Australian Retirement Trust (ART) seems to have perfected the art (no pun intended) of mergers in the superannuation industry.

Australia’s second-largest super fund, with A$330 billion (US$236 billion) under management (FUM) for 2.4 million members, completed seven of them between 2022 and 2024.

But it was not alone in driving consolidation of the the $4.3 trillion retirement savings sector through waves of mergers.

Known in industry parlance as successor fund transfers (SFTs), mergers have transformed the sector, with the number of funds halving since 2010 to about 90.

Once there were hundreds regulated by the Australian Prudential Regulation Authority (APRA), but in the five years to October 2025, the number fell from 158 to 87, according to APRA.

“The big are getting bigger and the small are getting smaller,” Deloitte Australia Actuarial Consulting Partner Andrew Boal said.

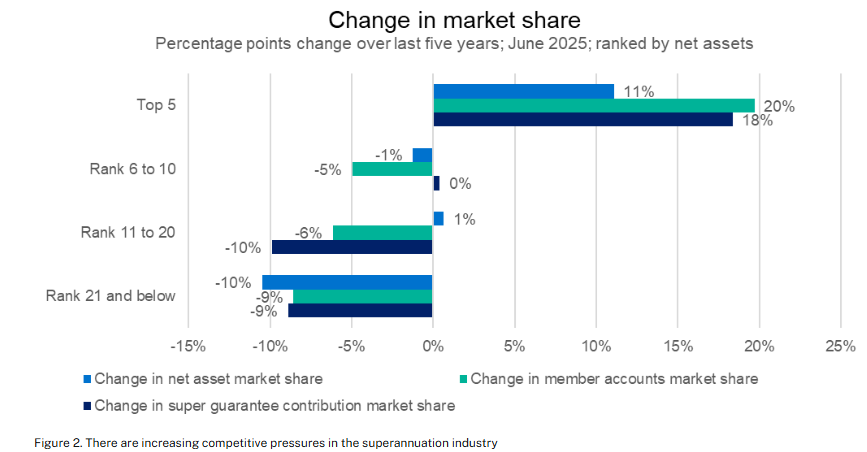

In the five years to June 2025, the top five funds increased their share of super guarantee contributions (SGC) and member accounts faster than their share of net assets, while those outside the top 10 saw their share decline, according to APRA.

“While declining market share is not a concern in isolation, it highlights increasing competitive pressure across the industry,” the regulator said in a paper.

SFTs are not corporate mergers in the traditional sense because the trusts remain separate but member balances are moved without requiring individual consent.

Where it all started

ART is outranked in size by AustralianSuper, which manages $385 billion for 3.5 million members, and was established in 2006 through the combination of Australian Retirement Fund (ARF) and Superannuation Trust of Australia (STA).

It was the original industry fund.

ARF was in turn set up in 1985 through an agreement between the Australian Council of Trade Unions and the Australian Chamber of Manufactures while STA was established in 1987 through negotiations between unions and employer groups.

ART, itself the result of the 2022 merger of SunSuper and QSuper, has mopped up: Australia Post Super Scheme, Incitec Pivot Employee Super Fund, Oracle Superannuation Plan, Woolworths & Endeavour Super Plans, Commonwealth Bank Group Super, Alcoa Superannuation Plan and AvSuper.

“We have highly experienced teams and dedicated service models to meet our employer customer needs, including an in-house transition team with specialist skills and experience in managing large-scale transitions and fund mergers,” an ART spokesman told Azzet.

Early mergers involved industry-based super funds like the Gas and Fuel Superannuation Fund and the Water Industry Superannuation Fund, which joined Equip Super, which had in turn grown out of the State Electricity Commission of Victoria’s fund established in 1931.

Among the industry tie-ups along the way have been CARESuper, which took over Asset Super in 2012, and Sunsuper, which absorbed smaller funds like Otis, Amatil, RACV, IAG-NRMA, DXC, and Worley between 2020 and 2021.

Among the combinations since the ART wave of activity are CARESuper with Spirit Super and Meat Industry Employees Superannuation Fund, TWUSUPER with Mine Super to create Team Super, and Active Super with Vision Super.

Underway is the merger between Aware Super, Australia’s third-largest fund, and Telstra Super.

Wave after wave

KPMG Partner Actuarial & Financial Risk Platon Chris said the first round of mergers involved funds that had failed the APRA performance benchmark test joining with other funds.

“What we're seeing at the moment is that second wave, which is more around sustainability issues and whether funds can sustain the wave of compliance and governance requirements that are coming through,” he told Azzet.

This referred in particular to prudential standards requiring funds to manage their businesses soundly and prudently and ensure they are adequately prepared for scenarios that may impact their financial viability.

Ask for how much consolidation was left, Chris said large funds would need to find target of sufficient size and strategic importance to consider SFTs.

“The larger to medium-sized funds are very much focussed on winning new members and ensuring that cash flows are strong. If it's not of strategic importance, I'd say they won't focus on the potential merger,” he said.

He said small to medium-sized, rather than large, funds would face sustainability challenges, but merging them would be complex, lengthy and costly.

Future activity

Chris expected AustralianSuper and ART to grow to $1 trillion dollars of FUM by mid- 2035 and the number of funds to drop to about 30, with the time frame hard to estimate because mergers would be taking longer.

He also saw a niche for small to medium-sized entities that performed well and engaged with members.

Other drivers of consolidation have been the desire to spread administration and investment costs over a larger asset base to reduce fees and improve services, to offer broader investment options, member tools and advice services, and attract default flows from employers and attract more members.

Boal said large funds were generating strong positive cash flows due to industrial awards and relationships with employers, whereas many funds had negative cash flows.

“You would be hard pushed to see those top 10 not being around for the long term. It would also be hard to see them merging with each other,” Boal said.

He expected to see at least 10 entities with more than $100 billion in the future, along with a similar number of smaller, niche-style funds with a competitive advantage.

“Pretty quickly you will see the very small funds will start to struggle and you will end up with an industry over time of probably around 20 funds. It will take a while to get there but even over the next couple of years you will be getting in under 50 funds,” he said.

Some funds would be absorbed by larger competitors if it could be completed relatively cheaply.

“But if not I think we might see a future at some point in the near future where some of the smaller funds just simply close and advise their members they will be closing and to look for an alternative fund,” Boal said.

“We haven’t seen that yet. I don’t expect that in the next year or two but I think we are not far away from seeing that.”

Industry observers expect to see mergers between large funds like HostPlus and REST, Aware and HESTA and Aware and Rest, partly because members are from similar industries, but they would present complications such as different administration arrangements.

“But you never say never, and they've always been spoken about,” said one industry watcher.

Another observer said the bottom half of the remaining super funds would be of no interest to potential merger partners because of the cost of these transactions, which could be as much as $5 million.

“Some of the larger funds are getting to the point (of thinking): 'Why would I bother merging with you?' Some funds are likely to merge to survive a bit longer. The big guys are not interested in merging. Those that are small, I don’t know what’s going to happen to them,” he told Azzet.