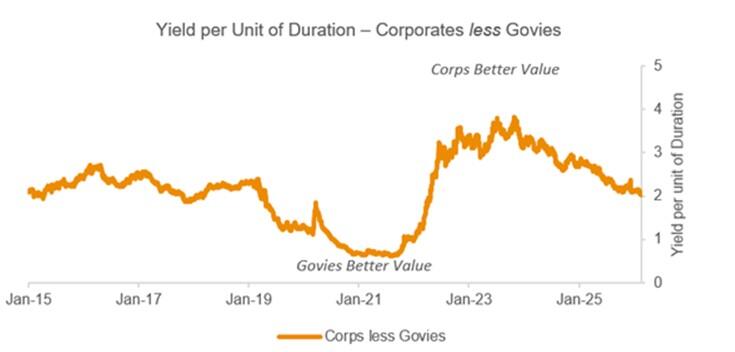

While strong United States corporate bond issuance and demand show no signs of letting up, with calendar year-to-date issuance of around US$309 billion - up almost 30% on the same time last year – U.S. investment grade spreads have tightened to near record levels at 75 basis points (0.75%).

New issue concessions, where additional spread is provided to make sure the raise is successful, have fallen to a low 2 basis points.

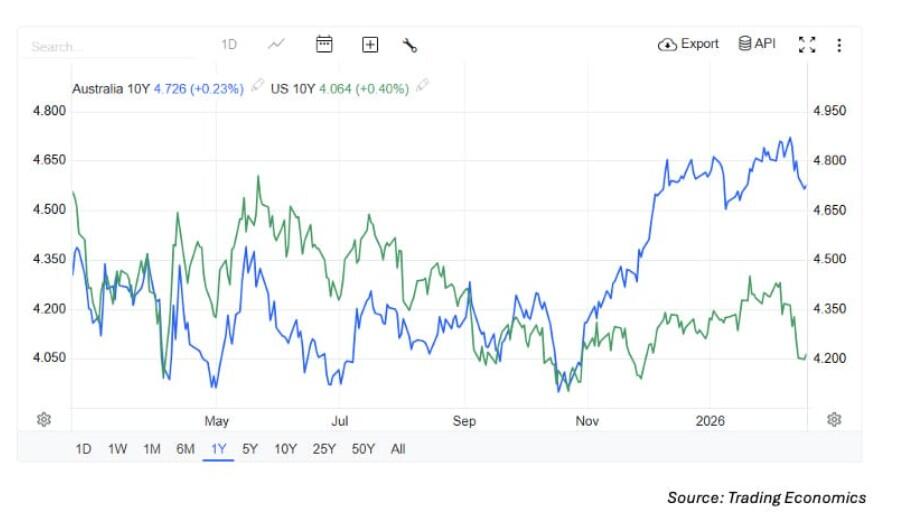

Meantime, while U.S. markets are expecting two further rate cuts this year, yields here in Australia continue trending higher on the back of lingering inflation concerns, with the Reserve Bank (RBA) likely to raise rates twice again this year.

Changing index composition

While this has moved Bond Advisor’s A$ Corps index to a yield of 5%-plus, what’s also evident are radical changes within the index, in terms of both issuer composition and term.

The changing term composition of this index may be a function of shorter-dated state government issuance, but it also highlights the fact that the Australian Office of Financial Management (AOFM) – as Australia's sovereign debt manager - has tried to issue fewer long-term Australian Commonwealth Government Bonds (ACGBs) at higher levels.

Meanwhile, on the corporates side, there’s been a marginal increase in term, plus a shift towards more fixed-rate issuance.

Also worth calling out is the increase in subordinated issuance (i.e. corporate hybrids), the increase in kangaroo-based senior preferred – Australian dollar-denominated bonds issued by foreign entities in the Australian market - and the demise of (Additional Tier 1) AT1 hybrids, previously issued by banks.

New issuance

The biggest changes have been in the capital structure, where Tier 2 levels have materially increased, and they feature strongly in the list of recent new issuance:

- ANZ raised $1 billion in an 11NC6 (11 years, non-call six) Tier 2 sustainable bond deal. The deal tightened five basis points from initial price guidance.

- A $725 million floating rate tranche priced at 125 basis points over 3-month Bank Bill Swap Rate (BBSW).

- A $275m fixed to floating rate tranche priced at 125 basis points over semi quarterly swap.

- Avanti Finance raised $150 million in a senior secured floating rate note with a margin of 415 basis points over 3-month BBSW.

- Macquarie Bank raised $1.25 billion in a 10.5NC5.5 Tier 2 deal. The deal tightened eight basis points from initial price guidance.

- A $850 million floating rate note at 132 basis points over 3-month BBSW.

- A $400 million fixed-to-floating tranche with a 5.757% issue yield.

- Rabobank is taking indications of interest (IOI) for three and five-year senior unsecured bonds.

