Whether or not Virgin Australia’s pending IPO 2.0 on 24 June is successful or not, it won’t make the same mistakes it made during its failed attempt to relist on the ASX two years ago.

Instead of going all out to capture market share from its larger counterparts, Virgin now appears happy to occupy the sweet spot between Qantas (ASX: QAN) and its budget subsidiary Jetstar.

In what was regarded as tantamount to a media faux pas, Virgin’s new CEO, Arizona-born Dave Emerson, alluded to institutional investors that there was no competition on pricing between Australia’s two airlines that control 98% of the market.

Virgin investors are now more realistic about Virgin's limited growth ambitions.

Incremental growth

In light of the current global plane shortage, the volume of airline seats – whether operated by Qantas, Jetstar or Virgin - isn’t expected to dramatically increase over the next five years.

As a result, all airline growth - including Virgin's - will at best be incremental rather than large-scale.

One of the benefits of Qatar Airways buying a 25% stake in Virgin last year was the ability to grow its long-haul market without taking on greater fixed costs.

But without an underlying growth story, Virgin’s market share of Australia’s passengers may not grow much beyond its current 29%.

While the company is expected to generate significant free cash flow in the next few years, investors shouldn’t be expecting a dividend anytime soon.

Now or never

With optimal conditions for Virgin’s float fading fast, the now-or-never approach to this month’s IPO meant that it had to be attractively priced to guarantee it got away successfully.

As well as having the failed Virgin 1.0 float in its rear view mirror, the company’s management has also taken heed of recent high-profile IPO flops like DigiCo REIT (ASX: DGT).

One of the most disappointing IPOs of 2024, the data centre operator successfully raised $1.99 billion at $5.0 a share, but just two days after listing, wound up 14% lower at $4.30.

Given that Virgin’s latest IPO has been priced at 7x earnings (reflecting a $3.6 billion valuation) – at a 30% discount to Qantas – the brokers and fund managers Azzet spoke with were singing from the same hymn sheet:

If you can get scrip at $2.90 fixed issue price - do it.

Lingering overhang

Two weeks out from Virgin’s float, it’s becoming clear that institutional investors see sufficient upside in the discounted IPO price to justify the initial risk.

Much of the perceived risk can be attributed to any lingering overhang from the stock’s collapse into administration at the start of the COVID pandemic.

The market also realises that, like cyclical stocks, airlines’ fortunes are highly tied to economic conditions.

As well as being highly exposed to a highly volatile global economy, courtesy of U.S. President Donald Trump’s tariffs, investors also need to have a view on the oil price.

Oil is one of the major input costs confronting airlines and one airline axiom suggests that a $1 difference in oil prices impacts earnings by as much as $10 million.

Then there’s the sizeable stake that the airline’s owner, Bain Capital, will retain post-listing.

Escrow conditions mean Bain Capital can’t cash it up anytime soon.

But private equity players [like Bain] typically aren’t long-term holders once a stock floats, and the market may be wary of its eventual decision to run for the exit.

Demand exceeds supply

However, despite these issues, demand for scrip is expected to exceed supply. In other words, a lot of orders for the stock are likely to be scaled back.

UBS - one of three managers for the float – recently told fund managers that strong support from both domestic and global institutional anchor investors was “well in excess of the offer size”.

While the (IPO) transaction will raise $685 million and leave the newly listed business with a market capitalisation of $2.3 billion, Virgin will struggle to go straight into the ASX300, given that only around 30% of the stock will be in free-float once it relists.

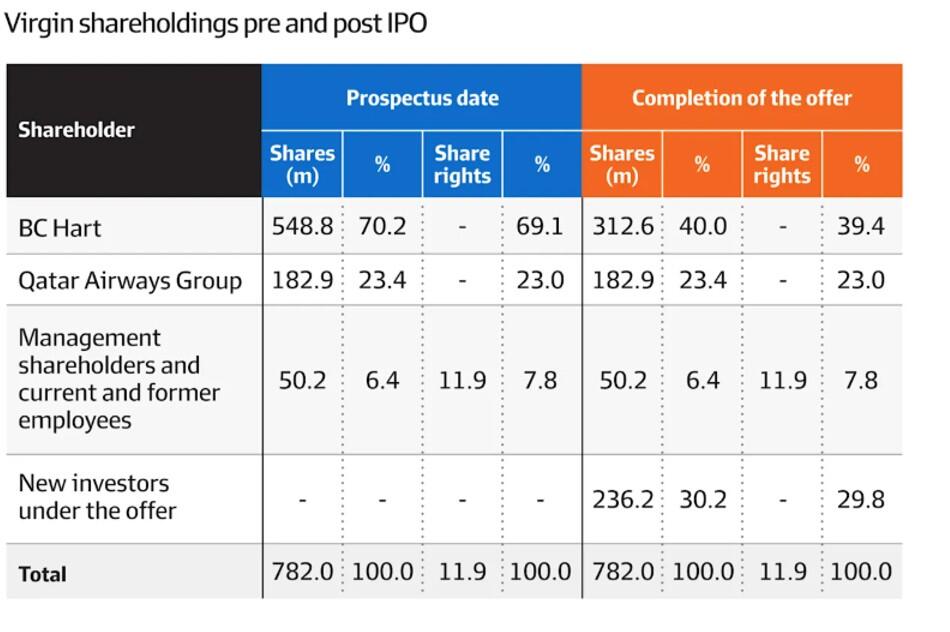

While the float will leave the airline’s owner, Bain Capital, with a stake of around 40% in the airline, another 7.8% of shares on issue will be in the hands of management, as well as current and former employees.

Most fund managers and brokers like the idea that Virgin’s staff will be sitting on around $180 million in shares, as it helps align them with what’s best for shareholders.

Capex to deliver incremental gains

Meantime, Virgin has capital expenditure plans of around $1.1 billion in the next financial year.

Based on the average fleet age of 12-13 years – younger than Qantas’ – Virgin needs to replace 7-8% of its planes annually.

Incremental gains from the next fleet of new planes – which arrive next year – include 19% greater fuel efficiency plus an additional six seats per flight.

While there were major question marks over the management team responsible for a failed IPO attempt in 2023, the market will clearly want to see the new management lineup get some early runs on the board.

One thing Virgin’s new management lineup has inherited is extremely favourable market conditions.

But they may not last long.

Back in May, the competition watchdog noted that Australia’s two largest airlines’ hefty profit margins reflected strong ongoing demand for flights and limited domestic competition.

Qantas recorded a 16% earnings margin from its domestic operations, and Virgin said its first-half earnings were the highest in its 24-year history.

No guidance

Overall, Virgin says it is on track to record revenues of $5.8 billion and a $219 million net profit this financial year.

Underlying earnings have risen from $722 million in 2023 to $1 billion this financial year.

Meanwhile, net profit has more than doubled from $99 million to $219 million due to cheap fuel and Bain’s cost-cutting measures.

The company expects to cut costs by $400 million this year, and by the same amount in FY26.

While Virgin’s prospectus has forecasts for June 30 2025, management believes there are too many variables outside the group’s control (oil price, currency, consumer sentiment) to put firm guidance in the market.

In light of the limited future guidance, it’s easy to see why the stock has chosen to float at a juicy discount.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.