Open up Canva today, and you’ll see plenty of sparkle symbols. The graphic design company, among Australia’s most successful startups, is forging ahead on artificial intelligence (AI) ahead of a prospective IPO.

Canva’s sales have surged, with the Sydney-based company reaching 200 million users and A$2.5 billion in revenue this year. Its valuation has leaped to $49 billion as investors begin selling shares to IPO-hungry buyers.

“We have 95 per cent of Fortune 500 companies using Canva at scale,” according to co-founder Cliff Obrecht.

Canva will likely be listed on NASDAQ, but a date for the IPO has not yet been set. While Obrecht said in March that 2026 was probable, he added this month: “There’s no big rush. It will happen in the coming years, no doubt.”

The great AI charge

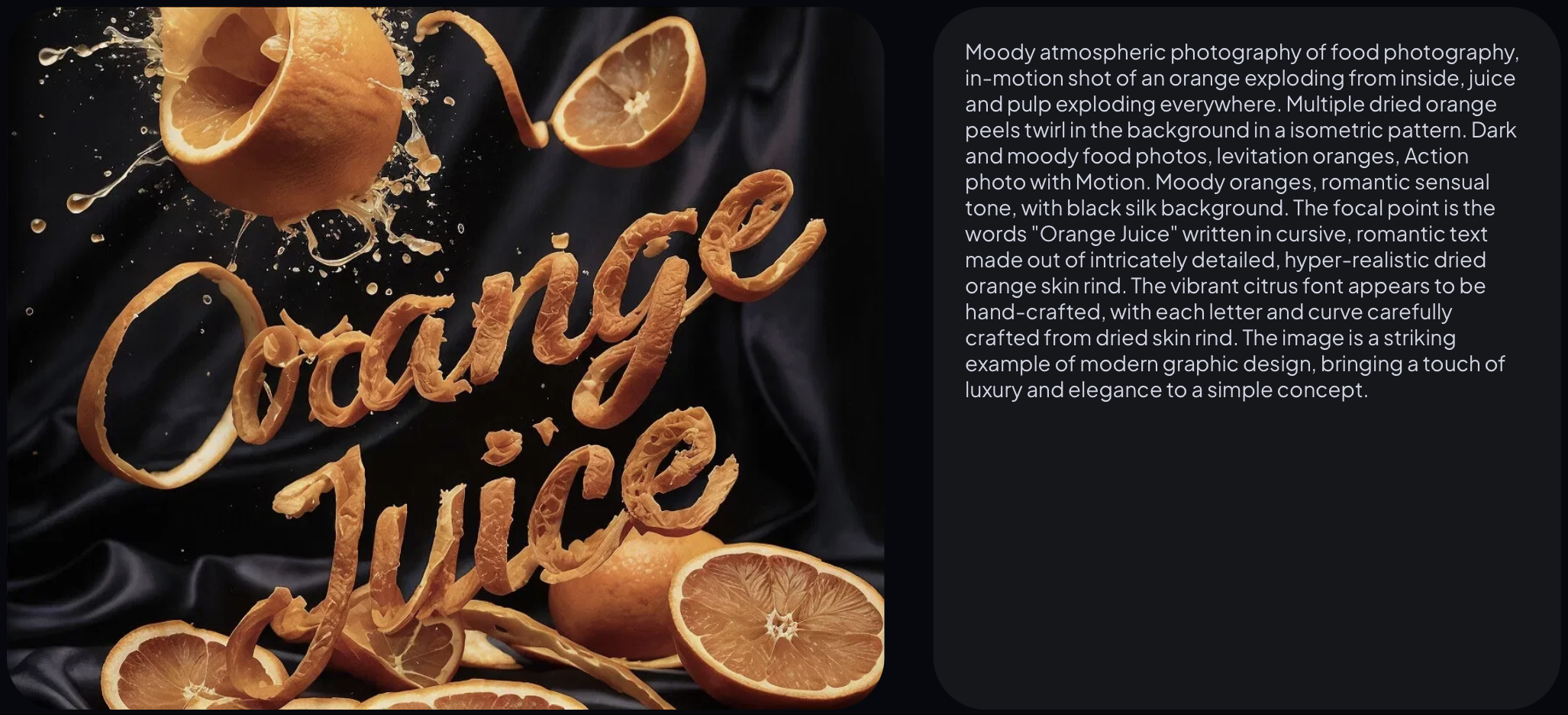

Last week, Canva unveiled Dream Lab, its new hub for generative AI. Intended to meet users’ text-to-image needs, it turns prompts like, for example, “Labrador puppy running through a meadow” into an AI-created picture.

This is not new technology for Canva. Before Dream Lab, it already offered an AI image generator based on Stable Diffusion’s model, which was launched in 2022.

Dream Lab’s use is somewhat more limited. Canva’s Stable Diffusion generator could withstand 100 images each day at launch, for each paid and free user. Dream Lab, meanwhile, allows just 20 images in total for free users, and 500 per month for paying subscribers.

However, Dream Lab was developed closer to home, and may have a major advantage over the competition.

Leonardo.Ai, an Australian AI startup, was acquired by Canva in July for an undisclosed sum. (Though it’s perhaps worth noting that Leonardo.Ai raised $47 million in a funding round last December.)

The company released its Phoenix model in June, shortly before the acquisition, and Phoenix is now the foundation of Dream Lab.

The model bills itself as able to consistently generate readable text, an issue that has long vexed leading text-to-image competitors like Stable Diffusion and DALL-E.

Further, the AI boom has been potent in Australia, and could particularly benefit a company like Canva, which is commonly used by businesses. A study by SAP released this month found that adopting generative AI is a medium or high priority for 90% of Australian businesses.

The Adobe challenge

Yet despite Canva’s push towards AI, Obrecht said in April: “The AI honeymoon is over.”

