The algorithmic revolution is reshaping global wealth distribution faster than a Tesla on autopilot, with analysts dubbing the artificial intelligence (AI) boom the most significant fortune-forging event in modern memory.

As computational intelligence demand rockets across every corner of the economy, a fresh crop of tech titans is ascending to billionaire heights - at a velocity that makes the rise of the dot-com darlings pale in comparison.

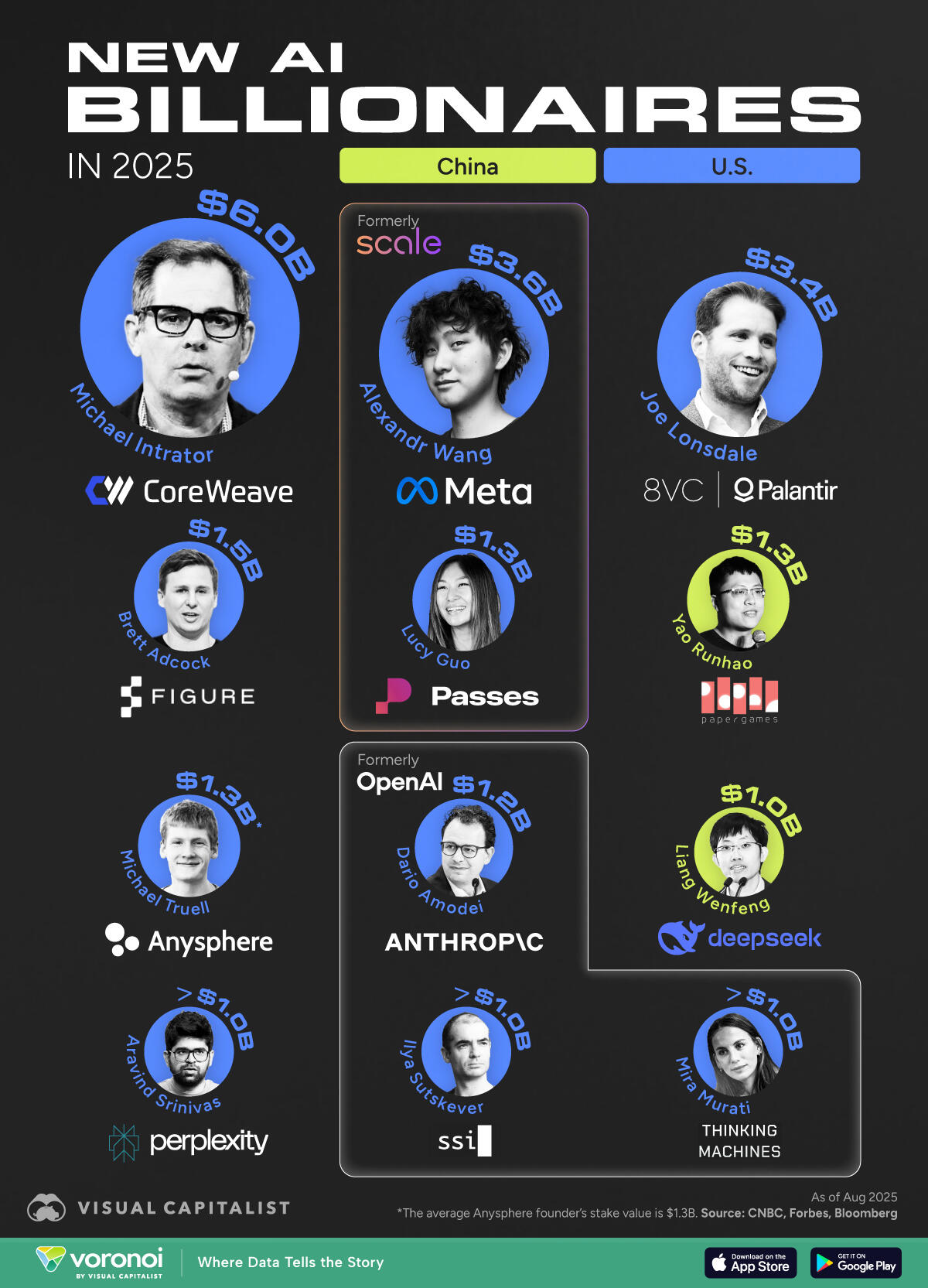

AI-spawned billionaires

You only have to gaze at Wall Street's top 10 most valuable companies by market capitalisation to realise the magnitude of algorithm-driven wealth is absolutely bonkers.

