An escalation of Western sanctions against Russia reached a new threshold this week as the European Union approved its 19th sanctions package and the United States Treasury Department unveiled measures targeting Moscow's oil revenues.

The coordinated actions represent an attempt to restrict the financial flows supporting Russia's war machine in Ukraine, signalling Western frustration with what officials describe as the Kremlin's unwillingness to pursue peace negotiations.

Road to escalation

The road to this point has been marked by incremental pressure that has intensified since Russia's full-scale invasion of Ukraine in February 2022.

Earlier sanctions packages targeted Russian banks, oligarchs, and conventional oil exports, but they often contained carve-outs designed to protect European energy security.

Russia exploited these gaps, continuing to fund its military operations through energy sales whilst showing limited commitment to diplomatic resolution.

Recent months have witnessed what Western officials characterise as deliberate Russian obstruction of peace efforts.

Despite various diplomatic overtures, Moscow has maintained territorial demands whilst continuing military operations across Ukraine.

This intransigence appears to have exhausted Western patience, prompting the current escalation.

EU LNG ban

The EU's newly approved package breaks ground by directly targeting Russian liquefied natural gas imports - a sector that had remained largely untouched throughout the previous eighteen sanctions rounds.

The ban's phased implementation includes short-term LNG contracts terminating after six months, whilst long-term agreements face a deadline of January 1, 2027.

This timeline accelerates the European Commission's original roadmap to end Russian fossil fuel dependence by a full year.

The approval came after Slovakia, the final holdout, received assurances on energy prices and industrial competitiveness.

Ukrainian President Volodymyr Zelenskyy's chief of staff, Andriy Yermak, welcomed the news.

"Less money in Russia means fewer missiles in Ukraine," he remarked.

His statement on Telegram also indicated that work had already begun on a twentieth sanctions package.

America's oil sector targeting

The U.S. Treasury Department's actions complement the EU's LNG ban by targeting Russia's petroleum sector.

The measures include restrictions on Russian oil producers, tankers comprising Moscow's "shadow fleet," and foreign entities facilitating sanction evasion.

“Now is the time to stop the killing and for an immediate ceasefire,” U.S. Treasury Secretary Scott Bessent said.

“Given President Putin’s refusal to end this senseless war, Treasury is sanctioning Russia’s two largest oil companies that fund the Kremlin’s war machine."

Those companies are Rosneft and Lukoil, as well as any of their subsidiaries.

A total of 117 additional vessels have been added to the banned list, bringing the total to 558 sanctioned tankers.

Washington aims to eliminate the alternative shipping networks that have allowed Russia to circumvent previous restrictions.

The inclusion of entities in Kazakhstan, Belarus and China is a notable expansion of the sanctions' increased reach.

Sanctioned are four Chinese entities connected to oil refining and trading - whose names will remain confidential until official publication - signalling Western willingness to confront third-party facilitation of Russian sanction evasion.

That's because Russia's economic resilience has depended substantially on opaque trading networks spanning multiple jurisdictions.

“Treasury is prepared to take further action if necessary to support President Trump’s effort to end yet another war,” Bessent said.

"We encourage our allies to join us in and adhere to these sanctions.”

Potential ramifications

By simultaneously targeting LNG and petroleum - Russia's two primary energy exports - Western powers aim to create logistical and financial obstacles.

Russia earned an estimated $180 billion from fossil fuel exports in 2023, money that directly funds military procurement and operations.

However, the effectiveness of these measures remains uncertain.

Russia has demonstrated adaptability in previous sanctions rounds, developing evasion networks and finding alternative buyers, particularly in Asia.

The inclusion of Chinese entities suggests Western recognition of this challenge, though Beijing's cooperation remains questionable given its strategic partnership with Moscow.

According to April 2025 analysis from the Brookings Institution, over 40% of new shadow fleet ships have come from EU - especially Greek - sellers, highlighting the complexities of enforcement.

Energy market volatility

Removing Russian LNG and petroleum from Western markets could markedly tighten global supply and ergo, drive up prices - a net benefit to Russia as it could increase revenues from remaining sales to non-sanctioning countries.

