After experiencing a bonanza year in 2025 – outperforming the S&P 500 Index - Asian equities look set to extend their winning streak in 2026, after climbing 7.5% in January alone. As of mid-February, the MSCI Asia Pacific Index has surged more than 12% year-to-date - its best start to the year this century.

Meanwhile, the S&P 500 and the NASDAQ 100 are down 0.52% and 1.22%, respectively, over the same period, which marks the weakest start to the year for United States stocks relative to the rest of the world since 1995.

What’s clearly playing on the performance of these two U.S. exchanges is the rotation away from U.S. tech stocks.

According to the latest Bank of America Global Fund Manager Survey, investors have slashed their allocations to U.S. tech equities and are now a net 5% overweight to technology, compared to a net 19% overweight a month ago.

Propelled by strong performances in Japan, Taiwan, Korea and Thailand, Bloomberg’s Asia Pacific market index has also surged by around 11% this year.

Valuation play

Undervalued Asian equities that offer similar growth to U.S. tech – that trade on significantly lower PE multiples – appear to be benefitting from the rotation of global capital away from the U.S software companies.

As a case in point, Asian hardware leaders like Samsung Electronics (KRX: 005930) and TSMC (TWSE: 2330) are up 47% and 19.21% year to date; and 231% and 72.5% over one year, respectively.

While the MSCI Korea is the world’s best performing share market index – up 33% year to date – MSCI Thailand and the Nikkei 225 / MSCI Japan are up 19% and 12% over the same period.

Over the past year, the Nikkei and Taiwan’s market have added around 40%, while Korea’s KOSPI has more than doubled over that time.

Then there’s Shanghai, which is up over 21%, while smaller Asian counterparts like Vietnam have put on more than 40%.

Are Asian ETFs worth a sniff?

While the fortunes of these Asian indices appear to be driven by stocks within a handful of sectors, many analysts expect the region to continue its outperformance trend over 2026.

In light of this momentum, now might be a good time to seek a gateway into Asia’s dynamic growth markets via ASX-listed electronic trade funds (ETFs).

With that in mind, Azzet went in search of ETFs with exposure to Korean, Taiwanese, Thai, Vietnamese and Japanese stocks through a combination of single-country funds and broad-based Asian index trackers.

Here are four worth taking an initial look at:

Vanguard FTSE Asia ex Japan Shares Index ETF (ASX: VAE): Seeks to track the return of the FTSE Asia Pacific ex Japan, Australia and New Zealand Index (with net dividends reinvested) in Australian dollars, before taking into account fees, expenses and tax.

VAE is currently trading at $100.80 a share.

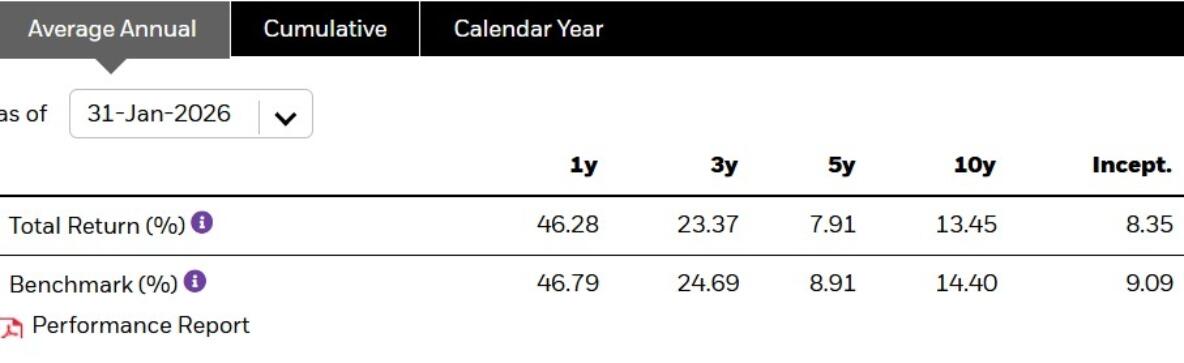

iShares Asia 50 ETF (ASX: IAA): Aims to provide investors with the performance of the S&P Asia 50 Index, before fees and expenses. The index is designed to measure the performance of 50 of the largest Asian companies domiciled in China, Hong Kong, South Korea, Singapore, and Taiwan and listed in Hong Kong, South Korea, Singapore or Taiwan.

IAA is currently trading at $161.88 a share.

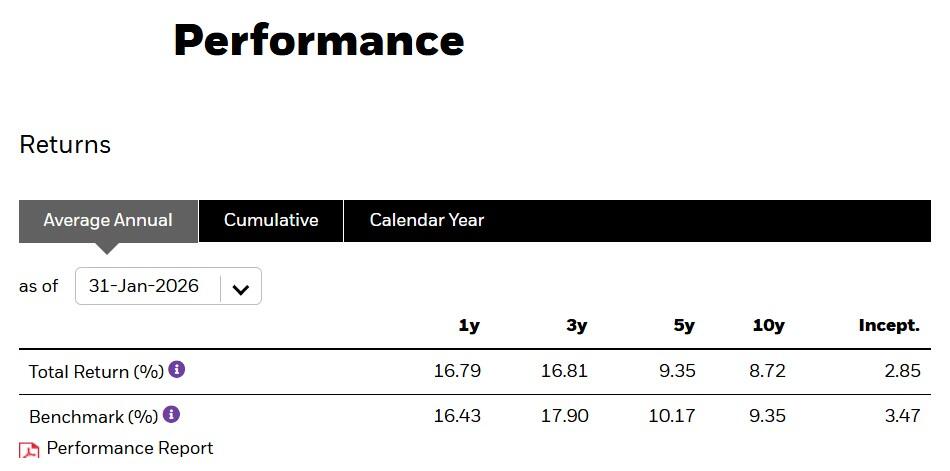

iShares MSCI Japan ETF (ASX: IJP): Aims to provide investors with the performance of the MSCI Japan Index, before fees and expenses. The index is designed to measure the performance of Japanese large & mid-capitalisation companies.

IJP is currently trading at $129.68 a share.

Betashares Japan ETF-Currency Hedged (ASX: HJPN): Aims to track the performance of an index (before fees and expenses) that provides diversified exposure to the largest globally competitive Japanese companies, hedged into Australian dollars.

HJPN is currently trading at $29.37 a share.