Bloomberg's latest forensic analysis reveals the sprint into computational intelligence has forged fortunes worth a collective US$71 billion across 29 fresh founders in 2025 alone.

Meanwhile, CNBC researchers have documented what they're calling "the largest wealth creation spree in recent history," with dozens of entrepreneurs pole-vaulting the billionaire threshold thanks to the AI gold rush.

Forbes' 2025 World's Billionaires List unveils the broader carnage: 46 brand-new billionaires emerged specifically from the machine intelligence sector this year, injecting $600 billion in combined wealth into the global pot.

This surge has turbocharged the total billionaire population worldwide to a record 3,028 individuals, collectively worth $16.1 trillion - an eye-whopping $2 trillion jump from last year's tally.

Goldman points to trillions

Wall Street heavyweights are painting an even more dramatic canvas for what's coming down the pike.

Goldman Sachs Research projects computational intelligence investment could rocket to $200 billion globally by 2025, with the potential for generative algorithms to turbocharge global GDP by 7% over the next decade—equivalent to nearly $7 trillion in economic juice.

Marco Argenti, Goldman's CIO and former Amazon Web Services veteran, forecasts 2025 will mark a watershed transition, from machine learning tinkering to industrial-scale deployment across industries.

"The evolution of increasingly powerful language models, turbocharged by advances in robotics, will trigger sweeping transformations to everything from employment patterns to regulatory frameworks," Argenti wrote.

