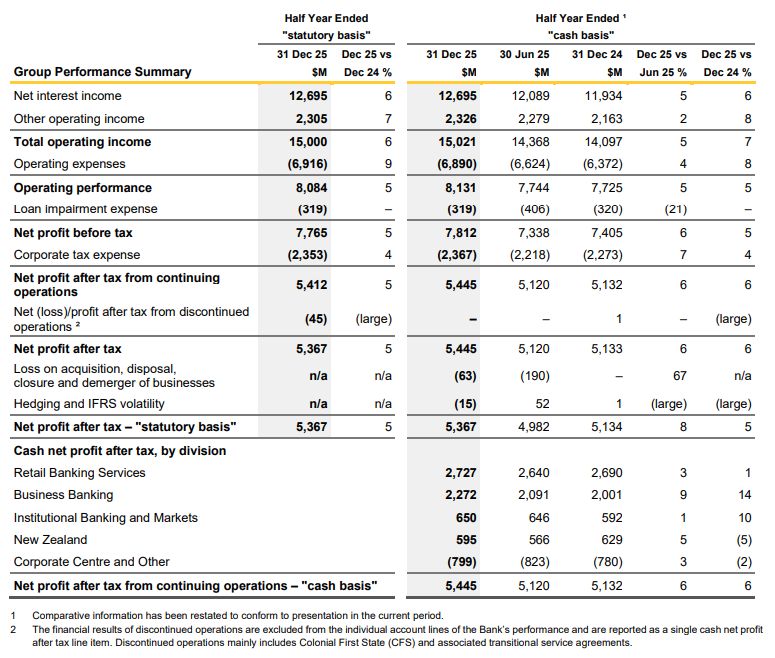

Commonwealth Bank of Australia (CBA) has reported a 5% increase in net profit after tax (NPAT) to $5.412 billion for the first half of the 2026 financial year (H1 FY26), with shares rallying 7.9% by 12:15 pm AEDT (1:15 am GMT).

Australia’s largest company said cash NPAT grew 6% to A$5.445 billion (US$3.85 billion) and cash earnings per share (EPS) rose 6.1% to 19 cents, on revenue which rose 6% to $15 billion in the half year ended 31 December 2025.

The bank said NPAT was supported by lending and deposit volume growth in its core businesses, which were partly offset by lower margins and higher operating expenses primarily due to inflation and a continued investment in technology.

Directors declared an interim dividend of $2.35, up 4% on a year earlier, to be paid on 30 March to shareholders on record on 19 February.

The net interest margin eased four basis points to 2.04%, mainly due to home lending competition, lower Treasury and Markets income, partly offset by higher earnings on the replicating portfolio and favourable funding mix from strong growth in at-call deposits.

Operating expenses rose 5% to $6.72 billion as a result of inflation, increased investment in technology, and additional lenders and operations resources, partly offset by benefits from productivity initiatives.

Market share remained steady at 24.6% in home loans, and rose to 17.6% from 17.2% for business lending and to 28.1% from 27.7% for credit cards, based on Reserve Bank of Australia data.

“We have continued to invest in technology and frontline teams to improve customer experiences,” CBA said in its profit announcement.

“Our balance sheet settings remain resilient with strong levels of capital, deposit funding and provisioning given the economic backdrop and geopolitical issues.

“Our financial position enables us to support lending growth, continue investing to accelerate our technology modernisation agenda and enhance our GenAI capability, and help combat fraud, scams, cyber threats and financial crime.

“We continue to watch the competitive intensity and its implications across the financial system. We are well placed to compete effectively and will continue to adjust our settings as appropriate.”

The result surpassed analysts’ consensus expectations of about a cash NPAT of A$5.2 billion.

At the time of writing, CBA shares were trading $10.95 or 6.90% higher at $169.69, capitalising the bank at $265.65 billion.

The shares have fallen more than 9% over the last six months and remain short of their record high of $192 in June 2025.