United States convenience store chain, Casey’s General Stores (NASDAQ: CASY) delivered robust financial results for the fourth quarter and fiscal year 2025, driven by solid growth in net income, EBITDA, and an aggressive store expansion strategy.

Earnings Growth Surpasses Expectations

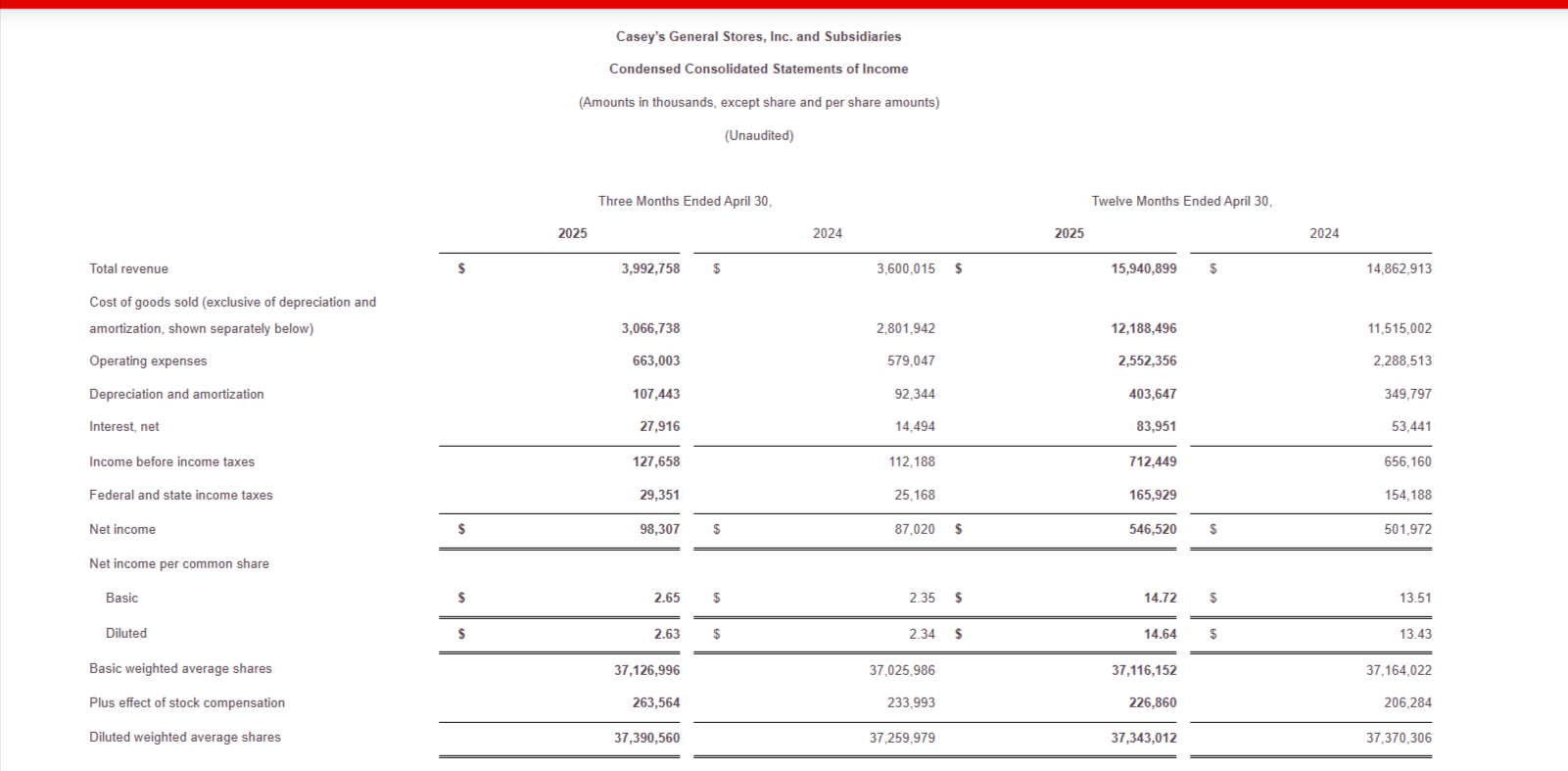

Casey’s reported Q4 net income of $98.3 million, marking a 13% increase year-over-year, while EBITDA surged 20.1% to $263 million. For the full fiscal year, net income reached $546.5 million, up 8.9%, with EBITDA climbing 13.3% to $1.2 billion. The company’s diluted earnings per share (EPS) rose 12.4% in Q4 to $2.63, beating expectations of $1.94 and rising 9% for the full year to $14.64.