- IMB Bank raised $100 million in a 10NC5 Tier 2 deal which priced at 3-month BBSW +185 basis points.

- Korea Gas Corporation, KoGas has mandated a four-year kangaroo deal.

- UBS has priced a $1 billion Additional Tier 1 fixed rate deal at 7.125%.

- DBS has raised $2 billion in a dual tranche senior unsecured deal.

- $1 billion in a floating rate tranche at 54 basis points over 3-month BBSW

- $1 billion in a fixed tranche at a 5.065% issue yield

- Watercare Services raised $500 million in a 5.5-year senior secured bond with a 5.203% issue yield.

- IMB Bank is taking IOI for a 10NC 5 Tier 2 deal with price guidance of 210 basis points over 3-month BBSW.

Private credit highly sought after

Meantime, private credit remains a sought-after fixed-income sub-sector.

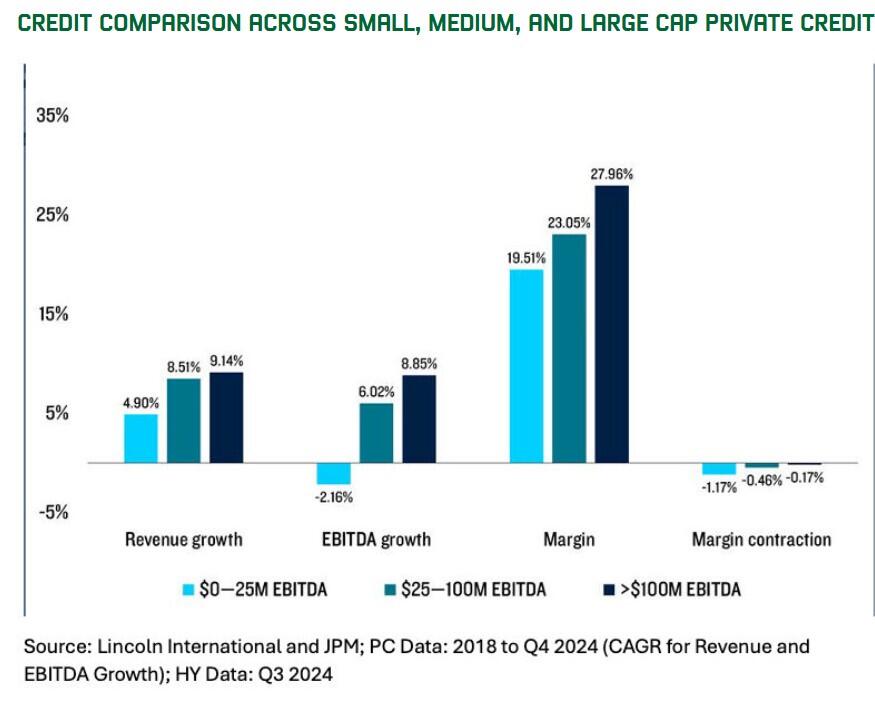

According to global asset management business of U.S.-based Prudential Financial, PGIM, growth within the size and breadth of participants has opened the door for larger companies with larger scale, stronger revenue growth, and more resilient margins.

Fuelled by greater competition between private and public syndicated markets, PGIM is witnessing a surge in cross-market refinancings.

While 2022-2023 saw a notable increase in the volume of broadly syndicated loans (BSLs) being refinanced by direct loans, 2024 and 2025 brought near equilibrium to that trend.

In 2025, the volume of broadly syndicated loans refinanced in the private credit market totalled US$39 billion, only slightly greater than the US$34 billion in direct loans that were refinanced with BSLs.

Larger companies enter the sector

“Although much of the expansion in private credit has focused on direct lending to small and middle market companies, the subsequent growth phase in direct lending finance now includes direct lending to large companies with EBITDA from US$75 million to US$1 billion,” notes PGIM.

“The credit costs of large-cap borrowers are slightly lower than the middle market cohort but once adjusted for a lower expected credit loss experience, the illiquidity premium of large cap private credit is more attractive in our estimation.”

PGIM has come to this conclusion based on the beneficial attributes of large-cap private credit, including, typically, stronger security and covenants compared to the broadly syndicated loans market, plus larger scale and stronger fundamentals.

The global asset manager believes the share of broadly syndicated loans issued with weak security documentation is at an all-time high.

“Carve outs, unrestricted assets and collateral, and overall fewer lender protections have enabled many public leveraged finance borrowers to undertake LMEs,” PGIM notes.

“These are distressed exchanges where the company inflicts principal loss to the lenders—often to the benefit of either shareholders or other creditor groups—and have become a mainstay in the broadly syndicated loan space.”

By contrast, PGIM reminds investors that private credit transactions generally benefit from stronger security over the borrower’s assets, leading to higher recoveries in the event of default.