All the top moves, shakes and red hot takes from Azzet's editorial team are right here in your weekly business wrap every Friday (14 March, 2025).

US markets nosedive as tariff pain festers

Like a toupée that's had its elastic stretched from overuse, United States markets have fallen into disrepair.

Perhaps falling from an already overheated bull run market, the valuation slide comes as President Donald Trump again increased import taxes - tatting the retaliatory tit as part of his drive to force foreign countries and American businesses to pay the piper for foreign goods entering the country.

The S&P 500 dived into correction territory after a bloody week in U.S. markets which saw the value of the top end of the sharemarket drop 10.1% from all-time highs by end of trade and the Dow Jones slid 537.4 points, or 1.3%, to 40,813.57, marking its fourth consecutive losing session.

Retaliatory tariff measures and countermeasures between the U.S., China, Mexico, Canada and the European Union in the ring read like a WWE Wrestlemania event with blows being landed from all angles and spilling over to affect the rest of the world.

And China looks like they're willing to team up with Canada against U.S. economic powerplays as ex-Bank of Canada Mark Carney was elected to become leader of the Liberal Party and thus next Prime Minister of the Great White North - with an eye-whopping 86% of the vote.

Chinese foreign ministry spokesperson Mao Ning said the Middle Kingdom was willing to work with Canada's new head of state.

"Regarding China’s relations with Canada, we always believe that we need to grow bilateral relations on the basis of mutual respect, equality and mutual benefit,” she said.

“(We hope the) Canadian side will form an objective and rational perception of China, pursue a positive and pragmatic policy towards China, and work with China in the same direction for the improvement and growth of bilateral relations."

Yet this came a day after China announced tariffs on over US$2.6 billion worth of Canadian agricultural and food products. Go figure.

CEO focus

The editorial team looked at company CEOs in among the headlines and the new chiefs taking the reins this week, with Intel appointing ex-board member Lip-Bu Tan, 7-Eleven’s Stephen Dacus fending off a takeover as Hyundai Australia appoints ex-Hyundai Canada boss Don Romano to oversee operations after a slide in domestic auto brand rankings.

And Donatella Versace has announced she would be stepping down from the role of her namesake fashion house after 30 years at the helm, as successor Dario Vitale - a former image and design director for Miu Miu - takes to the drivers' seat.

“It has been the greatest honor of my life to carry on my brother Gianni’s legacy. He was the true genius, but I hope I have some of his spirit and tenacity,” Donatella said.

"In my new role as Chief Brand Ambassador, I will remain Versace’s most passionate supporter. Versace is in my DNA and always in my heart.”

Rumours have it that rival luxury clothing behemoth Prada Group was looking to buy Versace from its umbrella company Capri Holdings.

Elsewhere

A peacekeeping effort to end the Russia-Ukraine war has been further knit together with Moscow providing a tempered response in support of America's ceasefire proposal.

"We agree with the proposals to cease hostilities. But we proceed from the fact that the cessation should be such that it would lead to long-term peace and would eliminate the original causes of this crisis,” Russian President Vladimir Putin was quoted by Reuters.

“Maybe I should call President Trump and have a discussion with him. But we support the idea of ending this conflict by peaceful means,” Putin remarked.

Ukraine President Volodymyr Zelenskyy has said he would accept a ceasefire as a first step toward peace talks.

Back in the land of the free and the heat by the Democrats is on the Elon Musk-led Department of Government Efficiency (DOGE) over firing ~1,300 people in a single day from New York's Department of Education - something Trump wanted to do during his first term in office, reports Azzet's Chloe Jaenicke.

And earlier in the week our very own business boffin Mark Story looked into the reasons behind why Australia's upcoming federal election may be a snoozefest for investors on the back of ruminating a when and why guide to selling shares.

There were also renewed calls to privatise debt-riddled loss-maker NBN Co which is $26 billion in the hole.

Reporter Harlan Ockey says it doesn’t help that late last year the ACCC found that Elon Musk’s Starlink registered faster (470mbps) transmission speeds than the NBN Skymuster (111mbps) either.

In tech, AI startup Coreweave struck a five-year deal with OpenAI worth US$11.9 billion ahead of its anticipated IPO on the Nasdaq.

In the markets…

Gold prices have reached a new record high of US$2,991.341 per ounce (oz), as the US-China trade war intensifies.

“Gold touched a new record high after modest U.S. inflation supports the case for further cuts by the Federal Reserve. Swap traders are now fully pricing in another 25 basis point (bp) cut in June, with about 70bp of easing seen for all of 2025," ANZ analysis showed.

