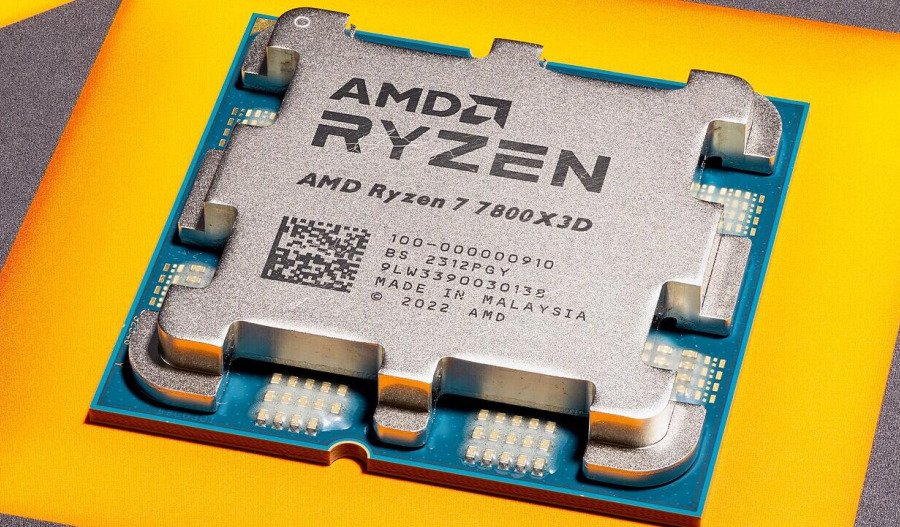

Chip maker Advanced Micro Systems (AMD) posted a 36% year-over-year revenue increase for the March quarter to US$7.44 billion, driven by high demand for its Zen 5 Ryzen processors.

That surpassed analyst projections of $7.13 billion - as did its earnings per share (EPS) of $0.96, exceeding an expected $0.94.

Revenue growth was led by AMD’s CPU and GPU sales, which totalled $3.7 billion, up by 57% year-over-year.

Client revenue came in at $2.3 billion, up 68% year-over-year, driven by strong demand for the latest Zen 5 AMD Ryzen processors, yet was dragged down by Gaming - which decreased to $647 million - a 30% drop year-over-year.

AMD CEO Lisa Su said the company had delivered “an outstanding start to 2025”, with a fourth consecutive quarter of accelerating year-over-year growth.

“Despite the dynamic macro and regulatory environment, our first quarter results and second quarter outlook highlight the strength of our differentiated product portfolio and consistent execution,” Su said.

“We are gaining revenue share in the right places. As we go through the year we are spending time aligning with our customers and we believe we have an overall good inventory position and continue to be very agile as we look at market share going forward.

AMD’s Q2 outlook sees expected revenue to come in at $7.4 billion, +/- $300 million and the Non-GAAP gross margin is estimated to be 43% - “inclusive of ~$800 million in charges for inventory and related reserves due to the new export controls”.

AMD shares were down 1.96% at Wall Street close, swapping for $98.62. The company maintains a market capitalisation of $159.47 billion.