By bolting the door against Chinese innovation as part of its fight to maintain global superiority, the United States has successfully protected its legacy fossil-fuel industry - yet at the cost of leaving its consumers behind in the global automotive tech race.

The rapid acceleration of China and its auto exports has fundamentally tilted the playing field, making the bustling wharves of Fremantle and Brisbane the new ground zero for a silent, high-voltage invasion that is currently rewriting the rules of the road for the next decade.

America is currently missing out on the rapid R&D cycles that are defining the next fifty years of transport, and (somewhat ironically) Australia has accidentally become the world’s most advanced automotive laboratory.

In the U.S., a 100% tariff "deadbolt" has been slid across the door, essentially banning the world’s most sophisticated New Energy Vehicles (NEVs) out of China to protect an incumbent industry that is still struggling to find the "on" switch.

Meanwhile Australia, with its diverse and rugged terrain, has become a proving ground for this production overflow, its consumers benefiting from a level of choice and fierce competition from the Middle Kingdom that U.S. buyers simply cannot access.

And so, while American punters are being forced to pay a "protection tax" for last-gen hardware, Australian drivers are currently feasting on "forbidden fruit" that is faster, cheaper, and more intelligent than anything rolling off traditional Western assembly lines.

The Middle Kingdom’s global coup

The final wash-up from the 2025 sales data is now in, and the figures tell an enigmatic story of an industry-wide upheaval that few incumbent execs saw coming even five years ago.

