A tsunami of Chinese brands such as Zeekr, XPeng, Deepal and Leapmotor are preparing to enter mid-sized luxury EV SUVs into foreign auto markets next year with premium offerings aiming to be highly competitive with the status quo luxury models from BMW, Mercedes and Lexus.

China's auto giants are flooring it on medium SUV exports, turning family haulers into weapons against Western dominance.

The mid-sized SUV market is one of the fastest growing in the auto industry worldwide, valued at an eye-whopping US$492.37 billion last year and projected to reach $968.75 billion by 2034, growing at a CAGR of 7.2%

And at the luxury EV end, China is now starting to flex its automaking muscle into a sub-industry once reserved for European manufacturing prowess.

Crouching tiger, hidden dragon

With 3.48 million vehicles shipped H1 2025 - up 18% - the Middle Kingdom's bullion isn't just gold; it's gearboxes and batteries.

The four Chinese brands are launching new medium-sized sports utility vehicles (SUV's incase you needed a refresher) in late 2025 and early 2026 across North America, Europe and Southeast Asia, each targeting different premium segments but collectively creating a presence that established manufacturers - and consumers - will notice.

Chinese medium SUVs like BYD's Song Plus (PHEV with 1000km+ range) and Chery's Tiggo 7 are priced 30-50% below rivals, packing ADAS tech that rivals Tesla.

Domestic saturation – 55% market share for locals - pushes exports 33% of them to Russia 33%, Mexico, and the UAE - where sales surged 20%+ in 2025.

EV deliveries exceeded 17 million globally in 2024, reaching a sales share of more than 20% and are expected to exceed 20 million in 2025, making up >25% of all new vehicle sales globally.

China maintained its lead, with electric cars accounting for almost half of all car sales in 2024.

To put this into some perspective, the >11 million electric cars sold in China last year were more than global sales just two years ago. Bonkers.

European markets are experiencing rapid change, led by CO2 emission standards changes that should increase the continent's EV sales share to 25% in 2025, with projections reaching close to 60% by 2030.

