Global plumbing products supplier Reliance Worldwide Corporation (RWC) lifted half net profit after tax (NPAT) by 52% to A$67.2 million in the first half of the 2025 financial year (H1 FY25).

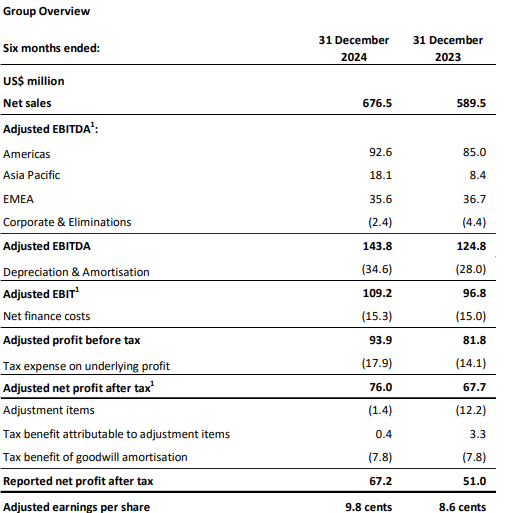

RWC said NPAT after adjusting for one-off items and the cash tax benefit from the amortisation of goodwill, rose 12.3% to $76.0 million on net sales which increased 14.8% to $676.5 million in the six months to 31 December.

Excluding a six- month contribution from new acquisition Holman Industries and the impact of the closure of the Supply Smart sales model in FY24, sales were 3.8% higher than the previous corresponding period, the company said in an ASX announcement.

Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) grew 15.2% to $143.8 million due to the contribution from Holman, which was acquired on 1 March 2024.

An interim cash dividend of 3.9691 (US5.0) cents per share, 50% franked, will be paid on 4 April to shareholders on record on 7 March.

The company, whose products included the SharkBite push-to-connect fittings, said the acquisition of Holman, organic growth in the Australian market and the pull forward of Americas demand from the second half to the first half, assisted sales growth.

Remodel and residential new construction markets continued to be relatively weak in most geographies.

RWC said macro-economic conditions in the second half of FY25 were not expected to materially improve from the first half as the easing in United States and British interest rates in the first half had yet to flow through to improved residential markets.

Long-term fixed mortgage rates remained at or near recent high levels and were continuing to adversely impact home turnover and remodel activity, new home construction volumes in the United Kingdom remained low, and new residential dwelling commencements in Australia also remained weak.

RWC expected full year FY25 external sales to be up by mid-single digit percentage points and it was targeting an improvement in consolidated adjusted EBITDA margin (excluding Holman) through cost reduction and efficiency measures.

By 2pm AEDT (3am GMT) RWC (ASX: RWC) shares had fallen 20 cents or 3.82% to $5.16.