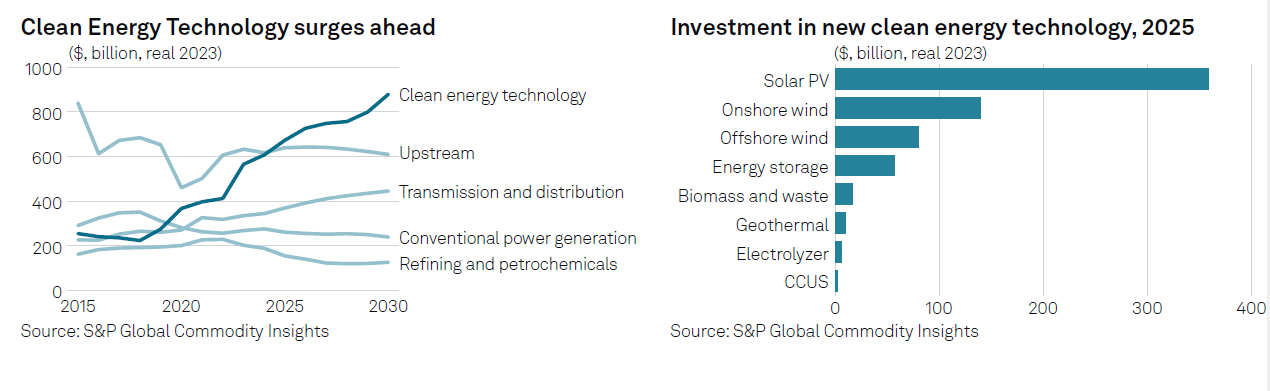

S&P Global has earmarked 2025 to be the year clean technology overtakes that of fossil fuels, with investment in renewable power generation, green hydrogen production and carbon capture and storage (CCS) set to reach a whopping US$670 billion (A$1.085 trillion), led by solar PV.

The pivot is driven by climate change and a subsequent global push to decrease CO2 emissions, as ratified by 196 countries in the United Nation’s 2015 Paris Agreement.

This shift, the world’s flagbearer of capitalism index says in its latest Global Commodity Insights report, underscores the growing dominance of renewable technologies, with solar PV expected to represent half of all cleantech investments and two-thirds of installed megawatts.

"The new year is not only bringing to the clean energy sector significant transformations that are reshaping energy production and consumption, but it promises to be pivotal for the clean energy sector, with significant advancements in corporate clean energy procurement and the integration of AI in energy management," S&P Global’s energy transition research head Eduard Sala de Vedruna says.

It warns, however, that despite this significant financial commitment, the overall investment levels remain insufficient to meet urgent climate goals.

According to S&P, 2025’s top trends in clean energy tech will see:

Supply chain tensions

S&P’s forecast says the global cleantech landscape this year will be shaped by an oversupply of equipment from China, particularly affecting the solar, wind, and battery sectors.

“Price declines may stabilise in 2025, but competition from Chinese manufacturers is expected to keep prices low, fundamentally altering industry pricing dynamics,” it says.

“Projections indicate that China's market share in PV module production will decline to 65% and battery cell manufacturing to 61% by 2030.”

Energy storage to transform markets

"Despite reductions in solar PV costs, the decrease in capital expenditures has not translated into robust project development, largely due to low power purchase agreement expectations," S&P says.

"To remain competitive, solar projects must integrate battery energy storage solutions, enabling developers to navigate price fluctuations and improve the economic viability of renewable investments.

An AI-driven revolution

The index's analysis arm says as intermittent renewable energy sources become more prevalent, the need for accurate forecasts has intensified and AI will be at the fore of the dynamic.

“AI-powered trading applications are emerging as critical tools to mitigate risks associated with discrepancies - potentially up to 700% - between forecasted and actual energy generation, thereby enhancing energy management and facilitating the integration of renewables into the grid.”

Datacentres for procurement

“Datacenters are expected to significantly increase their role in corporate clean energy procurement, with expectations to source approximately 300 TWh of clean power annually by 2030,” S&P writes.

“Currently, datacentres account for around 200 TWh, or 35%, of the global corporate clean energy procurement, a figure projected to rise dramatically over the next five years.

“North American datacentres are leading this transition, anticipated to represent approximately 60% of the global increase in clean energy procurement by 2030.”

Deeper decarbonisation efforts

Ammonia is peggeed to continue to emerge as a key player in low-carbon hydrogen production, contributing significantly to both electrolytic and fossil fuel projects with CCS.

“In 2025, the CCUS sector is expected to secure approximately 70 million metric tons per year of CO2 capture capacity, bolstered by recent announcements of carbon management strategies that enhance clarity for CCUS projects,” the report said.

“Despite the high costs associated with engineered carbon dioxide removal (CDR) technologies, the last three years have witnessed a surge in CDR offtake removal agreements, demonstrating increasing corporate interest and enhanced government policy support.”