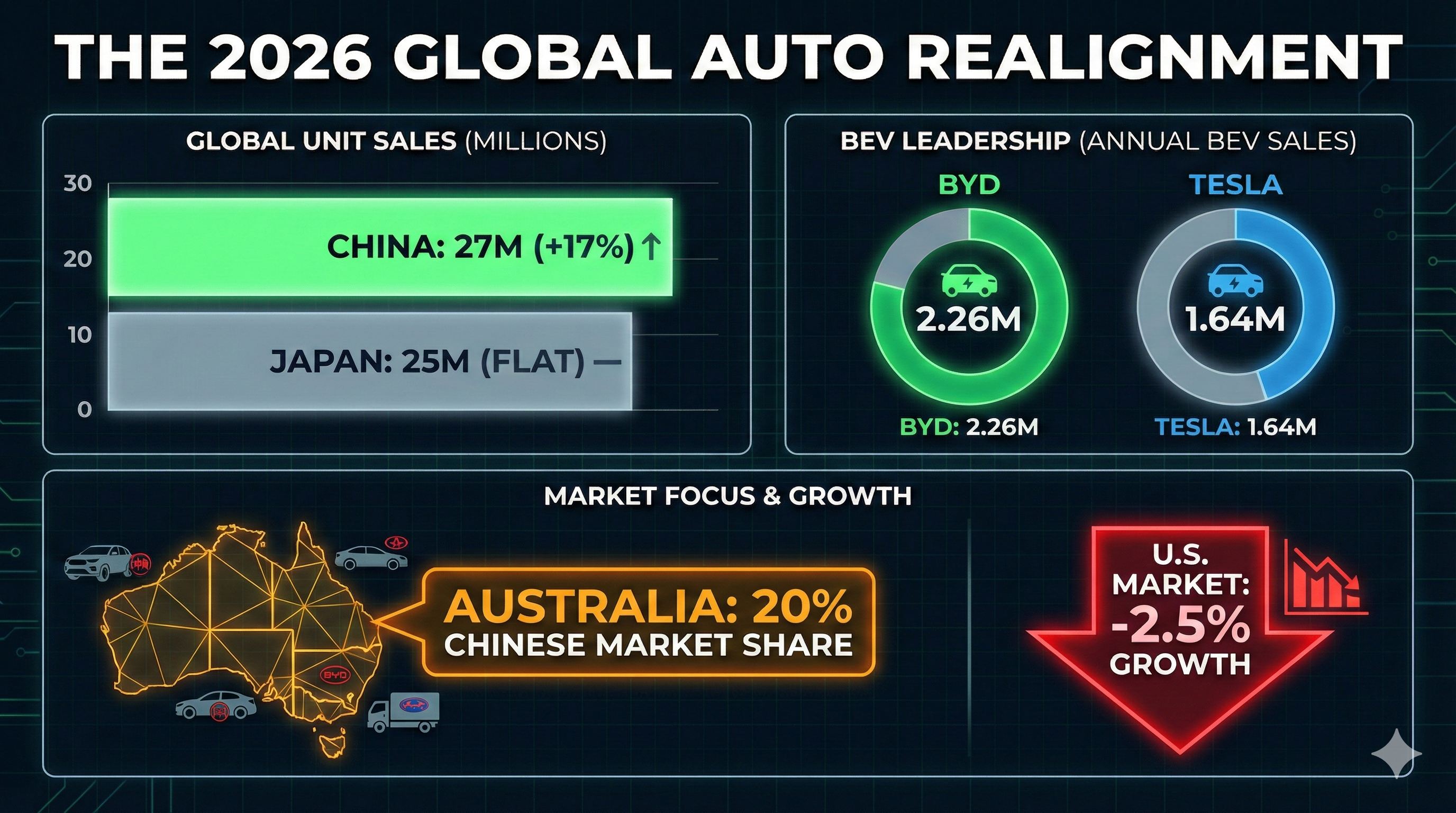

According to estimates compiled by Nikkei Asia, Chinese car brands have collectively become the world’s largest sellers of new vehicles, finally overtaking Japanese OEMs after more than twenty years of Tokyo's dominance.

The report says Chinese brands moved approximately 27 million units globally in 2025, a 17% increase YoY, while Japanese combined sales remained stagnant at roughly 25 million units.

For the first time in history, BYD delivered 2.26 million BEVs - officially dethroning Tesla as the world’s top-selling pure EV manufacturer by a significant margin.

In Australia, the momentum is even more aggressive as Chinese brands hit 20% of national market share for the first time in history, placing four manufacturers in the Australian top 10 simultaneously.

The BYD Shark 6 utility vehicle has already established itself as a staple on Aussie work sites - proof that the local "tradie" is more than ready to swap diesel for a high-output plug-in hybrid.

Targeting the global south

As Western theatres tighten their borders, China's exports to the Global South have reached an eye-whopping US$1.6 trillion - that's over 50% more than both the U.S. and Western Europe combined.

S&P Global says mainland China's vehicle exports are projected to exceed 6.5 million units in 2025 as manufacturers look to keep their massive gigafactories operating at a profitable capacity.

"The ultimate goal of Chinese OEMs is to deeply integrate in the auto manufacturing sector of an investment destination," S&P Global Mobility Principal Analyst Abby Tu said.

"They are moving from a 'Made in China' export model to a 'Made by China' regional manufacturing strategy to bypass growing trade barriers."

This strategy is nowhere more evident than in Brazil, the world's sixth-largest car market, where Chinese automakers now account for 10% of total sales and a staggering 70% of the EV segment.

BYD and Great Wall Motor (GWM) have successfully transformed former legacy sites - such as the Bahia Ford plant and the Mercedes-Benz Iracemápolis facility - into advanced local manufacturing hubs designed to supply the entire Mercosur region.

Heritage badges throw in the towel

Perhaps the most telling sign of this dominance is the quiet tactical withdrawal of Western giants who have in all but name stopped trying to compete with Chinese manufacturers on the pure electric front.

In a profound realignment for the Detroit industry, Ford recently announced it would take a $19.5 billion charge to cancel several pure EV models and discontinue the fully electric F-150 Lightning in favour of hybrid platforms.

"We are making a disciplined move to adjust our capital allocation toward where we can win," Ford CEO Jim Farley said in an interview last year.

"Our retreat from certain EV segments reflects the reality that the cost curve of Chinese battery technology is currently out of reach for traditional Western assembly models."

Similarly, Volkswagen has delayed its primary electrification targets and is now looking to halve its development costs by basing future designs directly in China to utilise their superior upstream supply chains.

It's an admittance that the manufacturing edge and vertical integration held by brands like BYD and Geely is now impossible to overcome through legacy engineering.

For instance, Geely's Zeekr 7X range opens at just A$57,900, a figure that significantly undercuts its rival Tesla Model Y while offering vastly superior 800V silicon and standardised once optional features like a sunroof and nappa leather seats that heritage badges struggle to offer without tacking on a premium.

At the end of the day - by hook, or by crook - Australia has become a primary beneficiary of a geopolitical price war and seeing the cost of high-tech motoring plummet, while ironically, consumers in the spiritual home of technological innovation are stuck in the past.