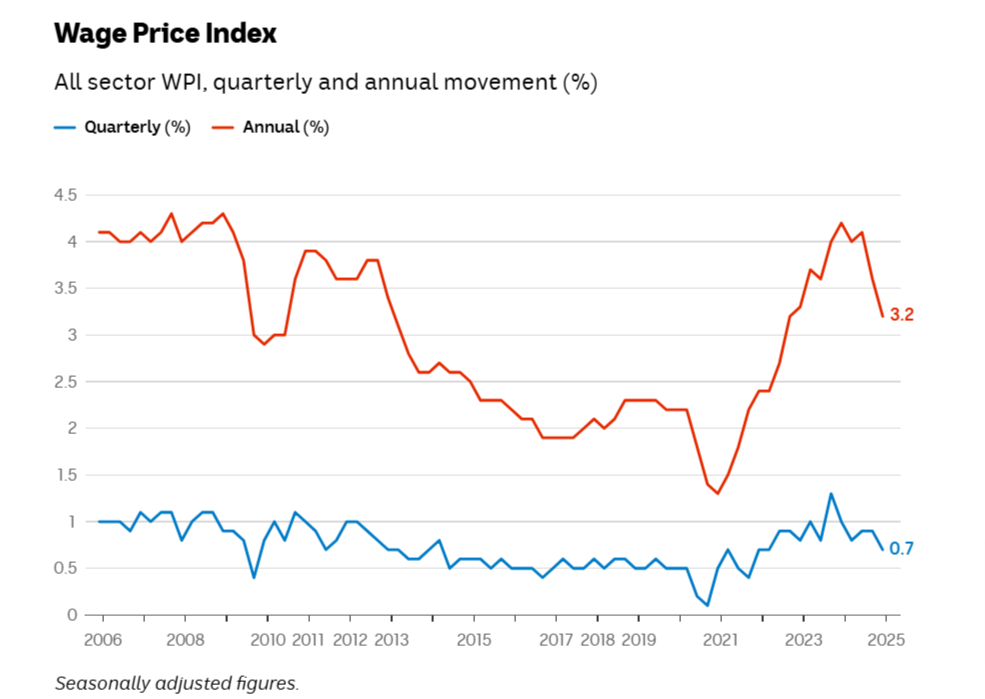

Australian Bureau of Statistics (ABS) data shows wage growth in Australia has decelerated to 3.2% over the past year.

Wage growth slowed to just 0.7% in the December quarter, the slowest quarter since March 2022.

This deceleration was forecast by the Reserve Bank of Australia (RBA), and the latest data confirms their prediction.

"The outlook for wages growth and inflation is sensitive to our assessments of the degree of balance between aggregate demand and supply in the economy and in the labour market; however, these assessments are subject to considerable uncertainty. Our central assessment is that the labour market is still tight, while the broader economy is estimated to be closer to balance," the RBA said in a release.

Based on the latest RBA forecast, published earlier this month, the Wage Price Index (WPI) growth in December is expected to slow to 3.2%.

Michelle Marquardt, ABS head of prices statistics said: “The 0.7% rise this quarter was the equal lowest growth since March quarter 2022. At 3.2%, the annual increase in wages was down from 4.2% in December quarter 2023 and is equal to the lowest increase since September quarter 2022.”

Earlier this week, the RBA cut interest rates for the first time in over four years. It reduced the cash rate target to 4.1% from 4.35%.

It was decided that a small rate cut would be warranted since inflation had slowed sufficiently to warrant a small rate cut.

In part, the RBA's decision was influenced by slower wage growth, which suggests that tight labour markets are not significantly contributing to inflation.

Michele Bullock, the RBA governor, has stressed that the bank will not rush into further rate cuts without more certainty that inflation is declining sustainably.

In addition to providing insights into wage trends across sectors, the monthly employee earnings indicator provides insight into how wages are changing over time.

According to the report, private sector wages grew 3.3% while public sector wages grew 2.8%.

There is a large disparity between wage growth and government spending.

As well, real wages have shown some recovery, but remain below pre-pandemic levels, adjusted for inflation.

It is evident that wage growth continues to be challenging when balancing inflation control with wage growth.