Cashed-up global media and information services company News Corporation has ruled out overpaying for acquisitions after reporting a 67% surge in net income from continuing operations in the third quarter of the 2025 financial year (Q3 FY25).

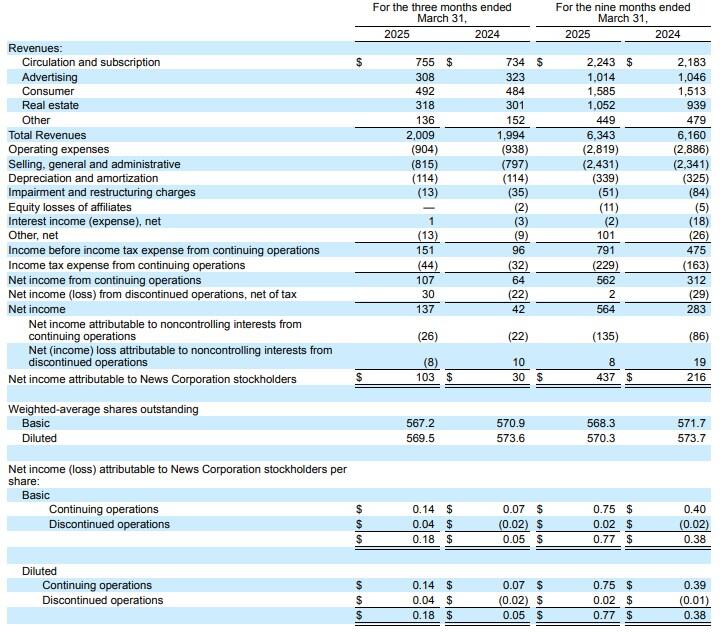

The company, controlled by Australian-born founder Rupert Murdoch's family trust through a 14% shareholding, earlier announced net income from continuing operations rose to US$107 million (A$168.18 million) from $64 million in the three months ended 31 March.

News Corp and telecommunications company Telstra sold subscription television service Foxtel to global sports streaming giant DAZN for an enterprise value of A$3.4 billion (US$2.2 billion) in December after 29 years of ownership.

Chief Executive Robert Thomson said the company would look for opportunities in its growth areas of Dow Jones, digital real estate and book publishing using the A$592 (US$379 million) of cash received from Foxtel repayments.

“What we will certainly not do is squander our hard earned cash by overpaying for businesses,” Thompson said on an earnings call.

News Corp said earnings before interest, tax, depreciation and amortisation (EBITDA) rose 12% to $290 million on revenue which edged up 1% to $2.01 billion in Q3 FY25, despite currency headwinds and macro uncertainty.

Reported earnings per share (EPS) from continuing operations doubled to 14 cents while adjusted EPS rose 31% to 17 cents in Q3.

In the nine months to 31 March, net income from continuing operations climbed 80% to $562 million on revenue which rose 3% to $6.343 billion.

“The sustained strength of News Corp’s third quarter reflects the company’s strategic transformation,” Thompson said in an earnings release.

“We have pursued digital growth, realigned our assets, focused relentlessly on cost discipline and asserted the essential value of our intellectual property in a changing, challenging content world.”

Financial publisher Dow Jones' Q3 revenue was underpinned by its circulation and professional information businesses, particularly Risk & Compliance and Dow Jones Energy.

Digital real estate company REA Group, 61% owned by News Corp, boosted revenue by 6% to $271 million, driven by continued strong Australian residential performance, while Book Publishing continued to benefit from a strong backlist and higher downloadable audiobook sales.

News Corp's direct tariff impact was expected to be immaterial, Chief Financial Officer Lavanya Chandrashekar said on the call.

Revenue, adjusted EBITDA and EPS were above analysts’ expectations.

News Corp (NASDAQ: NWSA) class A non-voting shares closed up 30 cents (1.06%) at US$28.48 on Thursday (Friday AEST) in the United States.

News Corp class B voting shares had ended 78 cents (1.56%) higher at A$50.68 on Thursday on the Australian Securities Exchange, capitalising the company at US$17.02 billion (A$10.89 billion).