Shares in automotive giant Tesla fell after it reported lower-than-expected results for the third quarter of the 2025 financial year (Q3 FY25).

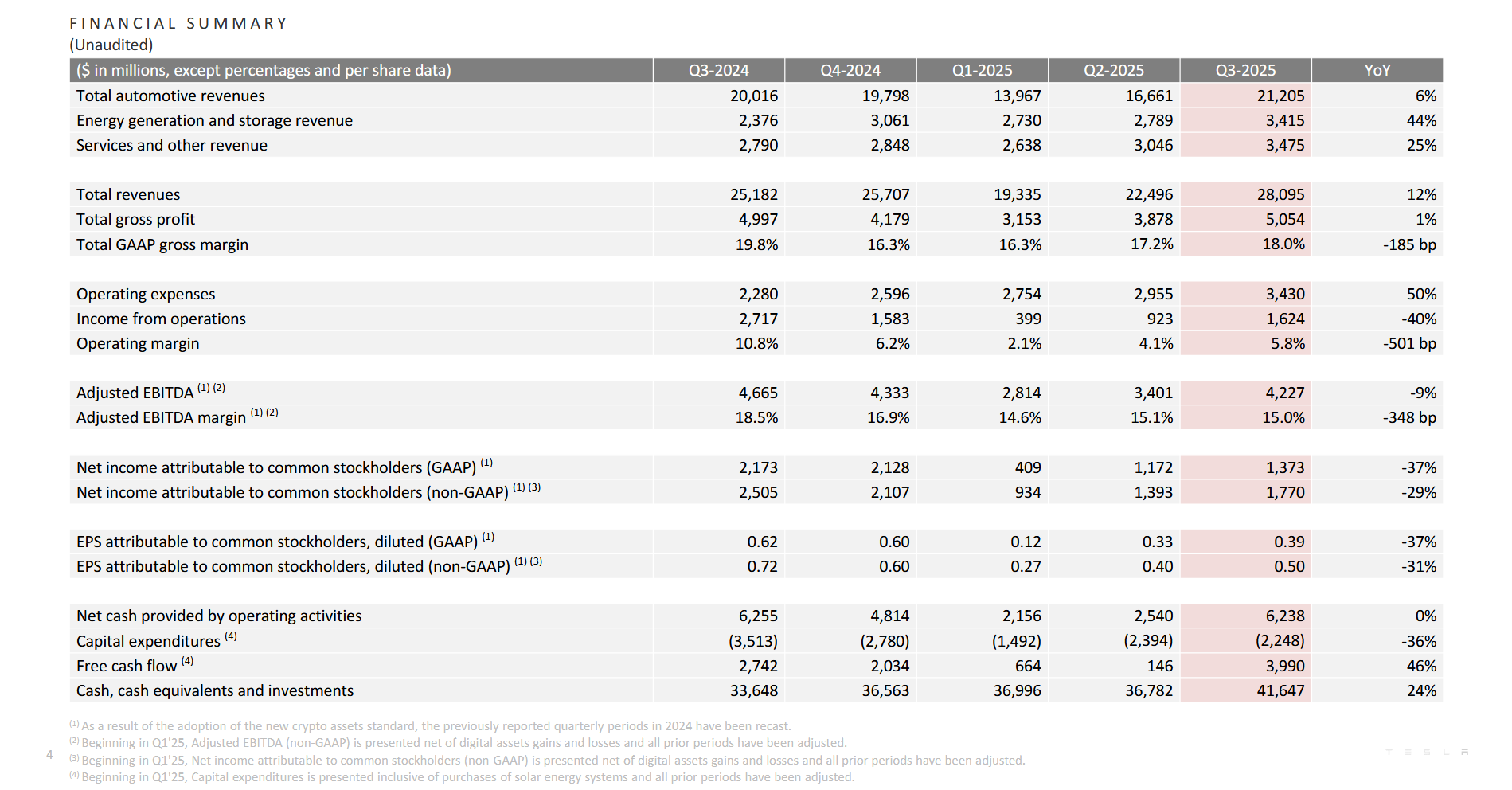

The electric vehicle to clean energy giant said net income fell 29% to US$1.77 billion (A$2.72 billion) and diluted earnings per share (EPS) plunged 31% to 50 cents in the three months ended 30 September 2025.

The factors driving income down included higher operating expenses, an increase in share-based compensation, restructuring and other charges, higher average costs per vehicle, an increase in tariffs and a change in sales mix.

Revenue jumped 12% to a record $28.1 billion due to an increase in vehicle deliveries, growth in Energy Generation and Storage, Services and other income and despite lower regulatory credit revenue and lower self-driving (FSD) revenue.

“In Q3, the Tesla team achieved record vehicle deliveries globally, showing strength and growth across all regions, while also achieving record energy storage deployments across the residential, industrial and utility sectors,” the company said in its Q3 2025 Update.

“This strong performance resulted in both record revenue and free cash flow generation in the quarter.”

Tesla introduced lower-cost variants of its Model Y and Model 3 vehicles earlier this month to increase demand.

Tesla said it was making the investments, including in future business lines, to create value in the transport, energy and robotics sectors.

“While we face near-term uncertainty from shifting trade, tariff and fiscal policy, we are focused on long-term growth and value creation,” the company said.

Although revenue exceeded the average analysts' estimate of $26.37 billion, diluted EPS was under the forecast of 55 cents.

The share price (NASDAQ: TSLA) closed $3.63 (0.82%) lower at $438.97 on Wednesday (Thursday AEDT), capitalising the company at $1.37 trillion, before falling to $421.31 in after-hours trading.