Spot gold prices have risen by almost 14% this year already, after increasing by 27% in 2024.

If fears about the already boiling trade war escalate, recession risks could rise, increasing the likelihood of further Fed rate cuts while driving gold prices to further new record highs.

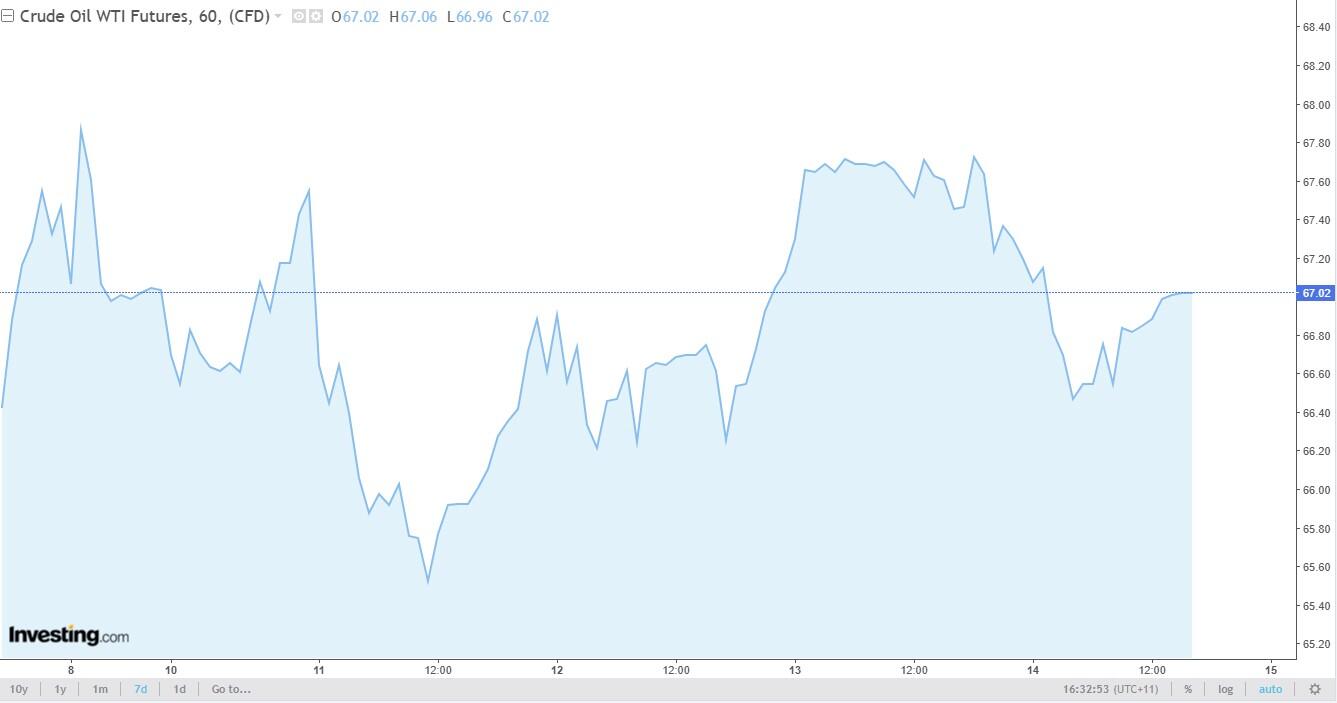

Oil has made a slow-moving rebound this week, the West Texas Intermediate climbing to US$67.01 per barrel, as fresh US sanctions against Iran and Russia coming into effect helped counter losses triggered by a bleak demand outlook from the International Energy Agency (IEA).

IEA’s latest Oil Market Report, which projects a growing supply surplus as escalating trade tensions weigh on demand just as OPEC+ ramps up production.

ANZ analysts highlighted concerns over trade tensions impacting global oil demand, as “rising trade tensions are threatening to slow the already anaemic rebound in oil demand”, the agency said.

The ASX 200 shared in the US market bloodbath this week with its third-largest weekly loss after a red run all week that shaved off nearly 2% of the market.

The Australian sharemarket snapped three sessions of consecutive decline on Friday, as the index narrowly avoided falling into correction territory, supported by gains in mining and utility companies.

Nine of the 11 sectors finished higher, with materials and utilities leading the advance.

The week's downward pressure came from a sharp decline in U.S. markets due to tariff turmoil, yet today's movement of Australia's top 200 stocks saw a slight green at the end of trade.

The S&P/ASX 200 added 40.6 points, or 0.5%, to close at 7,789.7 points.