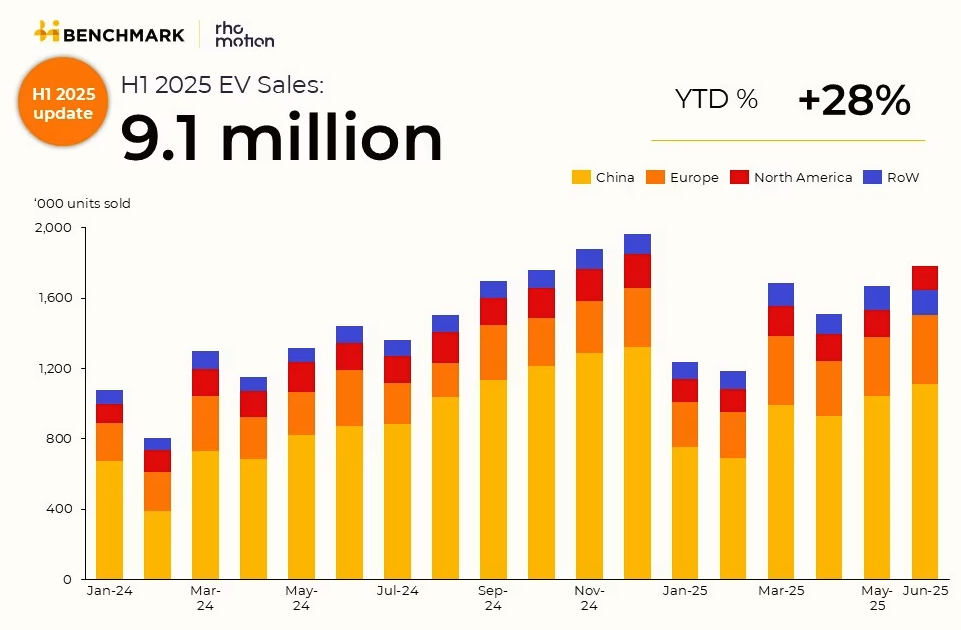

Global EV sales have surged 28% to 9.1 million units in H1 2025, yet North America's anaemic 3% growth exposes a widening gulf as China, Europe and the rest of the world race ahead in the electric transition.

China extends market dominance

China, the world's largest EV market, will explode with 5.5 million sales in H1 2025, a 32% year-on-year increase.

It now represents more than half of global EV purchases and almost half of its total domestic sales.

Government incentives continue to play a crucial role, with 2025's total auto-related subsidies expected to exceed 400 billion yuan.

Price wars among manufacturers have reached new heights, with BYD's cheapest model, the Seagull, starting at under $10,000.

BYD maintains its commanding position, capturing a 29.2% market share with 205,711 NEV sales in February alone.

The company previously received US$3.7 billion in direct government aid from 2018-2022 - demonstrating how state support has underpinned China's EV dominance.

Europe powers ahead despite uneven growth

European EV sales reached 2.0 million units in H1 2025, growing 26% year-on-year, however the growth masks significant regional disparities driven by subsidy policies.

Spain led the charge with a whopping 85% growth year-to-date, bolstered by the extended MOVES III incentive scheme.

Germany and the UK boith showed strong performances at 40% and 32% growth respectively, yet France slumped 13% following domestic subsidy cuts.

Small-segment vehicles like the Renault 4 and Renault 5 drove battery electric vehicle sales up 26%.

Plug-in hybrid sales grew by 27% as Chinese manufacturers used PHEVs to circumvent EU tariffs on battery electric vehicles.

US and Canada shift down

North American EV sales crawled to just 3% growth in H1 2025, with Canada down 23% and the U.S. managing only 6% growth.

United States President Donald Trump's “Big Beautiful Bill”, signed into law on July 4, eliminates the $7,500 federal EV tax credit by the end of September.

The legislation also removes the $4,000 credit for used EVs, fundamentally altering the American EV landscape.

The loss of federal support could lead to roughly 8 million fewer plug-in cars sold this decade, according to a Princeton University analysis.

However, a new tax deduction allows buyers of American-assembled vehicles to deduct up to $10,000 annually in loan interest from 2025-2028.

Emerging markets accelerate adoption

The "Rest of World" category delivered the strongest growth at 40%, reaching 0.7 million units.

Countries like Vietnam, Thailand and Brazil saw EV sales rise dramatically, with many achieving higher adoption rates than wealthier nations.

Chinese imports dominated emerging markets, accounting for a 75% of the increase in sales outside the three major regions.

In Brazil, >85% of new EVs came from China, whilst Thailand saw Chinese vehicles capture 85% of electric car sales.

Subsidy dependency a concern?

The divergent regional performance highlights the critical role of government support in EV adoption.

Global government spending on electric cars has declined from 20% of total spending in 2017, to less than 7% in 2024 - but it doesn't seem to have materially stopped adoption.

Key growth factors:

- Supply chain resilience: Chinese manufacturers' vertical integration and battery technology leadership position them to weather subsidy cuts better than competitors

- Manufacturing shift: U.S. incentives now favour domestic assembly, potentially reshoring production

- Price competition: Intense price wars in China are making advanced EVs accessible at unprecedented price points

- Market fragmentation: Policy divergence creates distinct regional markets with different competitive dynamics