Webjet shares jumped 17.9% by 12:35 pm AEDT (1:35 am GMT) after it received a takeover bid from a competitor and reported mixed results for the first half of the 2026 financial year (FY26).

The online travel agency said in an ASX announcement it had received a non-binding and indicative offer from Helloworld Travel for the 82.73% of the shares it did not already own by way of a scheme of arrangement at A$0.90 cash (US58.85 cents) per share.

Webjet said its Board had agreed to provide Helloworld with an opportunity to conduct due diligence, but there was no certainty that the proposal would result in a binding offer or a completed transaction.

Helloworld said the proposal represented a premium of:

- 31% to Webjet’s undisturbed closing share price of 68.5 cents on 7 May

- 54% to the one-month volume weighted average price, 58 cents to 7 May, and

- 19% to Webjet’s closing price of 75.5 cents on 18 November.

“Further, we believe that Helloworld and Webjet are logical partners and that a combination provides a strong platform for both companies to achieve their long-term strategic objectives,” Helloworld Chief Executive Officer and Managing Director Andrew Burnes said in an ASX announcement.

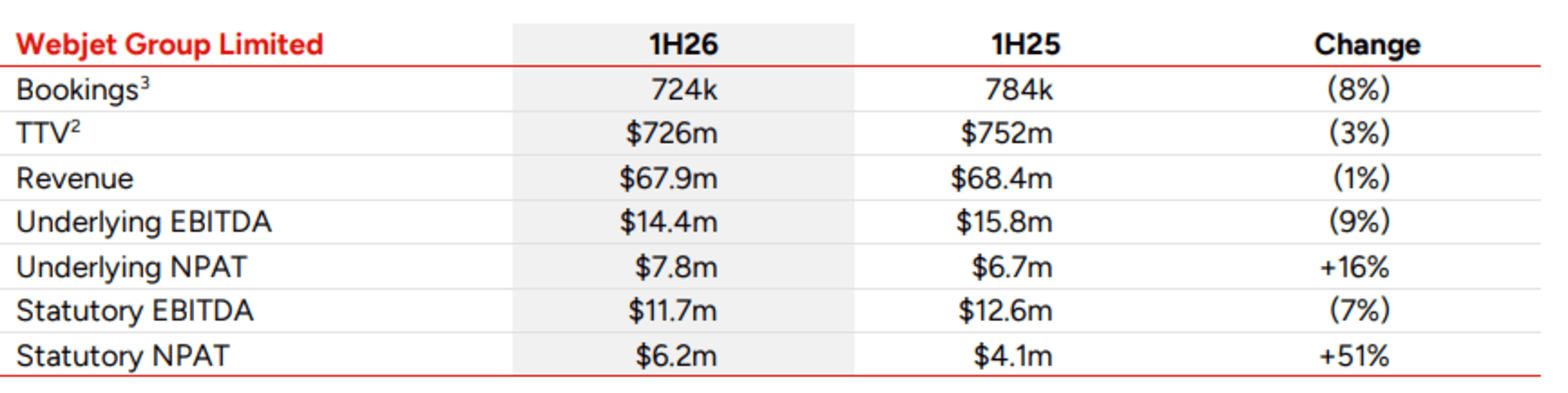

Webjet also announced that statutory net profit after tax (NPAT) jumped 51% to $6.2 million and underlying NPAT rose 16% to $7.8 million in the six months ended 30 September, despite revenue falling 1% to $67.9 million, bookings dropping by 8% to 724,000, and total transaction value shedding 3% to $726 million.

However statutory earnings before interest, tax, depreciation and amortisation (EBITDA) fell 7% to $11.7 million as underlying EBITDA were 9% softer at $14.4 million.

“Our results for the period were broadly in line with expectations, demonstrating the resilience of our business, despite experiencing challenging market conditions,” Webjet CEO and Managing Director Katrina Barry said in an ASX announcement.

Directors declared a fully franked two cents per share interim dividend to be paid on 10 December to shareholders registered on 28 November.

At the time of writing Webjet (ASX: WJL) shares were trading 13 cents (17.88%) higher at 89 cents, capitalising the company at $349.35 million after trading between 86 and 89 cents.

Helloworld (ASX: HLO) shares were 4.5 cents (2.57%) stronger at $1.80, valuing the company at $293.17 million.

Webjet was demerged from the business-to-business company Web Travel Group (ASX: WEB) in September.