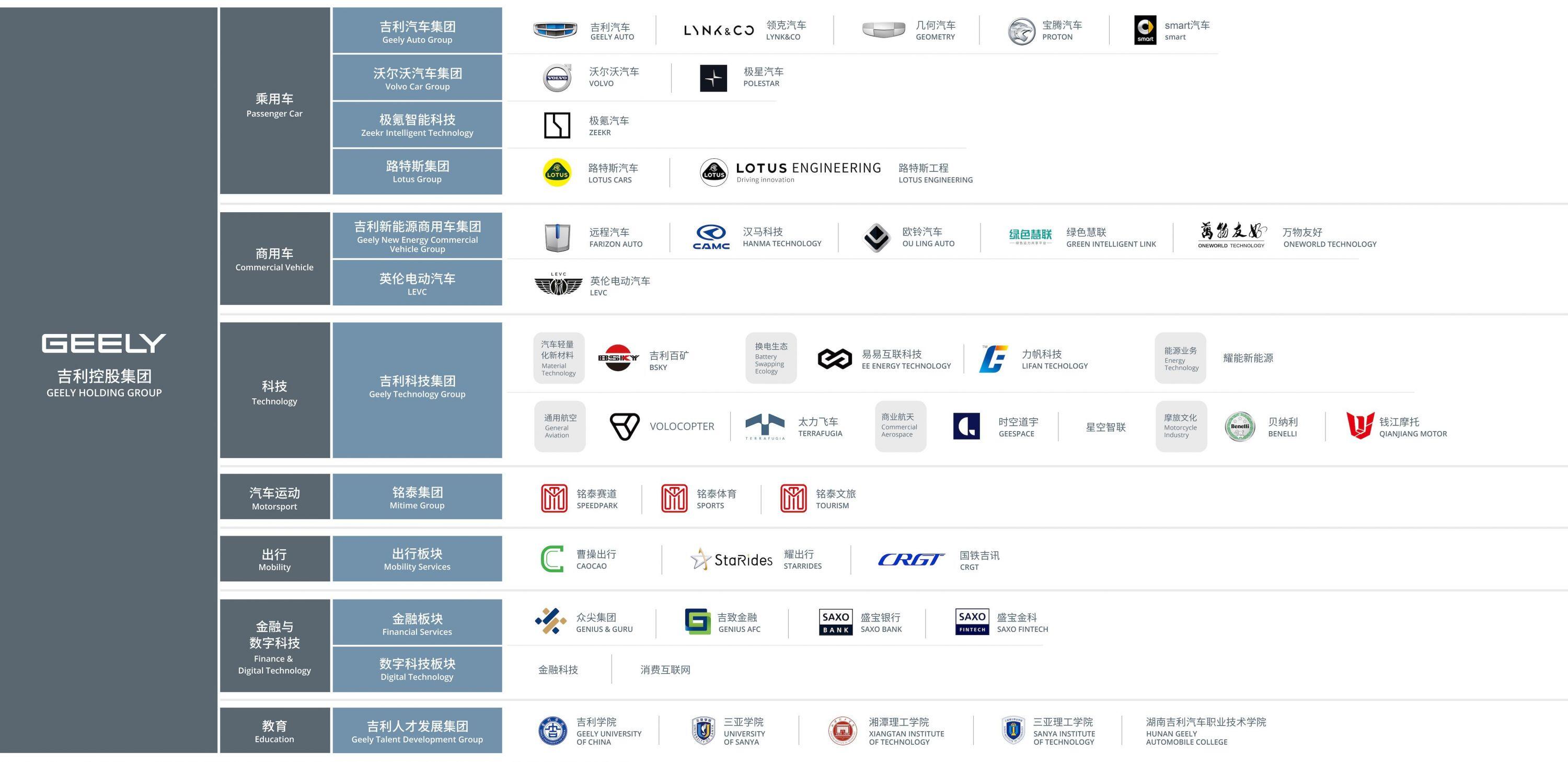

Geely is the perfect example of a structured long-play from Chinese multi-nationals. Case in point, Volvo was bought by Geely in 2015.

So, could most of them come from China?

The lineup

Designed in Volvo's Scandinavian design factories, the Zeekr 7X (pictured in headline) leads the charge with pricing starting at $57,900, directly competing with the Tesla Model Y at $58,900.

But Zeekr, owned by Geely, isn't operating alone. XPeng's G6 has already launched at $54,800, while Deepal's S07 electric SUV targets the Tesla Model Y and BYD Sealion 7 segment.

Leapmotor's C10 joins this competitive set, with all brands launching within months of each other in key markets including Australia and Europe.

Meanwhile, Tesla's Model Y has recently lost its global leadership position to the Toyota RAV4 in early 2024, suggesting vulnerability in what was previously considered a strong market position.

The move into foreign markets by Chinese carmakers has been tried and tested - BYD entered the American market in 2011, establishing its North American headquarters in California.

Since 2021, it has been exporting passenger cars into key markets across Europe, Latin America, Southeast Asia and Australia.

Unlike their predecessor BYD, these new bunch of cars from the Middle Kingdom aren't competing on price alone.

At its domestic launch in China, Zeekr received 58,429 orders for medium SUVs.

The 7X model offers 615 km range, 13-minute charging from 10-80%, and 0-100 km/h acceleration in 3.8 seconds.

It features Qualcomm's Snapdragon 8295 automotive chip and industry-first innovations, including emergency window-breaking buttons and active airbag child seats.

AI-driven ZeekrGPT voice technology enables drivers to change climate control settings or enter navigation destinations while keeping hands on the wheel.

The pure EV also operates on an 800V electrical architecture with vehicle-to-load functionality, allowing owners to power external electrical appliances.

"[China is] an execution machine," Zeekr CEO Giovanni Lanfranchi said at CES 2025. "Give them a target, they will hit it".

XPeng CEO He Xiaopeng said his company is preparing for intense competition abroad.

"The market will definitely see fiercer competition in 2025, and I can even make a bold prediction that price war will ignite from January", he wrote in an internal letter to employees.

The brand plans to expand to 60 international markets this year, doubling its current footprint in around 30 countries and regions.

Meanwhile, Deepal's S07 includes synthetic leather with orange stitching, heated and ventilated front seats, an augmented reality head-up display, and a 15.6-inch tilting infotainment screen.

Deepal Australia boss Cormac Cafolla described the S07 as a real game-changer.

"It's a unique mix of SUV and mini truck, all wrapped up in a luxury trim for an unbeatable driving experience", he said.

Fourth competitor Leapmotor's international expansion is backed by automaker Stellantis.

"The mission is to promote sales of Leapmotor models in the rest of the world outside of China", said Stellantis CEO Carlos Tavares.

"We plan to cover 65 per cent of the Australian segments in the next three years", Leapmotor Australia CEO Andy Hoang told CarExpert.

Dominating global sales

As Chinese carmakers doubled their EU market share to 5.9% in May 2025, EU automakers are struggling to compete.

Chinese automakers are expected to boost annual production in Europe by 800,000 vehicles by 2030; meanwhile, their EU counterparts could shutter 400,000 in capacity worth $18 billion.

To counteract this shortfall, German manufacturers are now seeking out Chinese technology. Volkswagen Group announced its investment of $700 million in XPeng in July 2023, purchasing a 4.99% stake to collaborate on developing two VW-brand electric models for the mid-size segment in the Chinese market by 2026.

Major global automakers, including Stellantis and Volkswagen, are seeking their own way to keep up with competition from Chinese rivals, with both automakers investing in Chinese EV startups to gain access to EV know-how.

Chinese automakers operate with a "New Operating Model" that enables bringing automobiles to the sector twice as fast, with 40-50% less investment and a 30% cost advantage.

GM is cutting production at major EV facilities and delaying new model introductions, while GM executives expect "irrational discounts" from rival EV manufacturers to end as weaker players exit the industry.