Whether you see it as a heads-up on investments to steer clear of or want to ride on its coattails, new data from active investor Fidante reveals where financial advisers expect to allocate client funds over the next six months.

Last month, amid heightened uncertainty within global investment markets and stretched equity valuations, Fidante surveyed more than 200 financial advisers for its third edition of the Fidante Adviser Markets Survey.

Having run a ruler over the survey, Azzet presents Fidante's findings.

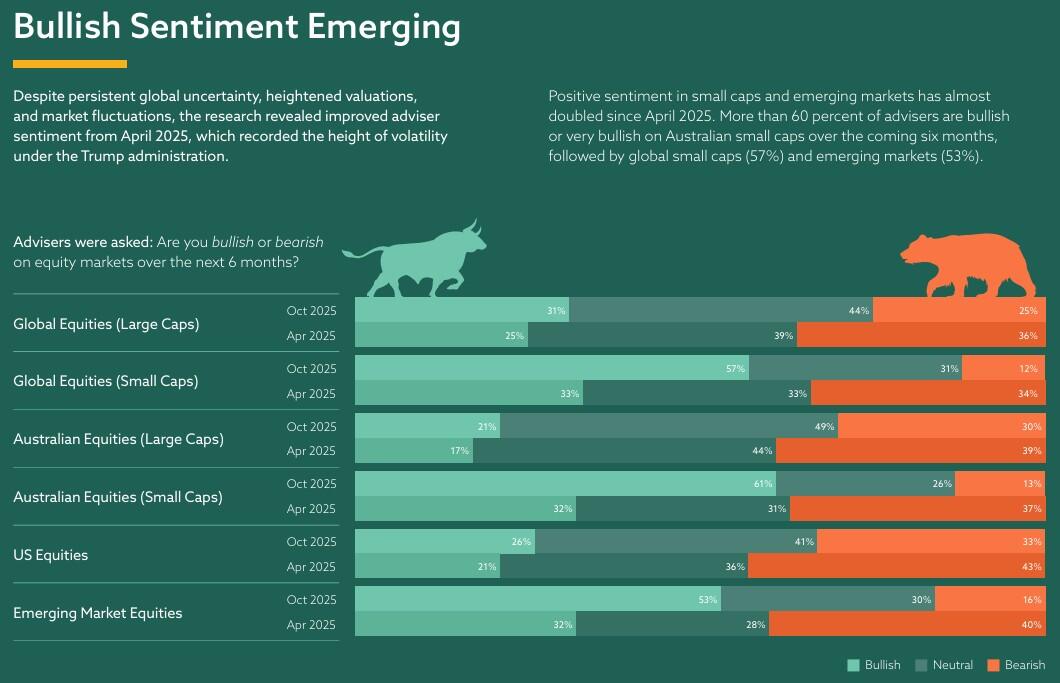

For starters, Fidante’s research points to bullish sentiment, particularly in small caps and emerging markets, as well as a growing appetite for alternative assets.

Despite heightened volatility under the Trump administration, especially following the so-called Liberation Day tariffs earlier in the year, positive sentiment in small caps and emerging markets has almost doubled since April 2025.

Unsurprisingly, given the global appetite for Australia’s asset classes right now, more than 60% of advisers are bullish or very bullish on Australian small caps over the coming six months, followed by global small caps (57%) and emerging markets (53%).

More than half of advisers surveyed expect small caps and emerging markets to outperform over the next six months.

Small Caps and Alternatives

While advisers plan to increase exposure to Australian small caps (44%) and global small caps (42%), a more risk-aware approach was reflected in emerging markets, with only 23% of advisers planning to increase client allocations to this sector.

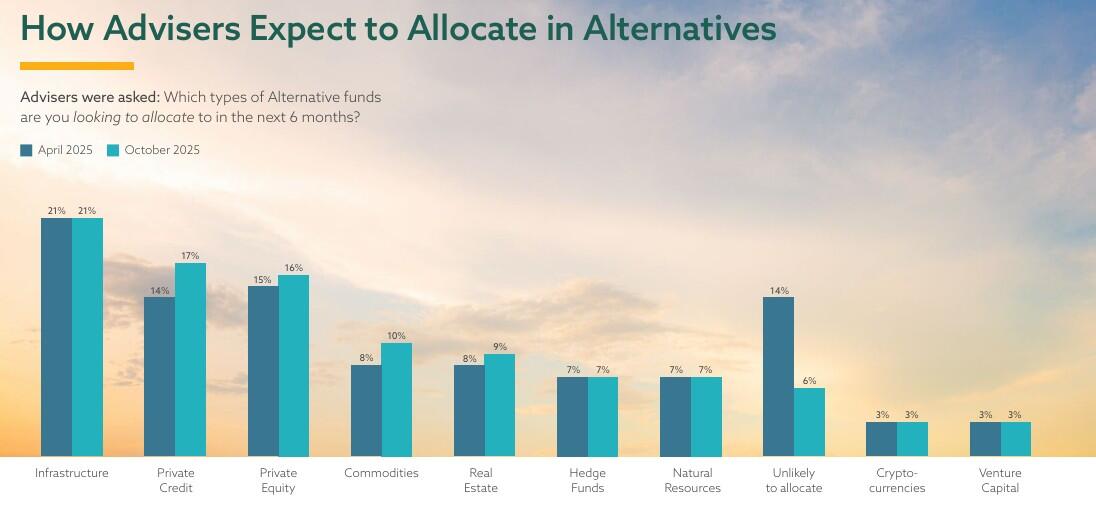

However, appetite is also growing for alternatives, with more than 3 in 4 advisers (77%) now allocating up to 10% of client portfolios to alternative assets.

While it remains the most popular sector for alternative funds, infrastructure allocations remained flat at 21% between April and October.

