The Big Australian has posted a milestone set of half-year numbers. For the first time since BHP created its copper segment in FY13, the red metal contributed the majority of group earnings - overtaking iron ore as the profit engine of the world's largest miner and officially signalling to the world the age of electrification.

By the numbers:

Underlying attributable profit rose 22% to US$6.2 billion for the six months ended 31 December 2025, in line with Visible Alpha consensus.

EBITDA swelled 25% to $15.5 billion on a 58.4% margin - up seven percentage points on the prior corresponding period.

Revenue advanced 11% to $27.9 billion, propelled by a 32% spike in average realised copper prices to $5.28 per pound (lb) and a 4% nudge higher in iron ore to $84.71 per wet metric tonne (wmt).

Copper seizes the crown

The crossover to copper becoming king has been building for years, but two forces brought it to a head this half - record pricing and sustained volume growth.

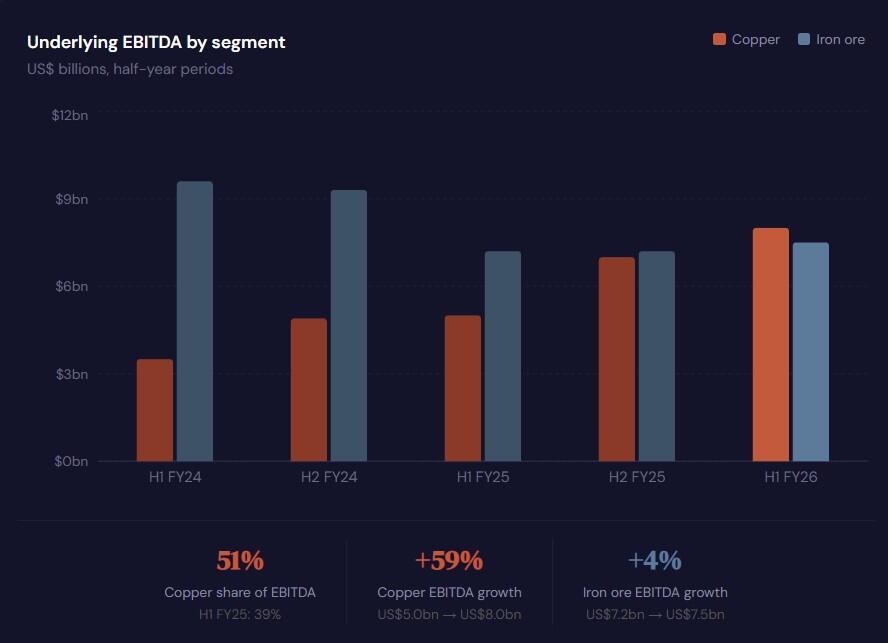

Copper EBITDA vaulted 59% to a record $8 billion on a 66% segment margin, while iron ore's $7.5 billion expanded a far more pedestrian 4%.

