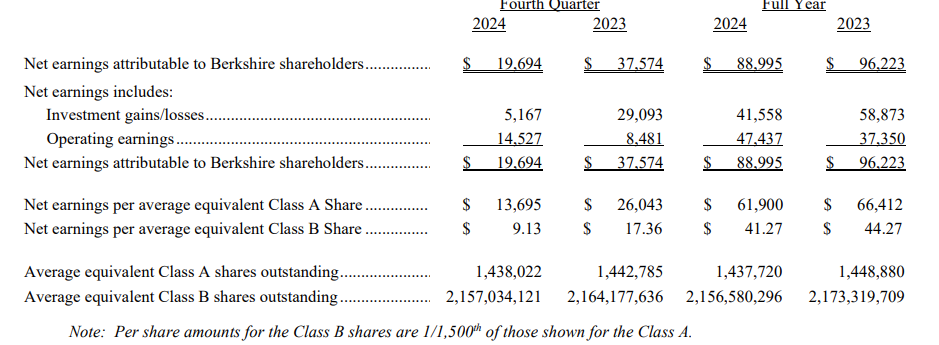

American investment company Berkshire Hathaway Inc. made record operating profits in 2024 and the last quarter of the year, but overall earnings dropped due to lower investment income.

Berkshire Hathaway, run by legendary investor Warren Buffett for 59 years, said operating earnings surged 71% to $14.527 billion (A$22.698 billion) in the fourth quarter (Q4) and 27% to $47.437 billion in 2024.

However net earnings dropped 48% to US$19.694 (A$30.77 billion) in Q4 and 7.5% to $88.995 billion in the full year with the inclusion of investment earnings, which plunged 82% to $5.167 billion in Q4 and 29% to $41.558 billion in 2024.

Buffett, the 94-year-old Chair and CEO, said Berkshire performed better than he expected although 53% of its 189 operating businesses reported a decline in earnings.

“We were aided by a predictable large gain in investment income as Treasury Bill yields improved and we substantially increased our holdings of these highly-liquid short-term securities,” he said in a statement.

“Our insurance business also delivered a major increase in earnings, led by the performance of GEICO.”

He emphasised operating earnings as the best measure of performance because they exclude realised or unrealised capital gains or losses on investments.

Buffett said GEICO’s performance improvement in 2024 was spectacular, but not still complete, as efficiency increased and underwriting practices were updated.

He said property-casualty insurance pricing strengthened, reflecting a major increase in damage from convective storms, and although climate change may have been announcing its arrival. no “monster” event occurred last year.

Berkshire’s railroad and utility operations, its two largest businesses outside insurance, improved their aggregate earnings but had much left to accomplish.

Berkshire Hathaway class B shares (NYSE: BRK.B) closed at US$478.74, down $3.06 (0.64%) on Friday, capitalising the company at $1.03 trillion.