What’s most surprising of all – especially given heightened concerns over disclosure and quality issues - more than a third (36%) are planning to increase allocations to private credit and infrastructure.

What’s equally unsurprising is the corresponding deterioration in sentiment towards U.S. equities, with the bearish outlook moving from 36% in April to 43% in October.

According to Fidante’s research, U.S. equities were a standout laggard, with almost 1 in 3 advisers (29%) planning to decrease client allocations in the coming six months.

“Large cap equities remain the ‘engine room’ for portfolio returns, but our survey revealed a clear focus among advisers on increasing satellite allocations in both Australian and global small caps,” said Evan Reedman, general manager of Fidante Affiliates.

“We are seeing strong demand for alternative assets that offer defence and diversification from traditional asset classes. We expect this to continue as more advisers and investors realise the power of unlocking alternatives in portfolios.”

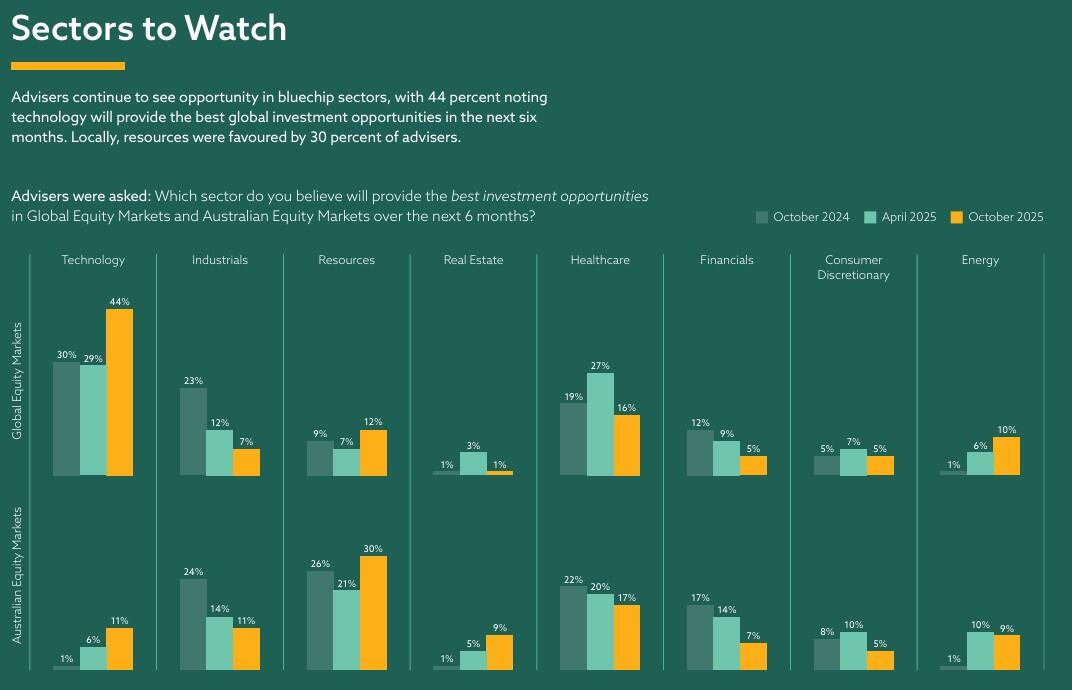

Sectors to watch

Overall, advisers continue to see opportunities in blue-chip sectors, with 44% expecting technology to provide the best global investment opportunities in the next six months.

However, closer to home here in Australia, resources were favoured by almost a third (30%) of advisers, followed by healthcare at 17%, with technology and industrials at 11%, respectively.

Valuations a key concern

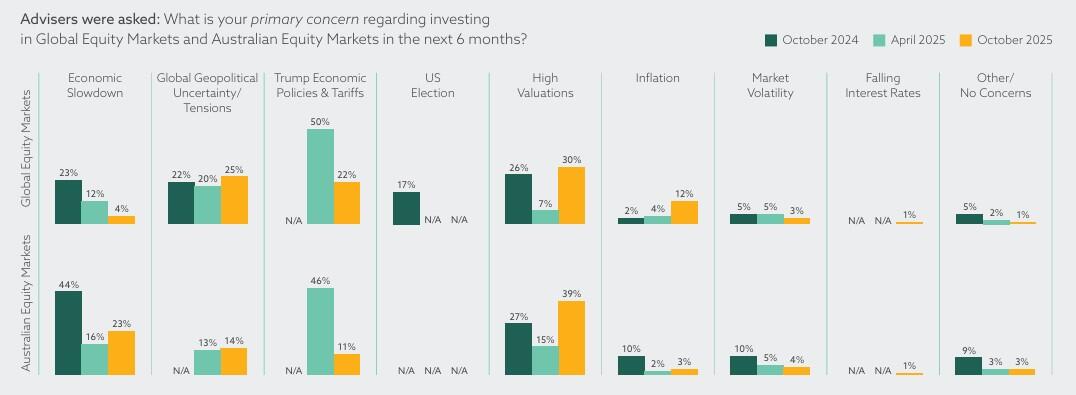

When it comes to investing in both global and domestic equities, valuations were seen as the standout concern for advisers.

While 40% of advisers noted valuation concerns in Australian equities, valuations were also a primary concern in global market valuations (30%) and eclipsed concerns around Trump policies.

However, liquidity risk stood out for almost 40% of advisers as the biggest barrier to increasing alternative allocations.

“Interestingly, concerns surrounding the Trump administration have more than halved since reaching fever pitch when we last surveyed advisers in April,” said Reedman.

“However, we are still seeing this dynamic play out. This includes rising concerns over inflation risk in global equities, driven by tariffs and Trump’s pressure on the Fed to cut rates, which may pose a notable threat to global markets.”