A$3bn in Australian defence properties to be sold

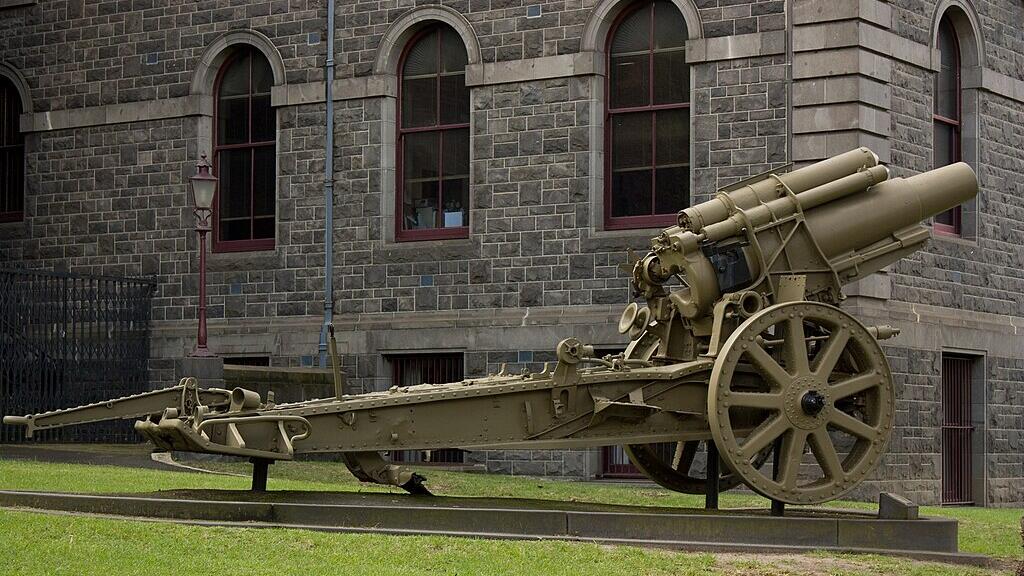

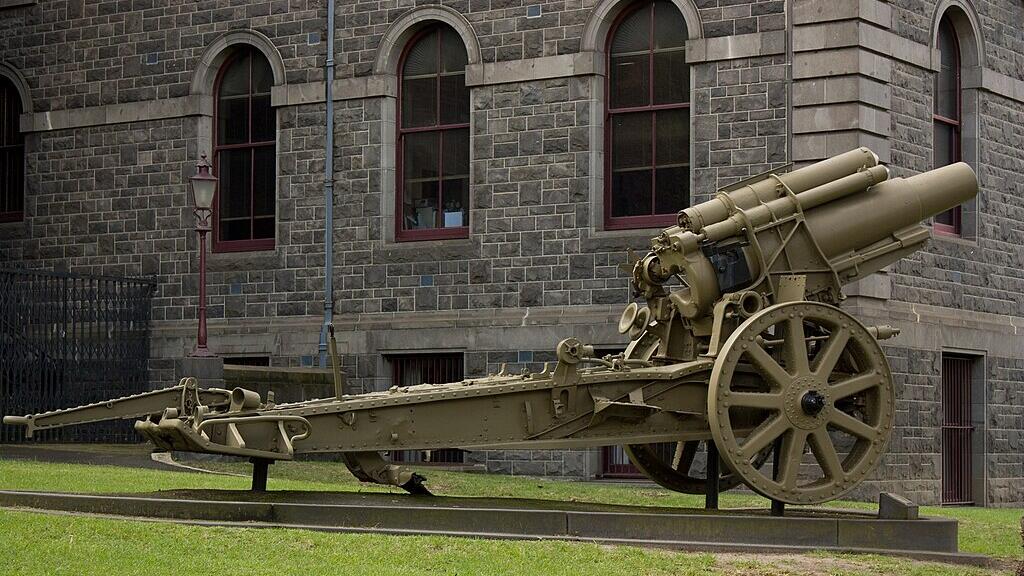

The federal government has agreed to sell off A$3 billion in defence properties around the country, in the largest military sell-off in Australian history. Some of the sites up for grabs include Victoria Barracks in Sydney, Melbourne and Brisbane, along with dozens of inner-city training depots and barracks across the country. This followed a multi-year audit that was tasked with identifying surplus and costly property holdings, often costing millions to maintain. A number of the properties sold could be used for new housing developments, after sales managed by the finance department. This comes as housing prices in Australia are set to surge in 2026, in part due to tight housing supply. Defence Minister Richard Marles released the audit of the 3 million defence estate and agreed to recommendations to sell more than 60 properties. A longtime target for remediation, it could fit 6,000 new homes. After relocation costs and other expenses, net proceeds of about $1.8 billion are expected. About $100 million a year is expected to be saved from the upkeep of disused and run-down properties. Labor plans to boost the take-up of modern office spaces, including Defence Plaza in Melbourne, which is operating at just 4