Amazon.com Inc shares plunged after it forecast a big increase in capital expenditure this year, despite posting increases in profits for the fourth quarter (Q4) of 2025.

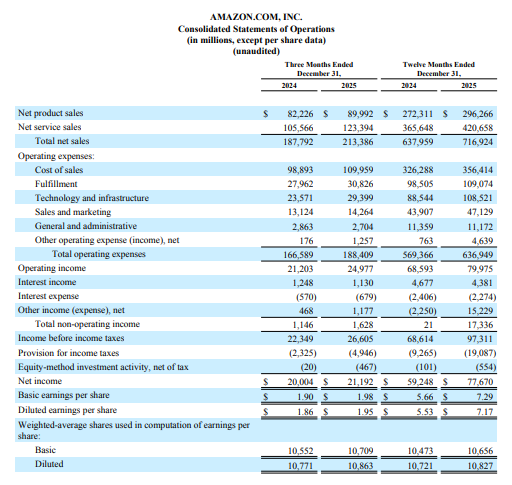

The global technology giant said net income grew 6% to US$21.2 billion (A$30.5 billion) in the three months ended 31 December 2025 from $20.0 billion in the previous corresponding period (pcp).

Diluted earnings per share (EPS) rose 4.8% to $1.95 on revenue, which increased 14% to $213.4 billion in Q4 compared with the pcp.

Markets were expecting EPS of $1.97 and revenue of $211.44 billion.

President and CEO Andy Jassy said the company was growing because it was innovating quickly and identifying and knocking down customer problems.

He said revenue increased 24% from its Amazon Web Services (AWS) cloud computing business, 22% from advertising, at “triple digit percentages” from its chips business and “briskly” from its North American and international stores.

“With such strong demand for our existing offerings and seminal opportunities like AI (artificial intelligence), chips, robotics, and low earth orbit satellites, we expect to invest about $200 billion in capital expenditures across Amazon in 2026, and anticipate strong long-term return on invested capital,” he said in an earnings release.

The increase of more than 50% in capital expenditures is consistent with the pattern among Amazon’s rivals, which are spending big on artificial-intelligence (AI) infrastructure.

Amazon shares (NASDAQ: AMZN) closed $10.30 ($4.42) lower at $222.69 before the announcement, capitalising the company at $2.38 trillion, and sank more than 10% to $199.39 in after-hours trading.

“It's been an action packed year of innovation and progress, and we've hit the ground running in 2026,” Jassy said on an earnings call.

Amazon said North America segment sales increased 10% year-over-year to $127.1 billion, international segment sales increased 17% to $50.7 billion, and AWS segment sales increased 24% to $35.6 billion.

Operating income increased to $25.0 billion in Q4, including three special charges: $1.1 billion for the resolution of tax disputes associated with its stores business in Italy, the settlement of a lawsuit, $730 million in estimated severance costs, and $610 million in asset impairments primarily related to physical stores.