Abercrombie & Fitch Co. reported strong first quarter fiscal 2025 results, with record net sales and share repurchases.

Fran Horowitz, Chief Executive Officer, said, “We delivered record first quarter net sales with 8% growth to last year. This was above our expectations and was supported by broad-based growth across our three regions.

"Hollister brands led the performance with growth of 22%, achieving its best ever first quarter net sales, while Abercrombie brands net sales were down 4% against 31% sales growth in 2024.

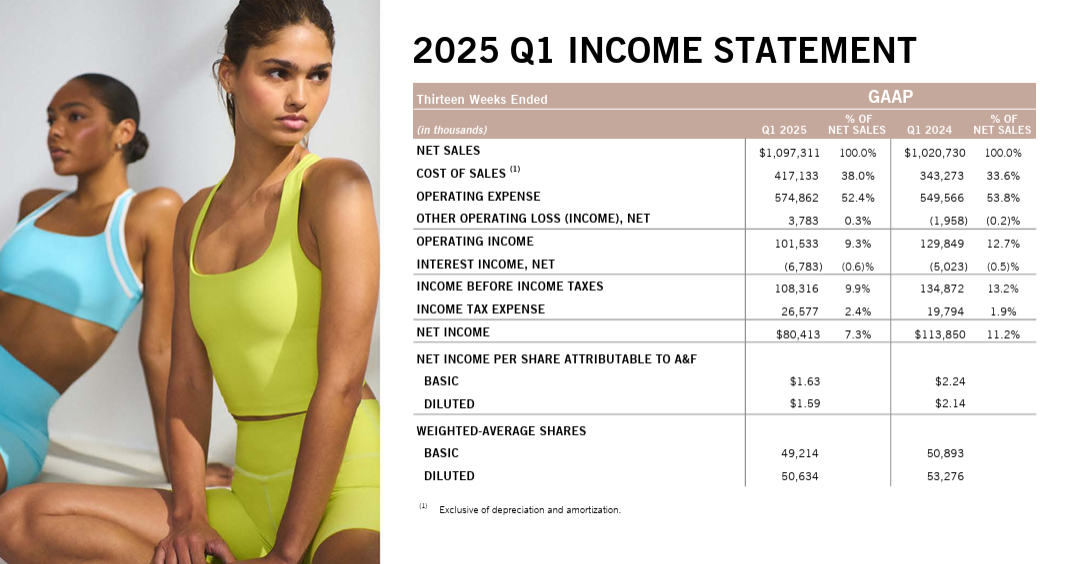

"We exceeded our expectations on the bottom line as well, with operating margin of 9.3% and earnings per share of $1.59.

"We also returned excess cash to shareholders through share repurchases totaling $200 million in the quarter, marking our fifth consecutive quarter of share repurchases.

"As we navigate the current environment, we have the team and proven capabilities in place to read, react and adapt, while continuing to deliver for customers globally. Importantly, with a strong foundation, we remain on offence and focused on top-line growth, store expansion, and investments in digital and technology that will enable sustainable long-term success.”

“We’re looking for expense reductions … across the business, but we’re doing that with a very clear eye to protecting long-term investments,” CFO Robert Ball told CNBC.

Financial Results

- Record first-quarter net sales of $1.1 billion, up 8% from last year.

- Net sales growth: Americas +7%, EMEA +12%, APAC +5%.

- Hollister brands grew 22%, while Abercrombie brands declined 4%.

- Operating margin at 9.3%, with $1.59 earnings per share.

- Operating income decreased to $102 million from $130 million last year.

Share Repurchase

- Repurchased 2.6 million shares for $200 million, representing 5% of outstanding shares.

- $1.1 billion remained on a share repurchase authorisation established in March 2025.

Financial Position

- Cash equivalents of $511 million, down from $773 million last year.

- Inventories are $542 million, compared to $575 million in February 2025.

- Liquidity of approximately $940 million, down from $1.2 billion last year.

Fiscal 2025 Outlook

- Net sales growth is expected to be in the range of 3% to 6%.

- Operating margin is projected between 12.5% and 13.5%.

- Net income per diluted share forecast between 9.50 and 10.50.

- Anticipated share repurchases of $400 million for the fiscal year.

At the time of writing, the Abercrombie & Fitch Co (NYSE: ANF) stock price was US$88.47, up $11.32 (14.67%) today, and traded after-hours at $88.60, up a further 13 cents (0.15%). It has a market cap of around $4.21 billion.

Related content