Mirvac Group reported its 1H25 results, showcasing a solid performance with a notable increase in residential sales activity.

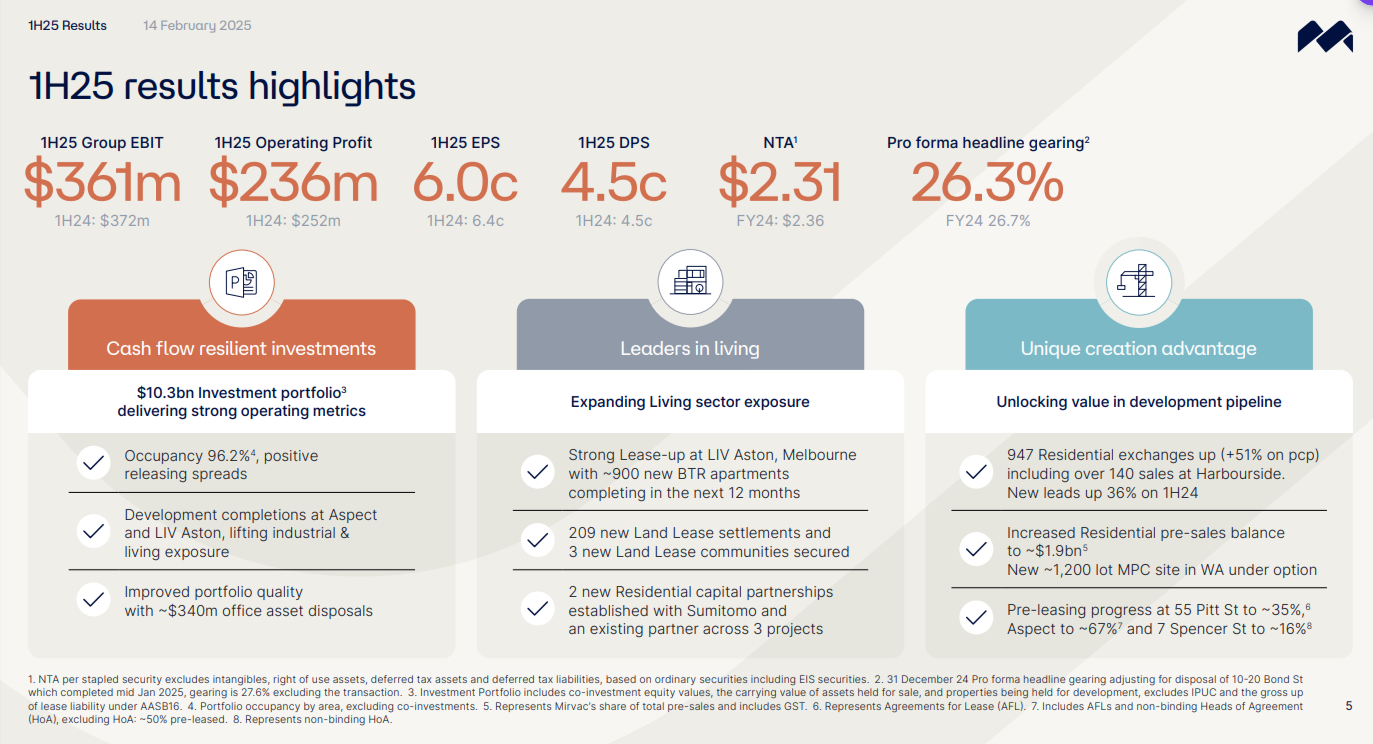

Executing against strategy, Mirvac improved future development earnings visibility, with 947 residential lot sales (up 51% on 1H24), which includes the successful launch of Harbourside Residences, Sydney.

Residential pre-sales grew to $1.9 billion and leads increased by 36% on 1H24.

Living sector EBIT increased to $26 million from $2 million in 1H24.

Key financial metrics

- operating profit after tax of $236 million (1H24: $252 million)

- operating EPS of 6.0cpss (1H24: 6.4cpss)

- statutory profit of $1 million (1H24: $201 million statutory loss)

- half-year distribution of $178 million, representing distribution per security of 4.5cpss (1H24: 4.5cpss)

- net tangible assets (NTA) of $2.31 (1H24: $2.56).

Analysts and brokers have reacted positively to Mirvac's results. Wilson Asset Management, despite some challenges in the real estate investment trusts sector, remains optimistic about Mirvac's long-term potential.

Mirvac’s CEO & Managing Director, Campbell Hanan, said: “We delivered a good result in the first half and remain on track to achieve guidance in FY25. We have made significant progress delivering our strategic initiatives and we are now setting the business up for a return to growth.

"We’ve seen a strong pick-up in residential sales, which are up 51% on the same period last year, with pre-sales now sitting at $1.9 billion. Combined with continued development pre-leasing and capital partnering, we have good visibility on earnings and NTA growth into the future.

“Our committed development pipeline is expected to deliver over $100 million in future net operating income and $650 million in potential development value in the coming years, while lifting our exposure to the living and industrial sectors. We have a strong balance sheet, with pro forma headline gearing at 26.3%, driven by successful asset sales and capital partnering.

“The new partnerships we have established in our residential business also build on our stated strategy to increase the velocity of capital to unlock value from our development pipeline, improve returns, and facilitate the accelerated release of lots into a deeply undersupplied housing market.”

The fund manager highlighted stabilising residential margins and the strong performance of upcoming project launches as key factors supporting their positive outlook.

Additionally, Fitch Ratings affirmed Mirvac's 'A-' rating with a stable outlook, reflecting confidence in the company's ability to navigate structural changes in the property market.

Looking ahead, Mirvac's economic outlook appears promising. The company's strategic focus on high-quality assets and disciplined approach to project approvals and capital partnerships are expected to support financial resilience.

Hanan said: “We maintained strong metrics in our investment portfolio during the half, with high occupancy, positive re-leasing spreads and limited lease expiry. Our modern, Prime-grade office portfolio continued to achieve impressive results, including occupancy of just over 95%, while our Sydney-focused industrial portfolio recorded strong NOI growth. Within our urban retail portfolio, leasing spreads were positive and sales remained strong.

“We continue to increase our living sector exposure, with our most recently completed build to rent asset, LIV Aston, already 66% leased since opening in August last year. Our land lease business has grown by 15% to over 7,000 lots since our initial acquisition 12 months ago and is well placed to capture demand in this sector.”

With a continued emphasis on sustainability and a diversified portfolio, Mirvac is well-positioned to capitalise on emerging opportunities in the residential and industrial sectors.

The company's commitment to maintaining balance sheet strength and reducing exposure to the office sector further bolsters its outlook.

“Our results today signal the beginning of a market turnaround, and we are starting to see real benefits from the execution of our strategy. We have multiple drivers for earnings growth in FY26 and beyond, including a strong pipeline of projects to deliver over the next few years, a high-quality investment portfolio that will continue to generate income for the Group, and earnings through our established funds. We are well positioned to capitalise on a recovery across all parts of our business, supported by falling inflation and signs that interest rates will start to ease in the near future,” Halan said.

At the time of writing, the Mirvac Group (ASX: MGR) stock price was $2.00, with a market cap of $7.89 billion.