Major United States equities ended mixed on Friday, capping a volatile week of trade dominated by Washington’s political gridlock and signs of growing economic strain.

On Friday, Dow Jones Industrial Average gained 74.8 points or 0.2% to close at 46,987.1, the S&P 500 added 8.5 points or 0.1% to 6,728.8, while the Nasdaq Composite fell 74.8 points or 0.2% to 23,004.5, marking its steepest weekly percentage loss since April.

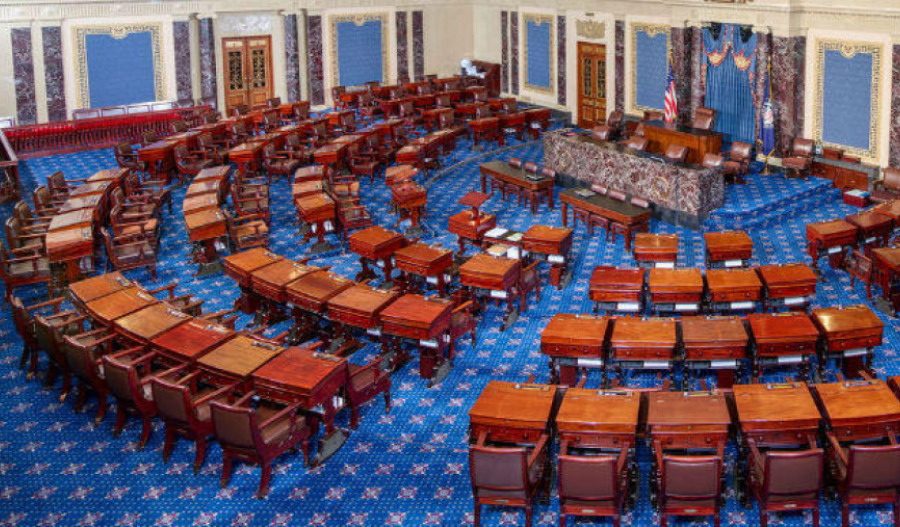

The declines came as the record-long U.S. government shutdown showed little sign of resolution.

Stocks briefly pared losses after Senate Minority Leader Chuck Schumer proposed a plan to reopen federal agencies with short-term funding in exchange for extending enhanced Affordable Care Act tax credits for a year, but Republicans reportedly dismissed Schumer’s proposal, which hinges on protecting enhanced Affordable Care Act subsidies for at least one year.

Concerns about the health of the U.S. economy deepened after a University of Michigan survey showed consumer sentiment nearing its lowest level on record, hitting 50.3 versus 53.2 expected and down from 53.6 prior.

The report indicated that pessimism was widespread across demographic groups, with only wealthier households holding substantial equity portfolios showing relative resilience.

The survey followed a report from Challenger, Gray & Christmas, revealing that October layoff announcements reached their highest level for that month in 22 years.

ANZ analysts noted: "The University of Michigan consumer sentiment survey highlights softness in the U.S. economy lurking beneath the surface of elevated equity valuations and the AI investment boom.

The University of Michigan’s press release noted the decline in sentiment was widespread across age, income, and political affiliation, with the exception being consumers within the largest tercile of equity holdings.

Taken with the weak Challenger job cuts report, the consumer sentiment survey highlights the downside risks to consumption and supports our view for a 25bp cut from the Fed in December."

The government shutdown also disrupted key economic releases, including the closely watched nonfarm payrolls report, which the Bureau of Labor Statistics was again unable to publish.

Corporate earnings season continued with 91% of S&P 500 companies having reported third-quarter results. According to FactSet Earnings Insight, 82% delivered positive earnings-per-share surprises, and 77% exceeded revenue estimates - figures that have so far provided some support for equity valuations despite mounting macroeconomic uncertainties.

Technology shares remained under pressure, dragging on the Nasdaq’s performance. Oracle lost 1.9% on Friday, bringing its weekly slide to 7.8%.

Advanced Micro Devices dipped 1.8% and Broadcom also fell 1.7%, each losing 10% and 7.6% respectively over the week.

Nvidia, Tesla, and Microsoft likewise saw declines earlier in the week as enthusiasm for artificial intelligence stocks cooled.

On the bond markets, yields ticked higher, with the 10-year Treasury note rising to 4.093% and the 2-year yield to 3.56%.