Bitcoin saw a surge yesterday, coinciding with United States President Donald Trump announcing he had authorised a 90-day pause on tariffs.

The spike came to the tune of 7%, following an earlier fall as far as as USD$74,567.02, while the benchmark 10-year U.S. Treasury yield briefly climbed over 4.51%.

The surge wasn't just limited to the flagship cryptocurrency, with it's own proxy stock MicroStrategy leaping by 23%, Robinhood by 24% and crypto exchange Coinbase by nearly 17%.

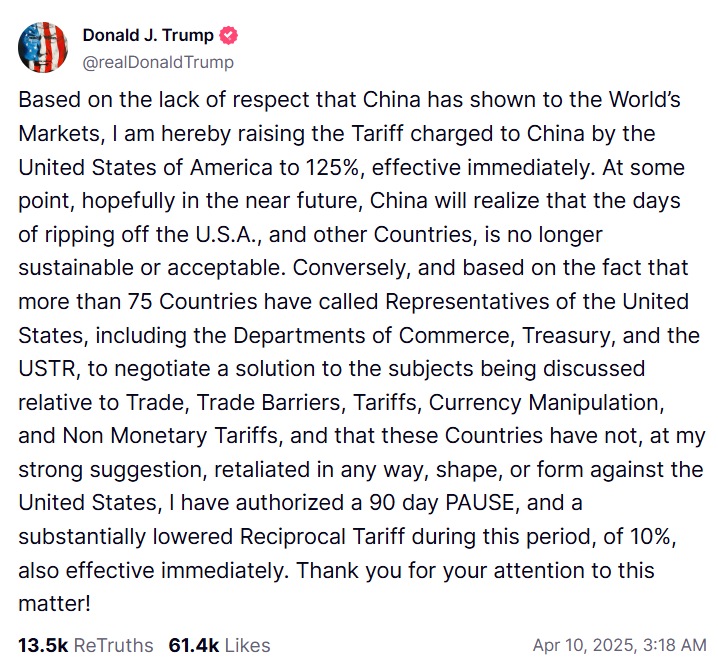

This surge ran parallel to the biggest rally since the Great Recession for the broad-market S&P 500 index, following Trump's announcement on a Truth Social post that he had authorised a 90 pause on his slew of new tariffs, as well as raising the taxes on China to 125%.

Ben Kurland, CEO at crypto research platform DYOR said that the temporary break was a “strategic breather” but "the uncertainty hasn’t gone anywhere."

“He’s easing short term market pressure without giving up leverage, sending a clear signal that his approach to trade is transactional, not ideological. This move calms investor nerves and gives businesses a momentary sense of stability, but it’s not long enough to prompt real supply chain shifts or investment decisions,” said Kurland.

At the time of reporting, 9:15 am (AEST) or 11:15 pm UTC, Bitcoin (BTC) was up 5.60%.