Procter & Gamble (P&G) has announced a 7% fall in net income for the second quarter of the 2026 financial year (Q2 FY26) due to an increase in restructuring charges.

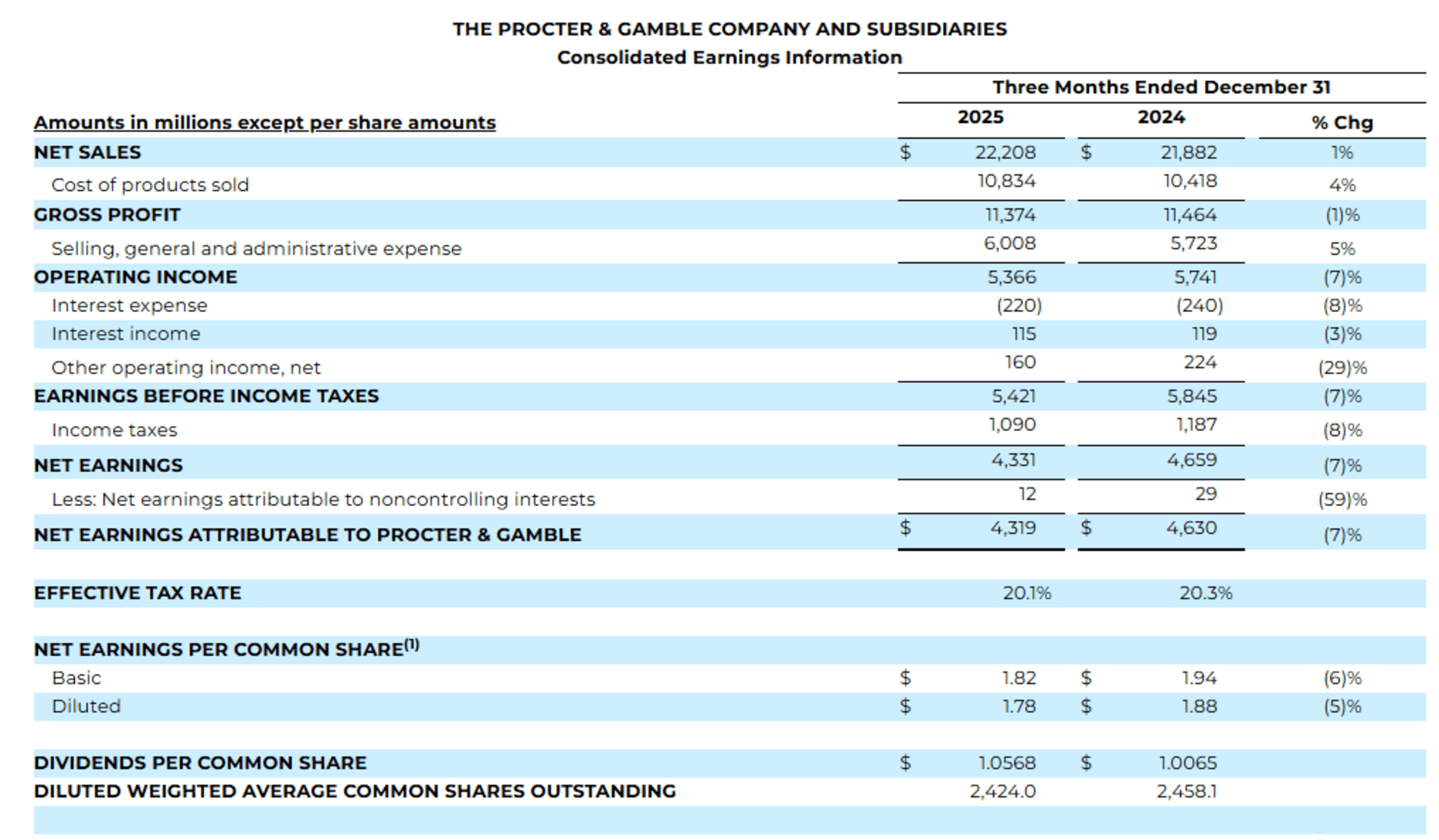

The consumer products company said net income dropped to US$4.319 billion (A$6.31 billion) in the three months ended 31 December 2025 from $4.63 billion in the prior corresponding period.

Diluted earnings per share (EPS) fell 5% to $1.78 on net sales which grew just 1% to $22.2 billion over the same period.

Excluding one-off items, P&G’s core EPS of $1.88 surpassed analysts' estimates of $1.86.

P&G (NYSE: PG) shares closed $3.87 (2.65%) higher at $149.93 USD on Thursday (Friday AEDT), valuing the Cincinnati-based company at $350.35 billion.

President and Chief Executive Officer Shailesh Jejurikar said P&G was on track to deliver within its organic sales growth, core EPS growth and adjusted free cash flow productivity fiscal year guidance ranges in a challenging consumer and geopolitical environment.

“We have confidence in our plans to deliver stronger results in the second-half of the fiscal year,” Jejurikar said in a news release.

Organic sales, which exclude the impacts of foreign exchange and acquisitions and divestitures, were unchanged as a 1% increase from higher pricing was offset by a unit volume decline of 1%.

P&G adjusted its outlook for diluted net EPS growth to 1-6% in FY26 from 3%-9% previously due to higher non-core restructuring charges but maintained its core EPS growth guidance at 0-4%.

P&G sells household and personal-care products in 180 countries with brands including Gillette, Old Spice, Pampers, Head & Shoulders, Oral-B and Vicks.