T-Mobile US shares rose on Wednesday despite the telecommunications company announcing a drop in profits for the fourth quarter of 2025 (Q4 FY25).

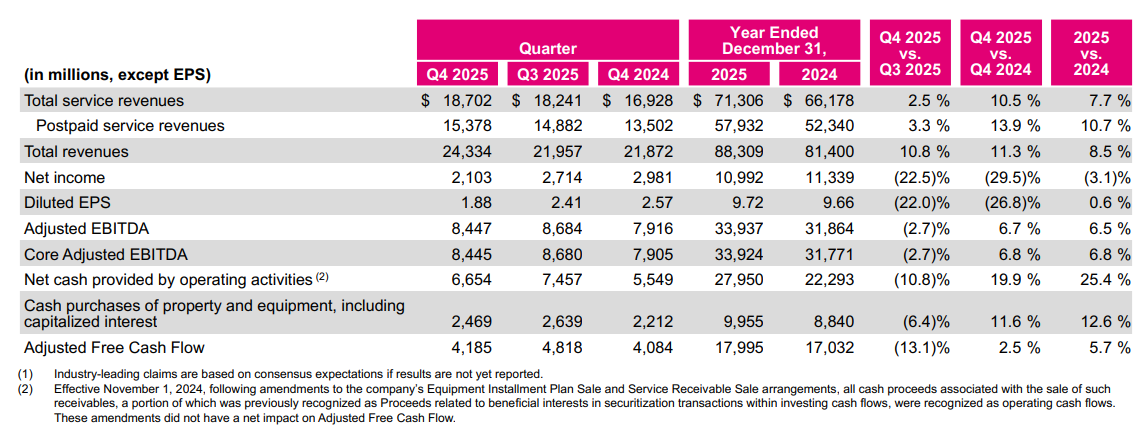

The company said net income fell 29.5% to U$2.103 billion (A$2.94 billion) and diluted earnings per share (EPS) dropped 26.8% to $1.88, on revenue which grew 11.3% to $24.334 billion in Q4 compared with the previous corresponding period.

EPS missed expectations of $2.05, while revenue came in slightly ahead of analysts' average estimate of $24.11 billion, according to data compiled by LSEG, but it added fewer wireless subscribers than expected in Q4.

For 2025, net income fell 3.1% to U$10.992 billion and diluted earnings per share (EPS) rose 0.6% to $9.72 as revenue jumped 8.5% to $88.309 billion.

T-Mobile said it delivered industry-leading customer results in post-paid net account additions, total post-paid net customer additions, post-paid phone net customer additions and total broadband net customer additions.

Revenue growth was multiple times that of its closest wireless competitors, net income was strong, core adjusted earnings growth was industry-leading, and net cash from operating activities was strong.

“As we look to 2026, we’re even more confident that the future is brighter than ever before,” the company said in an earnings release.

Chief Executive Officer Srini Gopalan said Q4 was a “great proof point” of the company’s winning formula, and it saw “significant runway ahead” to widen its margin of differentiation.

T-Mobile shares (NASDAQ: TMUS) closed $10.11 (5.07%) higher at $209.54, capitalising the company at $234.37 billion, before rising to $210.40 in after-hours trading.

T-Mobile US is about 50% owned by German telecommunications company Deutsche Telekom.