AMP has reported a 5% fall in net profit after tax (NPAT) for the first half of the 2025 financial year (H1 FY25) due mainly to planned business simplification and litigation costs.

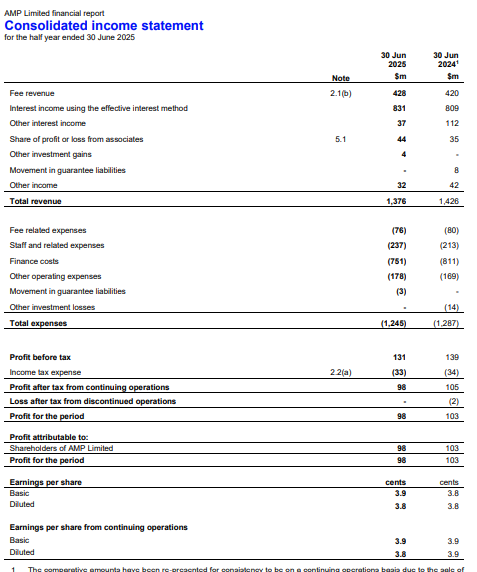

The Australian financial services company said NPAT fell to A$98 million in the six months to 30 June 2025 from $105 million in the previous corresponding period (pcp) on revenue which dropped 4% to $1.376 billion.

Directors declared an interim 20% franked dividend of two cents per share, in line with guidance and level with the pcp, to be paid on 26 September to shareholders registered on 22 August.

AMP said underlying NPAT rose 9.2% across the group to $131 million, with contributions increasing 7.4% to $58 million from its Platforms business, 9% to $36 million from AMP Bank and 11.8% to $19 million from New Zealand Wealth Management, and they were steady at $34 million from Superannuation & Investments.

Underlying earnings per share (EPS) increased 18.2% to 5.2 cents due to improved earnings and the final stages of the share buyback.

Net cash flow soared 98% while controllable costs were reduced by 4.4% to $303 million through continued cost discipline.

“These results highlight our continued discipline and delivery of the strategy and our pivot towards growth,” AMP Chief Executive Alexis George said in an ASX announcement.

She said AMP was building on the strong cashflow momentum in its wealth businesses and maintaining disciplined growth in bank lending as it expands its new AMP Bank GO digital offer.

Shares in the former Australian Mutual Provident Society closed two cents higher at $1.66 on Wednesday, capitalising the insurance, superannuation and investments company at $4.23 billion.