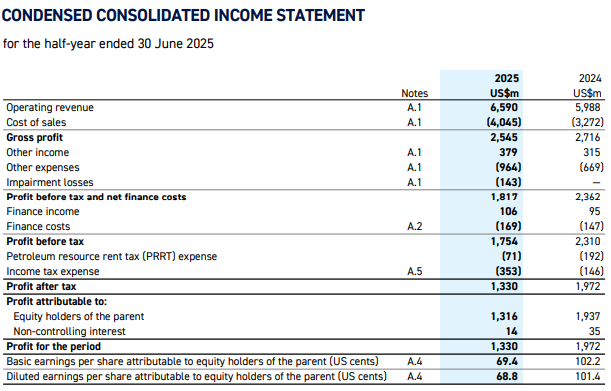

Woodside Energy's profits slid 24% in the first half of the 2025 financial year (H1 FY25) as higher costs, lower prices, increased provisions and other factors bit into the global energy company’s bottom line.

The oil and gas producer said underlying profit was US$1.33 billion (A$2.04 billion) in the six months ended 30 June 2025, compared with $1.632 billion in the previous corresponding period (pcp).

Operating revenue rose 10% to $6.59 billion as production rose 11% to 99.2 million barrels of oil equivalent (boe) and the average realised price weakened 1% to US$61.80 boe.

The cost of sales jumped 19% to $4.045 billion due to the inclusion of a full six months of production costs from the Sangomar oil field off Senegal, along with depreciation and amortisation costs.

Other factors that reduced earnings included updates of restoration provisions and impairment losses.

Directors declared a fully franked interim dividend of 53 U.S. cents per share to be paid on 24 September to shareholders registered on 29 August, representing 80% of underlying profit, compared with 69 cents a year earlier.

CEO Meg O’Neill said the results demonstrated Woodside was rewarding shareholders with strong dividends while ensuring the balance sheet strength to deliver major growth projects.

“Strong underlying performance of our assets, our robust financial performance, and a focus on disciplined capital management have enabled us to maintain our interim dividend payout ratio at the top end of the payout range,” she said in an ASX announcement.

O’Neill said a highlight of the half year was the ongoing exceptional performance of the Senegal project, which started producing oil in June 2024.

The Scarborough project in Western Australia planned to deliver its first liquefied natural gas (LNG) cargo in the second half of 2026, first oil from the Trion project off Mexico was planned in 2028, and a final investment decision was made in April for the Louisiana LNG project, now 60% owned after a sell-down to Stonepeak.

Woodside (ASX: WDS) shares had eased by 51.9 cents (1.93%) to $26.37 at the time of writing, capitalising the company at $51.05 billion.