The Institute for Energy Economics and Financial Analysis (IEEFA) has backed Australian government calls to accelerate an increase in gas supply to power the east coast grid.

The Australian Competition and Consumer Commission (ACCC)’s January gas report forecasts that the perennially tight east coast gas market is likely to have sufficient gas supply to meet anticipated demand in 2025 and 2026.

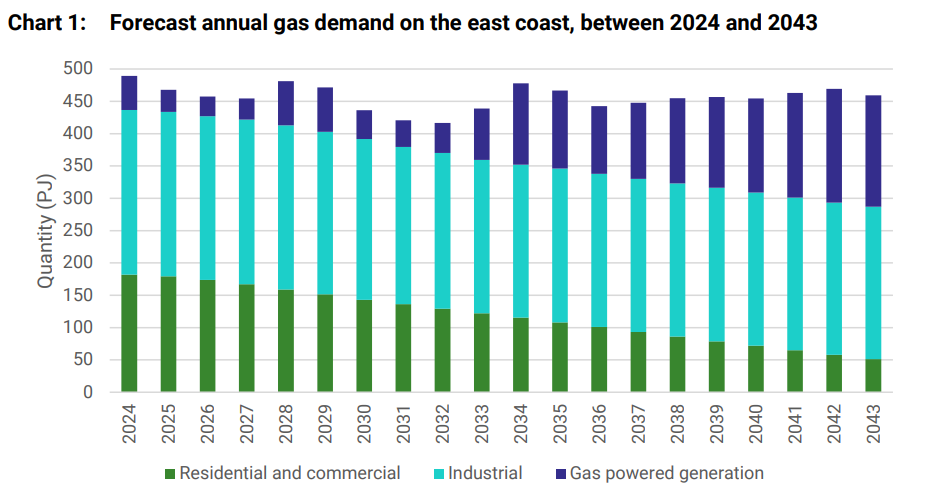

The report highlights longer-term concerns around future supply adequacy, with structural supply gaps likely to emerge as early as 2027 in the southern states along the eastern seaboard, and in the broader east coast gas market by 2029.

“Natural gas will play a critical role in Australia’s transition to lower emissions. As we increasingly rely on renewables for electricity generation, gas will be required to support energy security, reliability and affordability, while remaining an important source of energy and feedstock for residential, commercial and industrial users.” - ACCC

A range of factors, the IEEFA says, have contributed to the worsening supply-demand outlook: including:

- Declining gas production in the Gippsland Basin not being offset through additional domestic supply from elsewhere despite east coast gas production increasing over the past decade.

- Continued liquefied natural gas (LNG) exports from Queensland, which have accounted for all of the increase in gas production over the past decade, with LNG exporters now being net withdrawers of gas from the domestic market.

- A lack of investment in new gas supply, which the ACCC suggests reflects regulatory, market and financial barriers, but which may also reflect factors such as increasing gas production costs (as less marginal tenements are developed) and the prospect of further domestic demand destruction.

- The risks of infrastructure asset stranding, which can affect new infrastructure investments (particularly greenfield investments to connect new supply sources).

- Market concentration, which may result in gas “hoarding” by producers, particularly LNG exporters, who control most of the east coast’s proven reserves.

“At its core, the worsening supply-demand outlook reflects two key factors: that gas demand is not falling as quickly as needed, particularly in the southern states; and that the vast majority of gas produced on the east coast is exported as LNG at the expense of domestic gas users,” IEEFA said.

“Developing new gas supply to address projected supply gaps has failed.”

The ACCC says In the short term, it seems increasingly likely that the southern states will have to import gas to meet demand.

“The use of LNG imports can provide some greater flexibility in meeting demand in southern states and have a lower risk of asset stranding compared to traditional investments in new supply and infrastructure. In terms of new infrastructure investment, LNG imports could be a cheaper temporary solution to southern supply gaps compared to upgrading pipelines from northern gas fields and storage facilities in the south,” the report stated.

What to do?

The IEEFA says there’s a range of unused measures to address potential supply gaps.

One example it gives involves diverting some LNG exports into the domestic market and calls on Queensland-based LNG producers to consider the merits of discretionary LNG spot exports, not jsut on the east coast, but across Austalia.

FACT: Across Australia, the LNG industry accounts for about 80% of total gas consumption, making it a larger user of gas than all other users combined.

"There remain vast cost-effective opportunities to drive further electrification and energy efficiency upgrades in both households and industry that could materially improve the supply-demand outlook on the east coast.

IEEFA previously found that targeted interventions could reduce southern state gas demand by as much as 40% by 2030 (against 2022 levels), which at the time of the analysis would have been sufficient to eradicate future supply gaps.