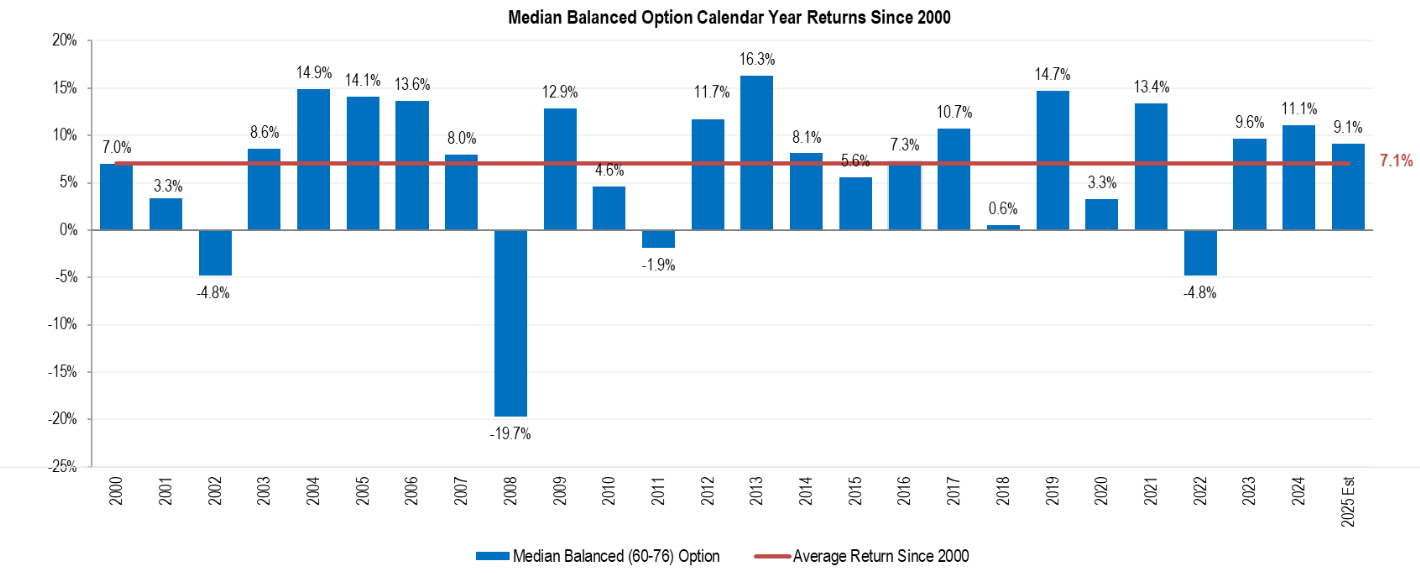

Australian superannuation funds generated a 9.1% return for median balanced options in the accumulation phase in 2025, according to SuperRatings estimates.

This was more than the long-term average of 7.1%, the super research house said in a media release.

Funds continued to strongly benefit from international share exposure as the key driver of performance although all asset classes were expected to have made a positive contribution, it said.

The median balanced option, with 60-76% in growth assets, returned 0.35% in December but positive returns over nine months including the seven months to October added up with a handful of top performers expected to reach double digit returns for the year.

“As the strong performance of equity markets continues to drive superannuation returns, funds with higher than average exposure to international equity have benefited in 2025, although we see funds focused on how to manage the ups and downs of the market, reflecting the uncertainties that exist in the market outlook generally,” Director Kirby Rappell said.

He said “further anticipation” around artificial intelligence (AI) was expected in 2026 with risks around inflation in Australia and markets being driven by exuberance around new technologies.

“However, members should be reassured that historically funds have been able to deliver good returns across a range of market conditions,” Rappell said.

Over the last three years average returns have raised the long-term average return to 7.1% p.a. over the past 25 years, which was 3% over the inflation rate for a balanced option.

“This means that funds have delivered returns of over 1% per annum above expectations to members since 2000,” he said.