Store Expansion Hits Record Levels

Casey’s accelerated its footprint, adding 270 new locations, the highest in its history. This includes the $1.1 billion acquisition of Fikes Wholesale, integrating 198 CEFCO convenience stores. The company now operates 2,904 stores, up from 2,658 a year ago.

Revenue and Margin Performance

Inside same-store sales grew by 1.7% in Q4 and 2.6% for the full year, outperforming industry trends. The company maintained a 41.2% inside margin, with strong contributions from the bakery, hot sandwiches, and beverages. Fuel same-store gallons sold edged up 0.1%, while total fuel gross profit jumped 21.4% to $307.8 million.

Dividend Growth and Fiscal 2026 Outlook

Casey’s increased its quarterly dividend by 14% to $0.57 per share, marking its 26th consecutive annual increase. Looking ahead, the company forecasts EBITDA growth of 10-12% and inside same-store sales growth of 2-5% in fiscal 2026. It plans to open at least 80 new stores, continuing its aggressive expansion.

“Casey's delivered another record fiscal year as our team continued to execute on our three-year strategic plan, reaching $546.5 million of net income and $1.2 billion in EBITDA," said Darren Rebelez, President and CEO. “Inside same-store sales outperformed the industry, up 2.6%, or 7.1% on a two-year stack basis, led by strong performance in hot sandwiches and bakery as well as alcoholic and non-alcoholic beverages. Our fuel team grew market share and produced a healthy margin, as fuel gross profit increased 10.7% from the prior year. The operations team performed exceptionally well during the year, driving strong performance, integrating the most new units in Casey's history, while reducing same-store labor hours for the twelfth consecutive quarter.”

Casey’s strong financial performance underscores its resilience in a challenging retail environment, positioning the company for sustained growth in the coming year.

Fourth Quarter 2025 Key Highlights

Diluted EPS increased by 12.4% to $2.63; net income rose 13.0% to $98.3 million. EBITDA grew 20.1% to $263.0 million; same-store sales were up 1.7%. Fuel same-store gallons increased by 0.1%; total fuel gross profit was up 21.4% to $307.8 million. Quarterly dividends increased by 14% to $0.57 per share, marking the 26th consecutive annual increase.

Fiscal Year 2025 Key Highlights

Diluted EPS rose 9.0% to $14.64; net income increased 8.9% to $546.5 million. EBITDA reached $1.2 billion, up 13.3% from the prior year. 270 stores were built or acquired, including the Fikes Wholesale acquisition of 198 CEFCO stores. Casey’s Rewards membership grew to over 9 million; debt-to-EBITDA ratio at 1.9x.

Earnings

Q4 net income: $98,307; Q4 diluted EPS: $2.63; Q4 EBITDA: $263,017. FY 2025 net income: $546,520; FY diluted EPS: $14.64; FY EBITDA: $1,200,047.

Inside Sales

Q4 inside sales increased by 12.4% to $1.41 billion; inside gross profit rose 12.5% to $582.4 million. Inside same-store sales are up 1.7%; grocery and general merchandise same-store sales are up 1.8%. Prepared food and dispensed beverages same-store sales increased by 1.5%.

Fuel Sales

Q4 fuel gallons sold increased by 17.8% to 818,641; same-store gallons sold were up 0.1%. Fuel gross profit rose 21.4% to $307.8 million; fuel margin at 37.6 cents per gallon.

Operating Expenses

Q4 operating expenses increased by 14.5% to $663.0 million; credit card fees rose to $63.8 million. Same-store operating expenses excluding credit card fees increased by 1.9%.

Expansion

Store count increased from 2,658 to 2,904; included 35 new constructions and 235 acquisitions. 24 stores closed during the year; 1 acquisition is not yet open.

Liquidity

As of April 30, 2025, available liquidity was approximately $1.2 billion, including $327 million in cash.

Share Repurchase

No shares were repurchased in Q4; approximately $295 million remains under the existing share repurchase authorisation.

Dividend

Quarterly dividend increased by 14% to $0.57 per share, payable on August 15, 2025.

Fiscal 2026 Outlook

Expected EBITDA growth of 10% to 12%; inside same-store sales are projected to increase by 2% to 5%. Anticipated same-store fuel gallons sold range from -1% to +1%; total operating expenses are expected to rise by 8% to 10%. Plans to open at least 80 stores through M&A and new construction.

Caseys General Stores Inc's (NASDAQ: CASY) share price traded at US$439.29, down $4.75 (1.07%), but in after-hours trading it was up $45.71 (10.41%) to $485, with a market cap of around $16.31 billion.