Struggling Australian financial services company AMP has emphasised a focus on growth as it announced a 43% slump in statutory net profit to $150 million for the 12 months ended 31 December 2024.

The company, which conducts insurance, wealth management and banking operations, said this reflected business simplification spending and a loss on the sale of the Advice business to Entireti for $10.2 million in December.

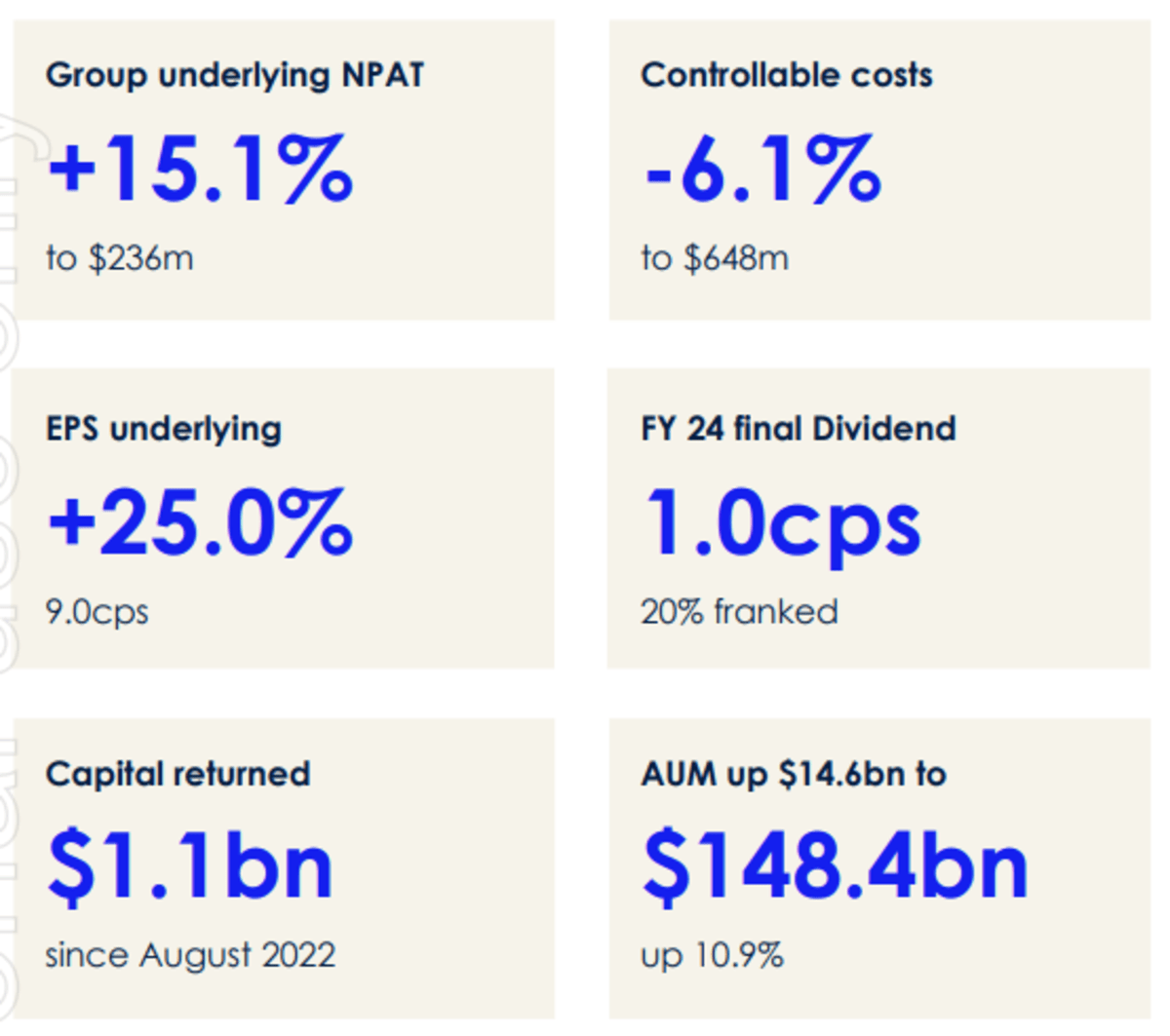

AMP said underlying net profit after tax (NPAT) grew 15.1% to $236 million on revenue which rose 5% to $2.869 billion in the 2024 financial year (FY24).

Platforms underlying NPAT grew 18.9% to $107 million and Superannuation & Investments underlying NPAT jumped 26.4% to $67 million but AMP Bank underlying NPAT reduced 22.6% to $72 million.

Directors declared a final dividend of 1.0 cent per share, 20% franked, to be paid on 3 April to shareholders on record on 3 March, taking the full year dividend to 3 cents per share, compared with 4.5 cents in 2023.

“2024 was another year of strategic delivery for AMP as we build positive performance momentum and focus firmly on growth,” Chief Executive Alexis George said in a statement.

She said AMP sold and transitioned the Advice business, hit cost targets and completed its $1.1 billion capital return program, the wealth businesses were competing strongly and it was launching new offers including digital advice.

AMP’s strong member proposition, including top-quartile investment returns for the year, in Superannuation & Investments was supporting the continued improvement in cashflows.

Improving trends were seen in AMP Bank in the second half of the year, including a return to growth in the mortgage book.

AMP (ASX:AMP) shares closed down one cent (0.57%) at $1.75 on Thursday, capitalising the company at $4.42 billion.

Shares in the former Australian Mutual Provident Society, started trading on the ASX in 1998 and have fallen 96% since they peaked in 2001 for a range of reasons including a poor financial performance and concerns over governance.