Platinum Asset Management (ASX: PTM) founder Kerr Neilson was a superstar fund manager, lauded for the returns he generated for clients.

Since Neilson stepped down as Chief Executive Officer (CEO) in 2018 the share price of the ASX-listed international investment company has plunged more than 95% as performance has deteriorated and funds under management (FUM) have plummeted.

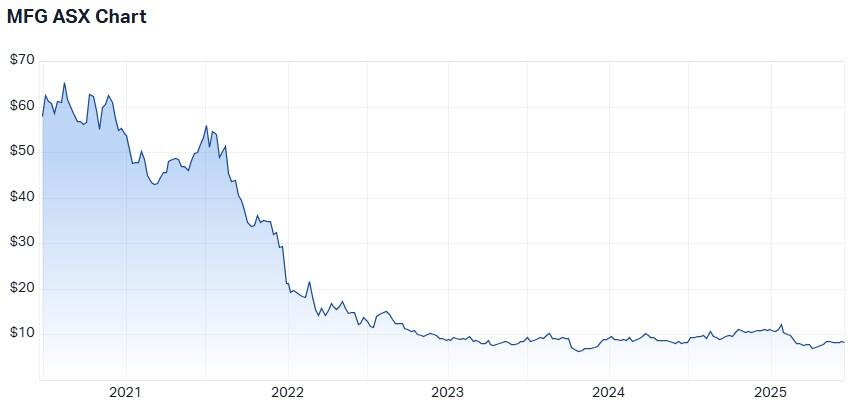

Hamish Douglass had a similar reputation at Magellan Financial Group (ASX: MFG) but subsequent to his departure in 2022 the shares have followed the same downward path as returns from its managed funds and FUM.

The combined A$15 billion (US$9.7 billion) drop in the market value of the two companies and the experience of other fund managers has shone a spotlight on succession in the A$1.2 trillion retail fund management industry.

It has also raised the question of whether the secret to success is based on people, processes, luck or a combination of these factors.

Industry veteran Chris Cuffe is in no doubt.

“I'm of the view that it's mostly the people, like 90% plus,” said Cuffe, a former CEO of investment companies Colonial First State Investments and Challenger and the founder of Third Link Growth Fund, which donates its fees to charities.

He said people who had built large fund management businesses tried to convince others about the importance of their processes because they knew few investors wanted to back an individual alone.

“I've always thought great investment managers are like artists. You just can't turn it into formula,” said the professional investor and adviser.

“I always follow the individual. Normally my money would leave when the individual leaves.”

Cuffe believes the best investors are those running boutique firms who have a small number of staff, limit funds under management and survive on performance fees.

This is distinct from “professional fund gatherers” who increase FUM, revenue and profits by adding new investment funds and expanding into other asset classes.

“The coupe de grace is when a manager lists a la Magellan or Platinum and it's normally the death knell because you’ve got the ultimate conflict,” he said.

“Your shareholders want to see your funds grow and a great investment manager should be just focused on great investment returns.

“It's a funny industry. You get paid by your funds under management. Wouldn't you think you'd only get paid by results rather than funds under management?”

Another industry observer saw it slightly differently, saying ongoing success could be measured by alpha, or returns in excess of a benchmark, which in turn depended on individuals and business structure.

“Is it a $10 trillion manager of which Australia is a relatively small part but there's an enormous organisation behind it, or is it two blokes in a garage with a spreadsheet?” he said.

He said a small boutique operation presented lots of key person risk whereas a large organisation had the management depth to replace senior people as they left.

“As a small boutique manager succeeds and gets bigger and bigger, what happens to their delivery to their clients in terms of alpha? It typically goes down, the observer said.

Heading south

Platinum’s FUM, which peaked at nearly A$30 billion in 2015, had fallen to $8.3 billion by May 2025 as investors withdrew their money in response to returns which not only fell but also failed to keep pace with benchmarks.

The annualised returns of its unlisted Platinum International Fund, which were once in double digits, have halved in that period and the story is similar for Platinum Capital (ASX: PMC).

Due to its value-based investment style Platinum missed the surge in the value of growth stocks including the United States' ‘Magnificent Seven’ technology giants like Nvidia (NASDAQ: NVDA), Meta Platforms (NASDAQ: META) and Microsoft (NASDAQ: MSFT) from late 2022.

The share price has fallen from a peak above $8 in 2007 to 47.5 cents at the close of business on 20 June, a destruction of shareholder value of more than $5 billion, with most of the damage done since founder Neilson departed five years ago.

At Magellan, FUM has dropped from $93.5 billion in March 2022 when Douglass announced he was leaving to $38.5 billion in April 2025, including a $23 billion mandate from London-based investor St James Place.

His period in charge was not without mis-steps as the flagship Magellan Global Fund (ASX: MGOC) returned -2% between April 2020 and February 2021 while its benchmark generated 13.64%, in contrast to the fund’s double-digit returns prior to that.

The performance since then has been mixed.

The Magellan share price has dropped from a high of almost $74 in 2020 to $8.41 at the close of business on 20 June, representing a $10 billion-plus loss of market value.

A former industry researcher said the challenge for any business was to de-personalise it to reduce reliance on founders or, in the case of funds management, “rockstar” CEOs and chief investment officers.

“It's interesting that with some fund management companies, as big as they are, when one individual who happens to run an investment strategy leaves, suddenly people panic,” he said.

“It is almost like they are Clint Eastwood, riding into town on his horse and then, when he has shot up a few people and conquered, he is off to the next town.

“If you're not building a system you're not building a business.”

Successful transitions

Succession planning was managed more smoothly at Investors Mutual Limited (IML) where founder Anton Tagliaferro, who established the firm in 1998, was replaced as CEO in 2023 by Natixis Investment Managers CEO Damon Hambly.

Natixis had bought a majority stake in IML in 2017.

Tagliaferro told clients at the time: “I know I leave our clients in safe hands with every confidence in the team’s ability to generate healthy returns moving forward."

Although the three-year returns of IML’s managed funds have lagged since-inception returns, the five-year returns have been comparable or higher.

"I think people and process are both very important and often there's a bit of a crossover because the process is developed by skilful and experienced people,” said Morningstar Director Manager Research Australasia Matt Olsen.

His firm assigns 45% weightings to each of the people and process ‘pillars’ respectively when rating funds managers, with the balance assigned to the parent organisation.

He said some fund managers became celebrities because they were successful, articulate, intelligent and engaging, but it was important for them to build teams around them for succession purposes.

“Money does follow certain personalities when they do a good job at communicating their investment approach, when they bring engaging ideas to the market, when they present highly intelligent investment theses and educate and inform the market,” Olsen said.

“To the extent that they can imbue that team around them with the process they've developed, that can be enduringly successful in some cases.

“In other cases when the star manager leaves there's a period of adjustment.”

Other examples of fund managers that have managed succession well include Perpetual (ASX: PPT), Ausbil Investment Management, Pendal Group (now owned by Perpetual), and Blackrock Australia with key personnel training others to succeed them to achieve ongoing success.