United States mortgage rates dropped again this week as the Federal Reserve announced an interest rate cut, according to Freddie Mac’s Primary Mortgage Market Survey.

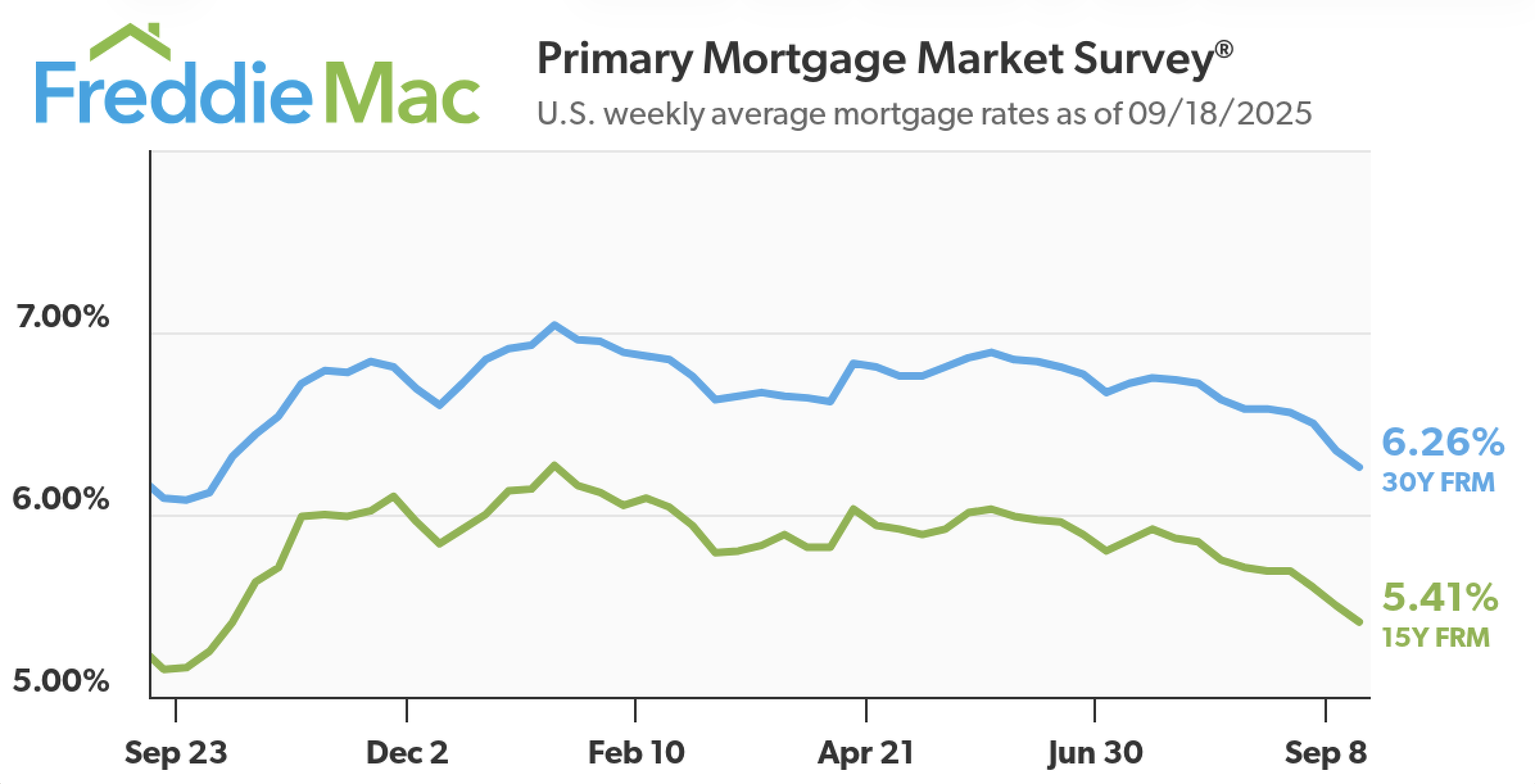

The 30-year fixed mortgage rate averaged 6.26% in the week to 18 September, falling from 6.35% the previous week to reach its lowest point since October. This is a year-over-year increase from 6.09%, however.

“Mortgage rates decreased yet again this week, prompting many homeowners to refinance,” said Freddie Mac chief economist Sam Khater. “In fact, the share of mortgage applications that were refinances reached nearly 60%, the highest since January 2022.”

The 15-year fixed mortgage rate also dropped from 5.50% to 5.41% this week, though it remains above the 5.15% average seen one year ago.

Fixed mortgage rates have largely been declining since mid-July, anticipating the 0.25% interest rate cut the Federal Reserve announced on Wednesday. A similar pattern occurred in July to September 2024 before an interest rate cut, with fixed mortgage rates climbing again in October.

Both the 30-year and 15-year rate reached their 2025 peaks on 15 January, at 7.04% and 6.27% respectively.

“The recent drop in mortgage rates is a positive development for helping to ease the affordability challenge. Rates could come down further, as the Fed has signaled the potential for two more rate cuts this year,” said Bright MLS chief economist Lisa Sturtevant.

“However, there are still risks of a reversal in mortgage rates. Inflation heated up in August and if the September inflation report shows another bump in consumer prices, it’s possible we could see rates rise.”

Related content