Unilever's free cash flow in 2024 was EU€6.9 billion, down €200 million year-over-year.

"Under the Growth Action Plan, we committed to doing fewer things, better and with greater impact. We executed the plan at pace and made progress in 2024," said CEO Hein Schumacher. "We continue to sharpen our portfolio, allocating capital to premium segments by acquiring scalable brands in attractive markets, such as K18 and Minimalist, and announcing the divestment of local food brands such as Unox and Conimex, as we focus our Foods portfolio on cooking aids and condiments categories."

The company plans to de-merge its Ice Cream division by the end of 2025. This new business will include brands like Magnum and Ben & Jerry's, and will be listed in London, New York, and Amsterdam, similar to Unilever.

Unilever projected full-year sales growth of 3-5% in 2025. Its shares closed 5.6% lower after the release of its results.

4:04 pm (AEDT):

On the NASDAQ, Palo Alto Networks (PANW) posted strong revenue growth. Revenue rose to US$2.3 billion last quarter, up 14% year-over-year and beating analyst projections of $2.2 billion.

Earnings per diluted share was US$0.81 last quarter, compared with $0.73 in the same period in the prior fiscal year. Net income was $600 million, increasing from $500 million last year.

"Our team has done a phenomenal job of executing at scale. We made considerable progress in platformisation, allowing us to outperform both our top and bottom-line expectations for this quarter," said CEO Nikesh Arora in an earnings call. “In Q2, growth was pretty broad across the entire portfolio with strength across all three geographies and platforms.”

Palo Alto Networks also said today that former Danish Prime Minister Helle Thorning-Schmidt and former ING and UBS CEO Ralph Hamers would join its board of directors.

The company projects revenue of US$2.26-2.29 billion this quarter, with revenue at $9.14-9.19 billion across FY2025.

4:20 pm (AEDT):

Looking ahead to this evening, the EPA will see financial results from Hermes International (RMS) at 6 pm (AEDT). The company is expected to report EU€14.94 billion in revenue across 2024, according to Dow Jones. This would be an increase from 2023's €13.43 billion.

Its projected 2024 net profit is EU€4.51 billion, up from 2023's €4.31 billion.

Hermes' share price closed at EU€2,816, up from its previous close at €2,757. Its shares have risen by around 21% so far in 2025.

4:42 pm (AEDT):

That's all from me today. Over the weekend, keep an eye out for earnings from companies like Crown Castle, FNMA/Fannie Mae, Moderna, Safran, and Paramount.

We'll see you again next week. Thank you for joining us!