Major United States benchmark averages finished mixed on Wednesday (Thursday AEST), as investors monitored trade updates as President Trump visited the Gulf and secured US$600 billion in Saudi commitments.

The Dow Jones Industrial Average fell 89.4 points or 0.2% to settle at 42,051.1. The S&P 500 ticked up 6 points or 0.1% to close at 5,892.58, while the Nasdaq Composite gained 136.7 points or 0.7% and ended at 19,146.8.

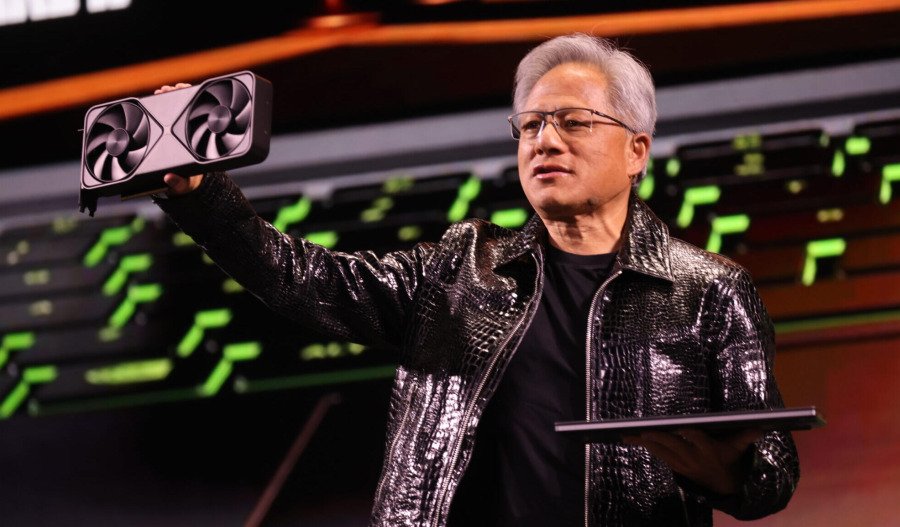

Technology stocks climbed. Nvidia advanced more than 4.2%, following news that it would send Saudi Arabia 18,000 of its top artificial intelligence chips.

Peer chip stock AMD also rose more than 4.2% on the back of a US$6 billion buyback.

Week to date, the S&P 500 and Dow are up more than 4.1% and 1.9%, respectively. The Nasdaq has jumped 6.8%.

Risk appetite grew this week after the U.S. and China temporarily slashed tariffs on a wide array of goods. The U.S. reduced duties on China to 30% earlier this week, while Beijing lowered its own levies to 10% on U.S. imports.

Both nations had threatened in April to impose tariffs above 100% on the other.

The tentative accord between the world’s biggest economies has led investors to hope it will eventually yield a more concrete trade agreement.

On the bond markets, 10-year and 2-year were up 1.3% and 1.4% to 4.976% and 4.059%, respectively.