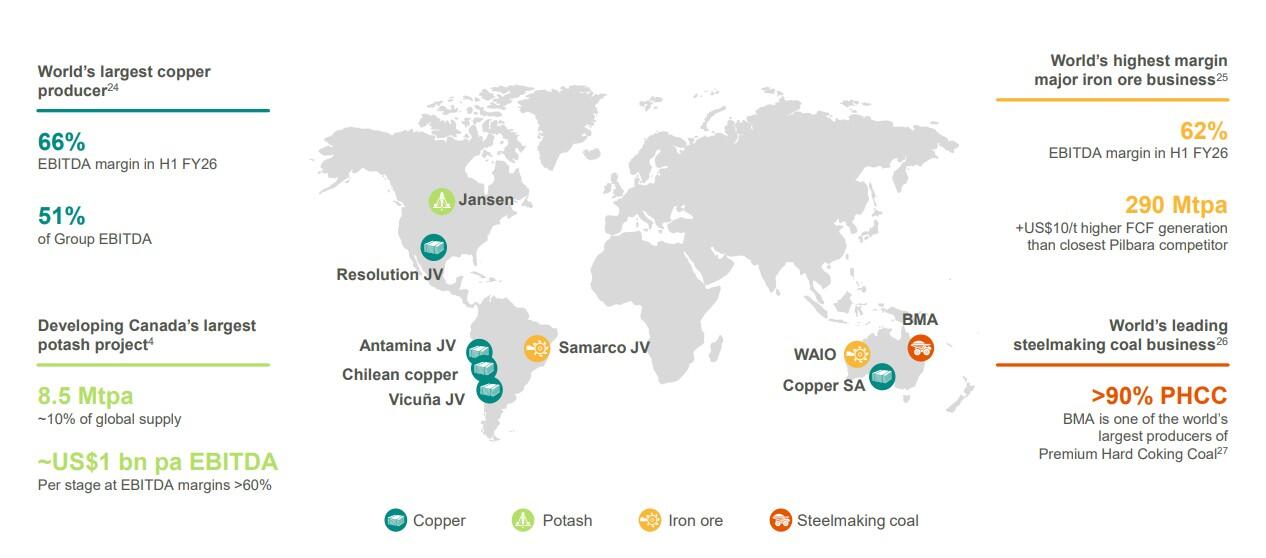

BHP has ratcheted copper output roughly 30% over four years, with FY26 group guidance now tightened upward to between 1,900 and 2,000 thousand tonnes (kt).

Wood Mackenzie projects global copper consumption will balloon 24% by 2035 to 42.7 million tonnes per annum (Mtpa), fuelled by electrification, AI data centres and rapid industrialisation across India and Southeast Asia.

The consultancy estimates data centres alone will hoist copper demand for grid infrastructure to 1.1Mtpa by 2030, with AI set to devour an additional 2,200 terawatt hours of electricity by 2035.

BHP itself flagged that data centre copper appetite could expand sixfold to nearly 3Mtpa by 2050.

The International Copper Study Group now pencils in a refined copper shortfall of around 150,000t in 2026, flipping what had been a forecast surplus.

BHP's project pipeline - Escondida, Copper South Australia, Vicuña in Argentina and Resolution in Arizona - charts a pathway to roughly 2Mtpa of attributable production by FY35.

Iron ore: dependable but capped

Western Australia Iron Ore (WAIO) notched record first-half production of 130Mt, with EBITDA inching up 5% to $7.5 billion and C1 unit costs of $17.66/t - the lowest among major producers for a sixth straight year.

China has held steel output at approximately 1 billion tonnes for seven consecutive years, and its property sector - responsible for about half of steel consumption - continues to weaken.

ING anticipates iron ore prices will average $95/t in 2026, while Goldman Sachs sits at $93/t.

Fresh supply from Guinea's Simandou project - slated to ship 20Mt this year and ramp to 120Mtpa by 2030 - will heap further pressure on the seaborne market.

WAIO's cost position keeps it cash-generative at virtually any price, but the earnings growth is now weighted to copper.

Dividend pips consensus

The board declared $0.73 per share at a 60% payout ratio - a 46% leap on the prior half's $0.50 and comfortably above consensus expectations of $0.62.

"We determined an interim dividend of US 73 cents per share, equivalent to a 60% payout ratio, reflecting strong operating performance, disciplined capital allocation and confidence in our outlook," BHP chief executive Mike Henry said.

Net operating cash flow backed the payout, climbing 13% to $9.4 billion.

BHP also unveiled a $4.3 billion silver streaming agreement on its Antamina stake and a $2 billion WAIO power arrangement with Global Infrastructure Partners, flagging scope to unlock up to $10 billion through active portfolio management.

Net debt rose to $14.7 billion - parked around the midpoint of the $10 billion to $20 billion target range - while the Jansen Stage 1 potash project stays on track for mid-2027 first production at a confirmed capex of $8.4 billion.

Coal was the sore spot, with segment EBITDA tumbling 60% to $0.2 billion on softer steelmaking and energy coal prices.

BMA is mothballing Saraji South and axing roughly 750 roles across Queensland.