Oil and gas markets are bracing for a rollercoaster 2025 as President Donald Trump leads the United States down a shift in energy policy with executive orders and tariffs on its neighbours and shouts about LNG being uneconomical compared to renewables.

Especially hit will be Canadian and Mexican oil producers that will see a 10% and 25% tariff hit respectively on energy exports to the U.S. as Trump embarks on carrying out his “drill baby drill” election promise to build American dominance in the energy sector.

The number of drill rigs operating in the US has dropped, and that is impacting production, due to a slowdown in the growth of projects in the Permian Basin.

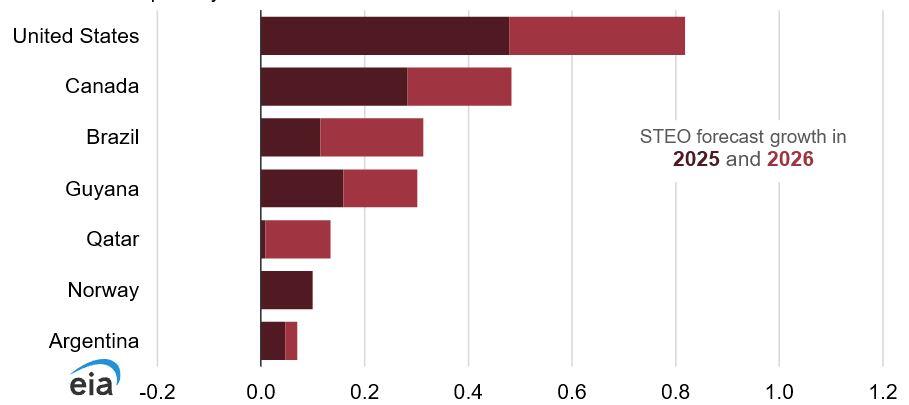

Annual record oil production of 13.2 million barrels per day (bbl/d) in the U.S was hit in 2024 and the International Energy Agency (IEA) reckons crude oil production will increase to just 13.6m bbl/d in 2026, charting less than 1% growth.

WTI prices are pegged to average $62 per barrel in 2026, down from $70 per barrel this year.

Falling production growth in the U.S. - (currently the world's largest crude oil producer) in 2026 adds uncertainty to global supply growth according to the U.S. Energy Information Administration and is largely dependent on supply level numbers from Arab-led oil conglomerate OPEC+.

"Global consumption of liquid fuels is to increase by 1.3 million bbl/d in 2025 and 1.1 million bbl/d in 2026, driven by consumption growth in non-OECD countries. Much of our expected growth is in Asia, where India is now the leading source of global oil demand growth in our forecast.

“Although we expect OPEC+ supply to grow as the latest round of voluntary production cuts are scheduled to unwind by 2026, these OPEC+ production increases have already been delayed several times and are their own source of uncertainty.”

LNG on the out?

Discussions at the World Economic Forum in Davos, Switzerland last month laid out the economic risks of continued reliance on liquefied natural gas (LNG) as a source of energy.

Institute for Energy Economics and Financial Analysis (IEEFA) LNG/Gas Asia Research Lead Sam Reynolds believes LNG is passing its use-by date as a go-to energy source, especially in developing nations.

“Based on dollars and cents, LNG is uncompetitive with renewable energy technologies. It’s unreliable compared to domestically sourced low-cost renewables, and it is not displacing coal in many emerging markets,” Reynolds noted.

Reliability due to weather and geopolitical machinations is affecting the transportation of LNG, making the import of gas increasingly untenable.

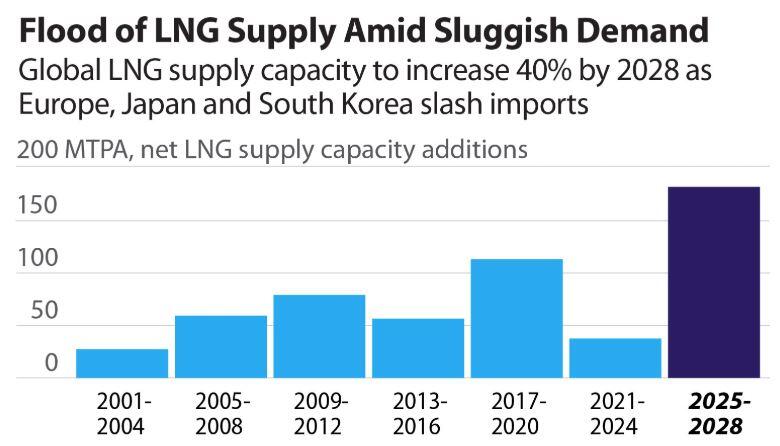

“As more LNG supply comes online and the demand picture looks increasingly weak, the investment case for LNG starts to dwindle. There is a serious financial risk in continued investment in a fuel that is going to experience a glut,” Reynolds said.

According to Reynolds, some of the world’s largest LNG markets, namely Europe, Japan, and South Korea - which together account for half of the global LNG market today - are rapidly reducing their reliance on LNG.

It is also compounded by a flood of LNG supplies about to come online over the next three years.

Lower demand growth over the next two years will result in businesses in the sector hunting for buyers in the developing world, promoting LNG as clean, affordable, and reliable.

However, Reynolds says “in emerging markets like Cambodia, electricity generation from LNG can be up to five times more expensive than some renewable energy options”.

“So, despite what the industry says, relying on LNG is a pathway to energy insecurity, not energy security.”

US to lift LNG exports

Counter to those claims, U.S. LNG exports are set to lift on the back of a trade deal Trump signed with China during his first term for an extra US$200 billion of additional energy exports - of which the lion's share is expected to come in the form of gas.

The International Energy Agency (IEA) is backing this up in the short term, with a forecast that tight gas supply fundamentals will linger throughout the year.

Another spanner in the mix is the additional sanctions lobbed at Russia’s two biggest LNG producers - Gazprom and Surgutneftegas by the U.S. and U.K. that come into effect later this month which could potentially cut exports from the country.