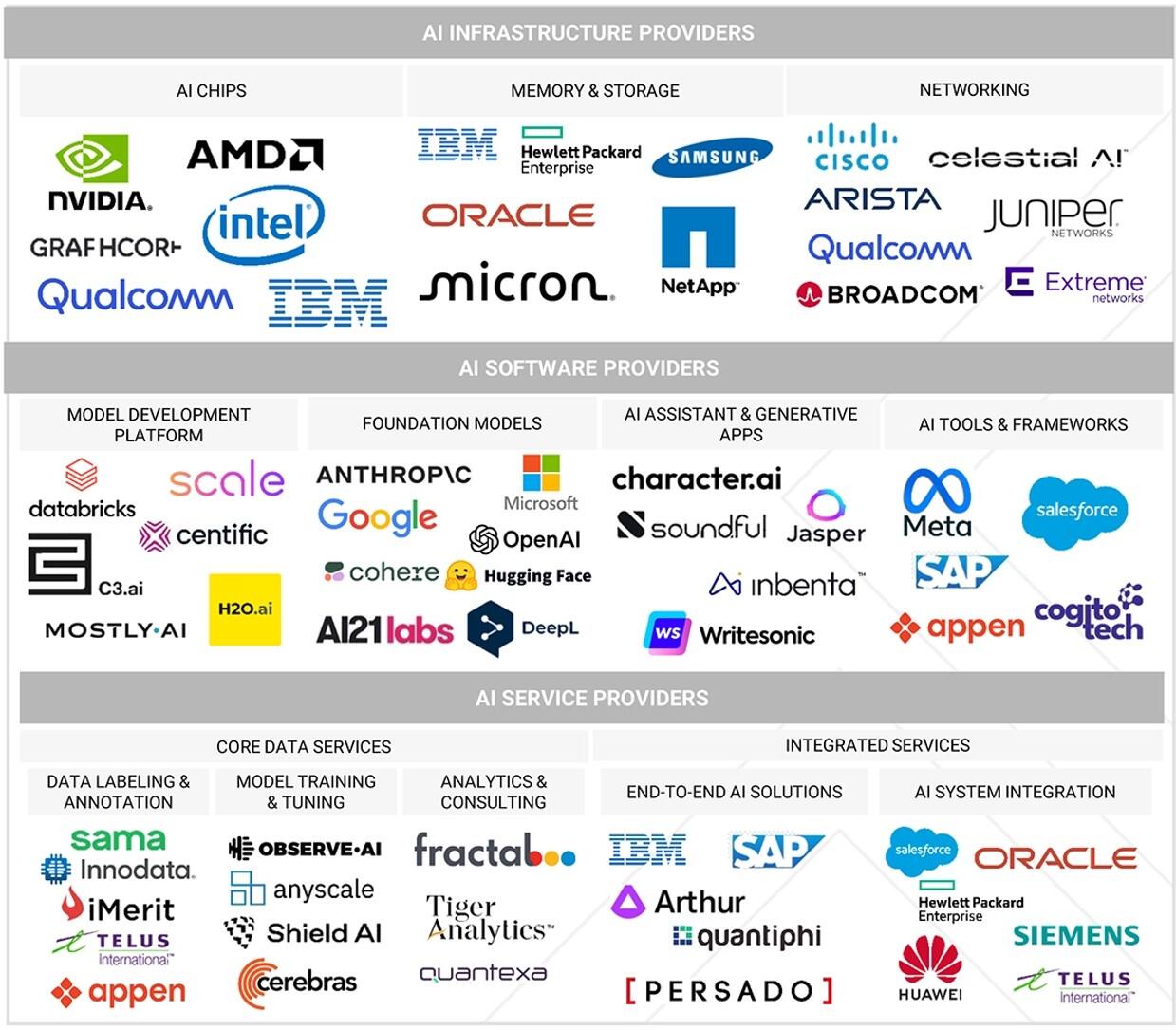

The firm's crystal-ball gazers identify four core business segments driving this rocket ship: companies crafting algorithmic models, infrastructure providers, software developers creating intelligence-enabled applications, and the enterprise end-users purchasing these digital services.

Transformational tsunami

McKinsey's latest workplace intelligence report reinforces the seismic nature of this societal upheaval, noting that while virtually all companies are dumping money into computational AI, they're all still surfing the early waves of value extraction.

The consulting group's analysis of 1,491 global participants shows that larger corporations are spending big on things like wholesale organisational rewrites, harvesting machine intelligence potential, pouring cash into algorithmic talent and neutralising associated risks.

Then there's Boston Consulting Group's 2025 Intelligence Radar survey of over 1,800 C-suite execs showing that 75% of business leaders crown machine learning as a top-three strategic priority for 2025.

BCG fortune-tellers predict leading companies will funnel >80% of their AI investments toward reshaping core operations and new offerings - rather than chipping away at productivity tweaks.

"Companies are graduating beyond the initial euphoria around machine intelligence to laser-focus on execution and tangible outcomes," BCG researchers observed.

"Two-thirds of corporations are exploring intelligent agents - advanced systems capable of autonomous action - suggesting 2025 could mark an inflection point for mass adoption."

Cogs of the fortune factory

Unlike the dot-com explosion of the late 1990s, today's algorithmic wealth creation is predominantly cooking in private kitchens… (it is?!)

Yep, that's according to CNBC's wealth management sleuths, who note that most machine intelligence billionaires clutch onto stakes in private enterprises, making their fortunes less liquid but potentially more explosive over time.

The constant cash transfusion between venture capital powerhouses, sovereign wealth juggernauts and family office titans allows AI startups to remain private longer while achieving valuations that dwarf many public corporations.

This dynamic is manufacturing what analysts dub "a historic goldmine for wealth management firms" as these private fortunes eventually transform into liquid assets through IPOs or secondary market deals.

Companies like OpenAI, valued at ~$500 billion in recent secondary trading, exemplify how private AI companies are soaring to reach valuations multiple times their price-to-earnings ratio.

Energy clusters

The algorithmic wealth tsunami is also redrawing global economic geography.

Goldman Sachs says San Francisco now hosts more billionaires than New York - 82 v 66 - with the Bay Area's millionaire population also doubling over the past decade.

This concentration mirrors what one MIT researcher labelled the "mind-boggling geographic clustering" of the AI wave, a remnant of Silicon Valley's past tech dominance.

As AI continues its breakneck evolutionary sprint toward more sophisticated applications like autonomous agents and robotics integration, analysts predict this wealth concentration will only intensify further.

The emergence may herald a fundamental shift in how global wealth gets manufactured and concentrated - led by an army of billionaire tech bros.