“There was a lot of AI exuberance that saw a lot of investor, especially early-stage investor, activity that ultimately hasn’t resulted in deeply technical or defensible products,” he said.

Leonardo.Ai’s acquisition is just one component of Canva’s greater expansion plans. In March, Canva acquired Affinity, an Apple-based graphic design and editing software suite.

Affinity is a rival to Adobe’s Photoshop and Illustrator, a move that may signal Canva hopes to challenge Adobe’s dominating market share.

Adobe is the current leader in the creative software market, and has captured over 70% of the the US$15.4 billion market. Canva holds just 4%.

(Adobe is also in the middle of its own ventures into generative AI. It recently released Firefly, an AI model that can convert text prompts into short videos.)

Canva’s pitch to AI critics

Amid widespread lawsuits about whether AI models have been trained on copyrighted material, Canva has promised its use of AI will be ethical. Last October, it launched Canva Shield, its AI security and privacy platform.

According to Canva Shield, the company will commit more than US$200 million in royalty payments to creators who allow Canva to use their work to train AI models.

“With the new creator fund, they get access to a royalty pool that is aligned with AI creations. So as people use these AI tools throughout Canva, our creators who sign up to this program will also get rewarded for it,” Canva co-founder Cameron Adams told SmartCompany at the time.

Canva Shield notes that data from Canva’s users will not be used to train their models, by default. (Users can opt in through Canva’s settings.)

However, it does not indicate exactly what types of data Canva’s AI models have been trained on. Azzet reached out to Canva for clarification, though they declined to comment.

Concerns about generative AI’s environmental impact have also dogged the artificial intelligence sector. The AI research company Hugging Face calculated this year that generating just two AI images could cost as much energy as the average smartphone charge.

CEO and co-founder Melanie Perkins has said that Canva is conscious of the technology’s environmental issues. “As a company, our goal is to be carbon negative, and we’re already doing things where Canva global operations are offset by verified, nature-based carbon credits,” she told Fast Company this month.