Superannuation funds are set for high single-digit returns in the 2025 financial year after an improvement in May, SuperRatings estimates.

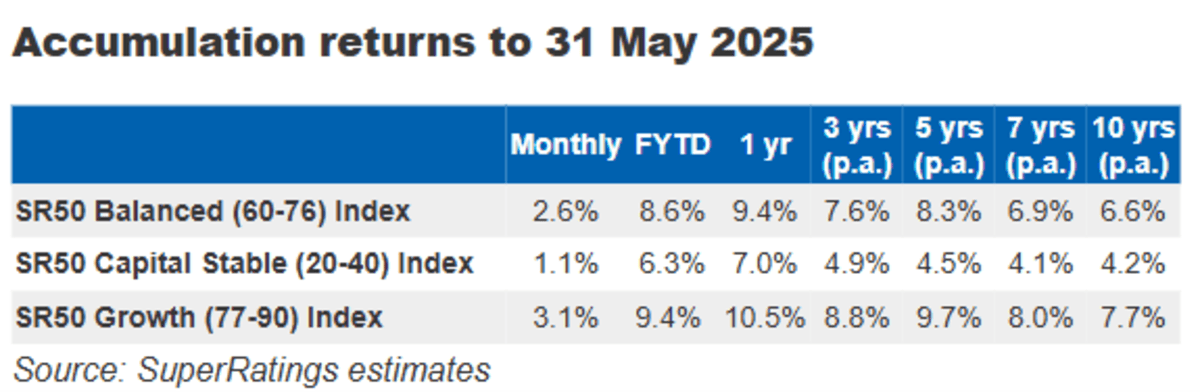

The media balanced option returned 2.6% in May, bringing the one-year return for an accumulation fund to 9.4%, the superannuation research firm said.

This compares with an estimated return in April of 0.6%, which implies a one-year return of 7.8%.

The median growth option grew by an estimated 3.1% and the median capital stable option rose by 1.1% in May, providing one-year returns of 10.5% and 7.0% respectively.

SuperRatings Executive Director Kirby Rappell said recent market volatility was a timely reminder to focus on the long term, because a member who switched to cash after the March downturn would have missed the strong rebound in May.

The firm said although the run-up to the end of the financial year looked relatively stable, the pause in United States tariffs on its trading partners was set to end shortly thereafter and it expected ups and downs in returns over the coming months.

“As we approach the end of the financial year, we see that investors seem to be able to look past tariff uncertainty,” Rappell said in a media release.

“Following the positive month it appears funds are back on track for a strong financial year result, despite the noise and uncertainty.

“While this will likely be a relief for members, we can see that volatility is likely to remain for some time.”

He said funds were on track to deliver mid to high single digit returns for the financial year, with more growth focused options potentially reaching double digits if the momentum carried through to June.

“However, as we saw a few months ago, markets can change quickly, and we encourage members to remember that superannuation is a long-term investment,” Rappell said.

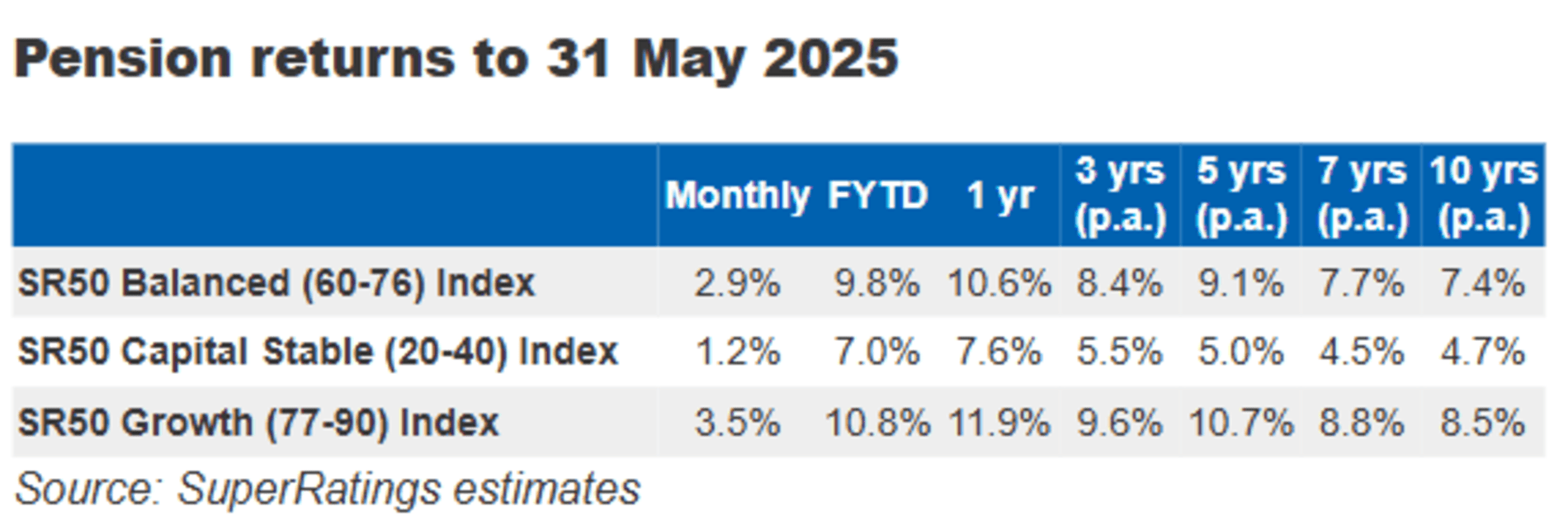

Pension returns also increased in May with the median balanced option returning an estimated 2.9%, the median capital stable option 1.2% and the median growth option 3.9%, bringing one-year returns to 10.6%, 7.6% and 11.9% respectively.