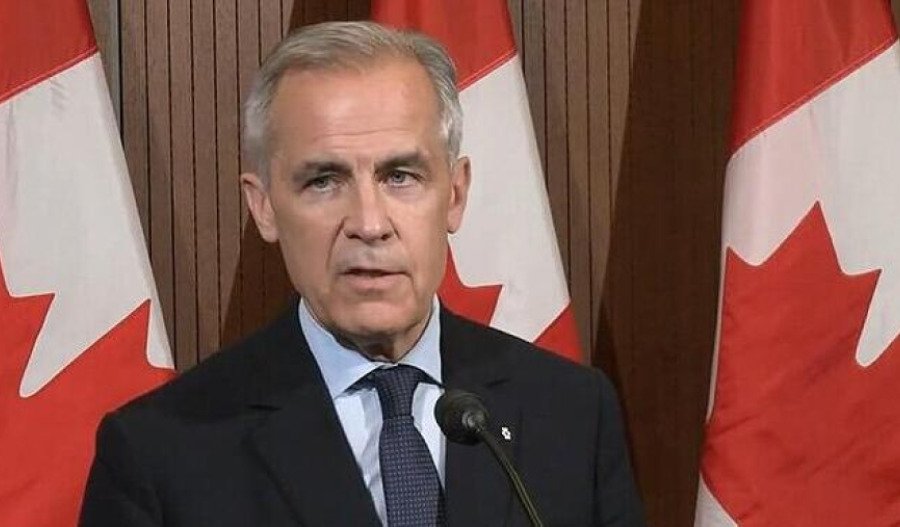

Canada's Senate has passed controversial legislation designed to accelerate approval of major resource projects, setting up a potential constitutional showdown as Prime Minister Mark Carney attempts to shield the economy from United States tariffs.

The legislation, dubbed the "One Canadian Economy Act," cleared the Senate just before Parliament's summer recess, despite fierce opposition from Indigenous groups and environmental organisations who threatened legal challenges and protests.

The Henry VIII clause

The bill's most contentious provision lies in its so-called "Henry VIII clauses" - named after the autocratic English king who preferred governing by decree rather than through Parliament.

These clauses grant the Cabinet extraordinary powers to exempt "national interest" projects from virtually any federal law or regulation, including environmental protection and Indigenous consultation requirements.

Legal experts warn the provisions could prove constitutionally problematic, noting that whilst Henry VIII clauses aren't automatically unconstitutional, their unprecedented scope raises serious concerns about parliamentary democracy.

Economic boost vs Indigenous rights

The Carney government's rationale centres on economic urgency and Canada's critical minerals sector represents a generational opportunity.

With U.S. President Donald Trump threatening crippling tariffs on Canadian exports worth US$600 billion, officials argue Canada must accelerate critical mineral projects to reduce its dependence on U.S. trade.

According to Natural Resources Canada, the country possesses world-class deposits of 34 critical minerals essential for clean energy and digital technologies.

The government estimates the sector could contribute between $5.7 billion and $24 billion annually to GDP by 2030.

Indigenous leaders argue the legislation undermines decades of reconciliation efforts. "This bill represents a major threat to First Nations rights," declared Assembly of First Nations National Chief Cindy Woodhouse Nepinak.

Former Couchiching First Nation Chief Sara Mainville warned that Prime Minister Carney “is likely going to be followed by an Indigenous protest if he continues on this course”.

Canada has been here before. The 1990s saw federal-provincial harmonisation agreements for environmental assessments, and later, the 2008 financial crisis prompted regulatory reforms to accelerate project development.

However, the current legislation goes further than previous efforts.

Ontario's parallel Bill 5 creates "special economic zones" where mining projects could be exempted from environmental regulations entirely; while British Columbia has similarly fast-tracked 16 extractive projects.

Winners and losers

The legislation could significantly benefit major Canadian miners positioned to capitalise on critical mineral demand.

Agnico Eagle Mines - already Canada's largest gold miner by market capitalisation at C$51.4 billion - operates key projects in Ontario and Quebec that could benefit from expedited approvals.

Teck Resources, recently restructured as a pure-play copper producer following its coal asset sale, stands to gain from accelerated copper projects development.

With copper demand surging for electrification and AI infrastructure, Teck's simplified focus positions it well for the critical minerals boom.

Ontario's Ring of Fire region, containing world-class chromite and nickel deposits, represents perhaps the biggest prize.

Companies like Canada Nickel – in which Agnico Eagle holds a 12% stake - could see their Crawford nickel project fast-tracked as a project of "national interest."

Navigating a pathway

The economic stakes are substantial, with a recent Canadian Climate Institute report estimating the country will require at least $30 billion in new mining investments by 2040 to meet domestic critical mineral demand alone.

Yet current investments average just $2 billion per annum, highlighting the scale of the challenge.

Natural Resources Canada's Major Projects Inventory identifies 504 major resource projects worth $632.6 billion under construction or planned through to 2034.

However, regulatory delays plague the sector, with projects often taking five years or more to approve.

Despite government assurances that consultation obligations will remain intact, Indigenous groups are already preparing legal challenges.

Ontario Regional Chief Abram Benedict confirmed there would "definitely" be legal challenges to both the legislation's constitutionality and operational implementation.

Path forward

While the legislation awaits Royal Assent from Governor General Mary Simon to become law, its implementation faces significant hurdles beyond legal challenges.

Research from British Columbia shows regulation delays are often overstated, with economic factors like commodity prices being the primary cause of project delays.

And Mining Watch Canada argues that fast-tracking approvals could paradoxically delay projects by increasing community opposition and litigation risks.

As Canada grapples with economic uncertainty and geopolitical pressure, the success of this legislative gambit will depend on whether the government can balance economic imperatives with constitutional obligations and Indigenous rights.