Much of it depends on whether increased production from the Middle East, the United States, and other suppliers can fill the gap.

European Commission President Ursula von der Leyen emphasised the bloc's readiness for this transition, stating: "Russia's war economy is sustained by revenues from fossil fuels. We want to cut these revenues. So we are banning imports of Russian LNG into European markets. It is time to turn off the tap."

She noted that Europe has been "saving energy, diversifying supplies and investing in low-carbon sources of energy like never before".

The sanctions also carry political implications for European unity.

Slovakia's last-minute reservations highlighted tensions between security priorities and economic concerns, particularly regarding energy affordability and industrial competitiveness.

Maintaining consensus through future sanctions packages may prove difficult as the economic toll accumulates.

Yet May 2025 analysis from the Atlantic Council suggests the measures demonstrate "Europe's resolve to maintain economic pressure on Russia" and signal "that Europe maintains strong economic leverage in potential negotiations".

EU High Representative Kaja Kallas says Russia has lost tens of billions in oil revenues from the actions to date.

"Its economy is shrinking, and its GDP has dropped. Sanctioning the Shadow Fleet has been particularly impactful: after our last sanctions package, the 17th sanctions package, the oil exports from Russia via the Black Sea and Baltic Sea routes declined by 30% in a week.”

The tough measures increase the already burdensome economic pressure war can load upon governments, yet Russia has often proved willing to endure economic hardship rather than accept perceived defeats.

So far, Moscow has shown limited indication that financial pressure will alter its objectives in Ukraine; however, the West's strategy assumes that it is a bluff and that sustained economic degradation will force the Kremlin to make difficult choices.

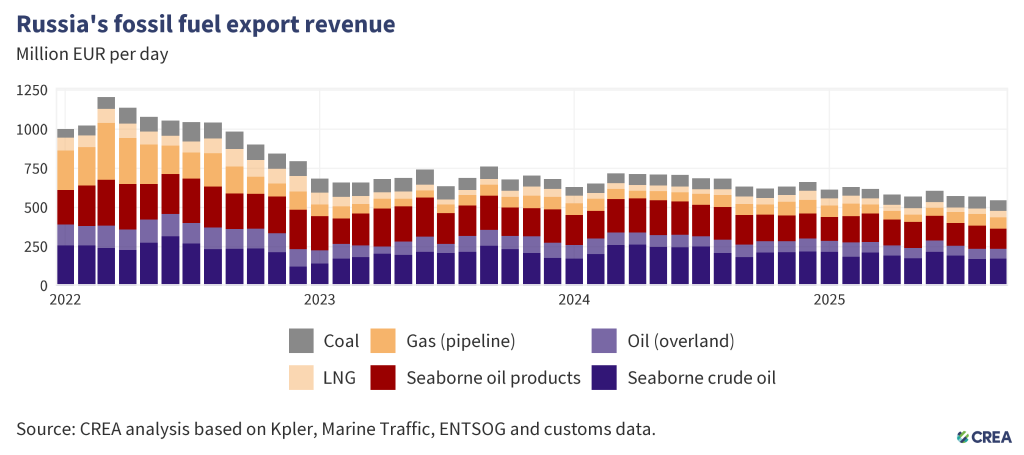

Recent data from the Centre for Research on Energy and Clean Air shows Russia's fossil fuel export revenues have fallen substantially throughout 2025, declining ~20% year-on-year for the first nine months compared to 2024.

September marked an unwanted milestone, as monthly revenues reached their lowest point since the full-scale invasion at €546 million per day.

“Russia's overheated war economy is coming to its limit,” Von der Leyen declared, noting that Russia's mounting challenges, including interest rates at 17%, inflation above 10% and, at minimum, a whopping 40% of the Russian budget devoted to defence spending.

As the conflict rolls into its fourth year, the measures are designed to test whether financial pressure can achieve what military aid and diplomatic efforts have thus far not been able to accomplish.