Technology giant Alphabet Inc has announced a 46% jump in net income for the first quarter of the 2025 financial year (Q1 FY25) as revenue grew strongly across its businesses and margins expanded.

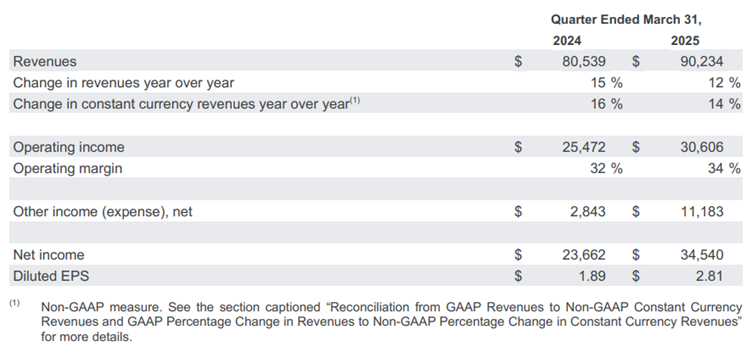

The parent company of the Google search engine business said net income was US$35.540 billion (A$55.53 billion) in the quarter ended 31 March 2025, which was well above analysts’ forecasts of $28.58 billion, and compared with $23.662 billion a year earlier.

The company said earnings per share (EPS) increased 49% to $2.81 on revenue rising 12% to $90.2 billion, reflecting robust momentum across its businesses.

Google Services revenue increased 10% due to strong performances from Search & Other, Google subscriptions, platforms and devices, and YouTube ads. Google Cloud revenue increased 28%, led by growth in the Google Cloud Platform across core products, AI (artificial intelligence) Infrastructure, and Generative AI Solutions.

Directors announced a 5% increase in the quarterly dividend to 21 cents per share.

“We’re pleased with our strong Q1 results, which reflect healthy growth and momentum across the business,” CEO Sundar Pichai said in a press release.

He said Alphabet surpassed 270 million paid subscriptions, driven by the YouTube and Google One businesses, engagement with features like AI Overviews helped the search business grow strongly, and the Cloud business grew rapidly.

A “unique full-stack approach” to AI underpins company growth.

Operating income increased 20% to $30.606 billion as the operating margin expanded two percentage points to 34%.

“This quarter was super exciting as we rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and is an extraordinary foundation for our future innovation,” Pichai said.

Revenue also exceeded analysts' average estimates of $89.12 billion.

Alphabet (NASDAQ: GOOG) shares closed $2.38 (1.47%) higher on Friday at $163.85, capitalising the company at $1.99 trillion.